Region:Middle East

Author(s):Shubham

Product Code:KRAC4341

Pages:100

Published On:October 2025

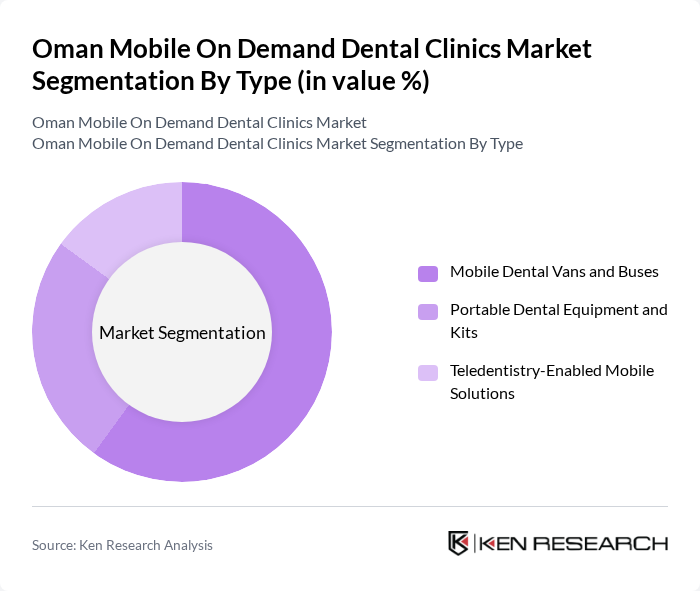

By Type:The market is segmented into three main types: Mobile Dental Vans and Buses, Portable Dental Equipment and Kits, and Teledentistry-Enabled Mobile Solutions.Mobile Dental Vans and Busesdominate the market due to their ability to deliver comprehensive dental services directly to patients across diverse locations. These mobile units are equipped with advanced dental technology, supporting a wide range of treatments and appealing to both urban and rural populations. The convenience and accessibility of these vans make them a preferred solution for patients seeking on-demand dental care .

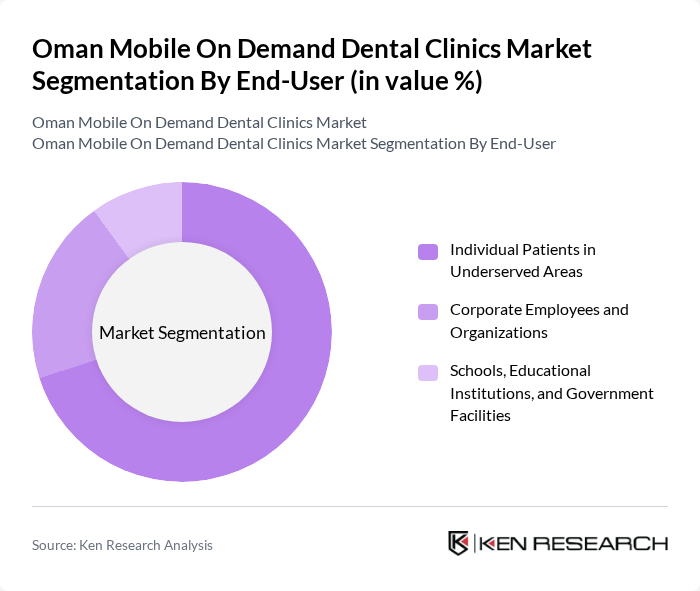

By End-User:The end-user segmentation includes Individual Patients in Underserved Areas, Corporate Employees and Organizations, and Schools, Educational Institutions, and Government Facilities.Individual Patients in Underserved Areasrepresent the largest segment, as mobile dental clinics primarily target these populations to provide essential dental care. The growing emphasis on preventive care and the convenience of mobile services have driven higher uptake among individuals who may otherwise lack access to traditional dental facilities .

The Oman Mobile On Demand Dental Clinics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dubai Smile Dental Clinic (Mobile Division), Apex Medical & Dental Clinics (Oman Operations), GSD Dental Clinics (Mobile Services), Ram Clinics (Mobile Dental Unit), Al Rabeeh Dental Center (Mobile Outreach), Premium Naseem Medical Centre (Mobile Division), Sijam Dental Clinic (Mobile Services), Ministry of Health - Mobile Dental Program, Oman Dental Association - Community Initiatives, Private Mobile Dental Operators (Independent Practitioners), Healthcare NGOs and Charitable Dental Organizations, Corporate Wellness Program Providers, Teledentistry-Enabled Mobile Platforms, International Mobile Dental Service Providers (Regional Expansion), and Emerging Startups in Mobile Dental Technology contribute to innovation, geographic expansion, and service delivery in this space .

The future of the mobile on-demand dental clinics market in Oman appears promising, driven by increasing urbanization and a growing emphasis on preventive healthcare. As the population continues to prioritize convenience, mobile clinics are likely to expand their reach, particularly in rural areas. Additionally, the integration of tele-dentistry services is expected to enhance patient engagement and accessibility, allowing for remote consultations and follow-ups. These trends indicate a robust growth trajectory for mobile dental services in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Dental Vans and Buses Portable Dental Equipment and Kits Teledentistry-Enabled Mobile Solutions |

| By End-User | Individual Patients in Underserved Areas Corporate Employees and Organizations Schools, Educational Institutions, and Government Facilities |

| By Service Offered | Preventive Care and Oral Health Screening Emergency Dental Services and Pain Management Restorative and Cosmetic Dentistry |

| By Payment Model | Pay-Per-Visit Subscription-Based Services Insurance-Based and Government-Funded Payments |

| By Geographic Coverage | Urban Areas (Muscat and Major Cities) Rural and Semi-Urban Areas Remote and Underserved Locations |

| By Age Group | Children and Pediatric Patients Working-Age Adults Seniors and Geriatric Patients |

| By Others | Specialized Dental Services (Endodontics, Prosthodontics) Community Health Initiatives and Outreach Programs Mobile Health Campaigns and Awareness Drives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Dental Clinic Operators | 60 | Clinic Managers, Dental Practitioners |

| Patients Utilizing On-Demand Services | 120 | Adults aged 18-65, Families with children |

| Healthcare Policy Makers | 40 | Government Health Officials, Regulatory Bodies |

| Dental Equipment Suppliers | 50 | Sales Representatives, Product Managers |

| Insurance Providers | 45 | Claims Adjusters, Policy Underwriters |

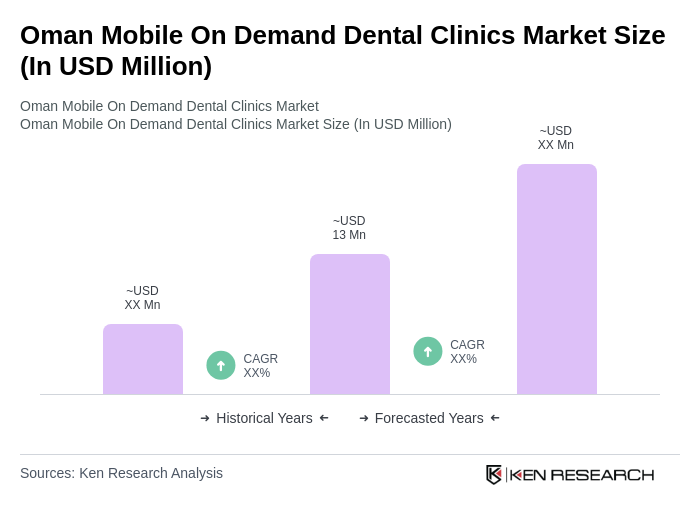

The Oman Mobile On Demand Dental Clinics Market is valued at approximately USD 13 million, reflecting its share within the broader dental services and mobile clinics market in Oman, which is experiencing steady growth due to rising demand for accessible dental care.