Region:Middle East

Author(s):Rebecca

Product Code:KRAD4312

Pages:99

Published On:December 2025

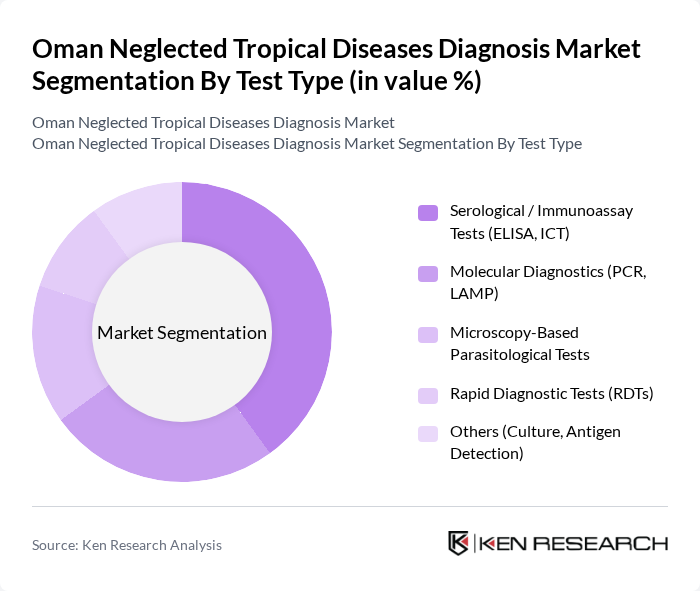

By Test Type:The market is segmented based on various diagnostic test types used for identifying neglected tropical diseases. The key subsegments include Serological / Immunoassay Tests (ELISA, ICT), Molecular Diagnostics (PCR, LAMP), Microscopy-Based Parasitological Tests, Rapid Diagnostic Tests (RDTs), and Others (Culture, Antigen Detection). Among these, Serological / Immunoassay Tests are leading due to their widespread use and reliability in detecting antibodies against various pathogens.

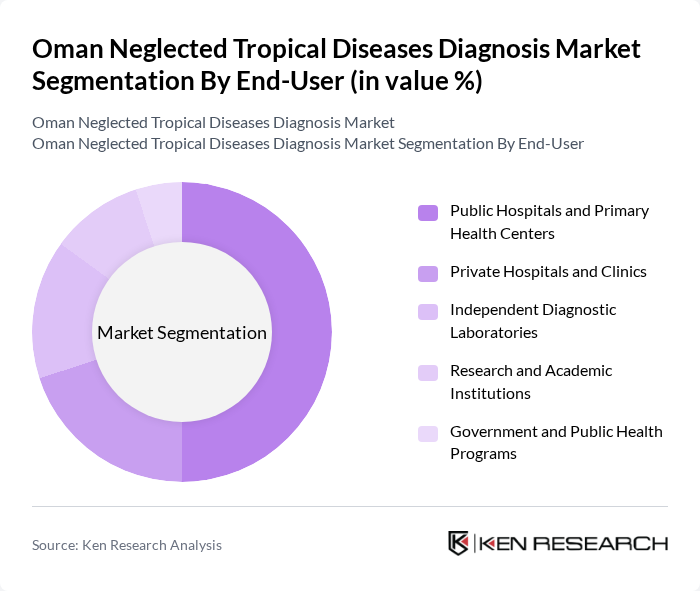

By End-User:The end-user segmentation includes Public Hospitals and Primary Health Centers, Private Hospitals and Clinics, Independent Diagnostic Laboratories, Research and Academic Institutions, and Government and Public Health Programs. Public Hospitals and Primary Health Centers dominate this segment due to their role in providing essential healthcare services and conducting mass screening programs for NTDs.

The Oman Neglected Tropical Diseases Diagnosis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health, Sultanate of Oman (Central Public Health Laboratories), Royal Hospital, Muscat, Sultan Qaboos University Hospital (SQUH), Armed Forces Hospital, Oman, Badr Al Samaa Group of Hospitals & Medical Centres, Starcare Hospital, Muscat, Nizwa Hospital, Al Dakhiliyah, Sohar Hospital, Al Batinah, Salalah (Sultan Qaboos) Hospital, Dhofar, Khoula Hospital, Muscat, Life Diagnostics Oman, Al Hayat International Hospital Laboratory, Apollo Hospital Muscat Laboratory, Nizwa Medical Laboratory, Muscat Private Hospital Laboratory Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman neglected tropical diseases diagnosis market appears promising, driven by ongoing government initiatives and technological advancements. The integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, while the shift towards point-of-care testing will facilitate quicker diagnoses. Additionally, public-private partnerships are likely to play a crucial role in expanding access to diagnostic tools, ultimately improving health outcomes for affected populations. Continued investment in healthcare infrastructure will further support these developments.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Serological / Immunoassay Tests (ELISA, ICT) Molecular Diagnostics (PCR, LAMP) Microscopy-Based Parasitological Tests Rapid Diagnostic Tests (RDTs) Others (Culture, Antigen Detection) |

| By End-User | Public Hospitals and Primary Health Centers Private Hospitals and Clinics Independent Diagnostic Laboratories Research and Academic Institutions Government and Public Health Programs |

| By Disease Type | Schistosomiasis Lymphatic Filariasis Leishmaniasis Soil-Transmitted Helminth Infections Other Endemic NTDs (e.g., Dengue, Leprosy) |

| By Testing Location | Central / Reference Laboratories Hospital-Based Laboratories Point-of-Care / Field Testing Sites Home and Community-Based Testing |

| By Distribution Channel | Direct Sales to Hospitals and Labs Tender-Based Institutional Procurement Local Distributors and Importers Online and E-Procurement Platforms |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Other Governorates |

| By Policy Support | National NTD Control and Elimination Programs International Donor and WHO-Backed Initiatives Government Subsidies and Reimbursement Research Grants and Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Nurses, Laboratory Technicians |

| Diagnostic Laboratories | 80 | Laboratory Managers, Quality Control Officers |

| Public Health Officials | 60 | Health Policy Makers, Epidemiologists |

| NGO Representatives | 50 | Program Managers, Field Coordinators |

| Pharmaceutical Companies | 70 | Product Managers, Market Access Specialists |

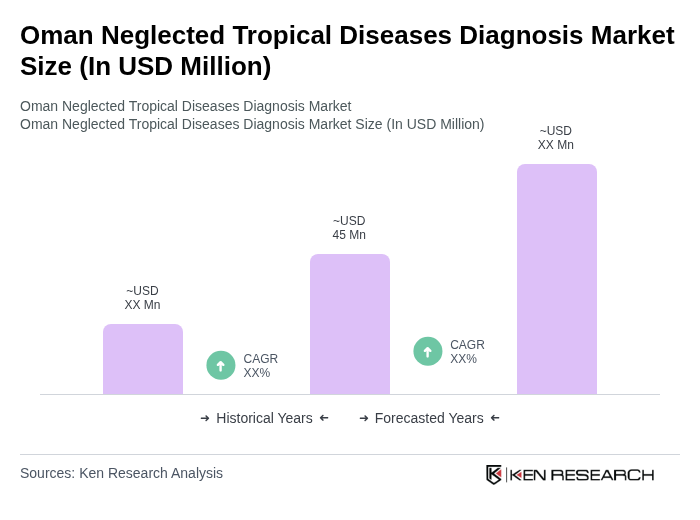

The Oman Neglected Tropical Diseases Diagnosis Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of neglected tropical diseases and government efforts to enhance healthcare infrastructure.