Region:Middle East

Author(s):Dev

Product Code:KRAD6334

Pages:86

Published On:December 2025

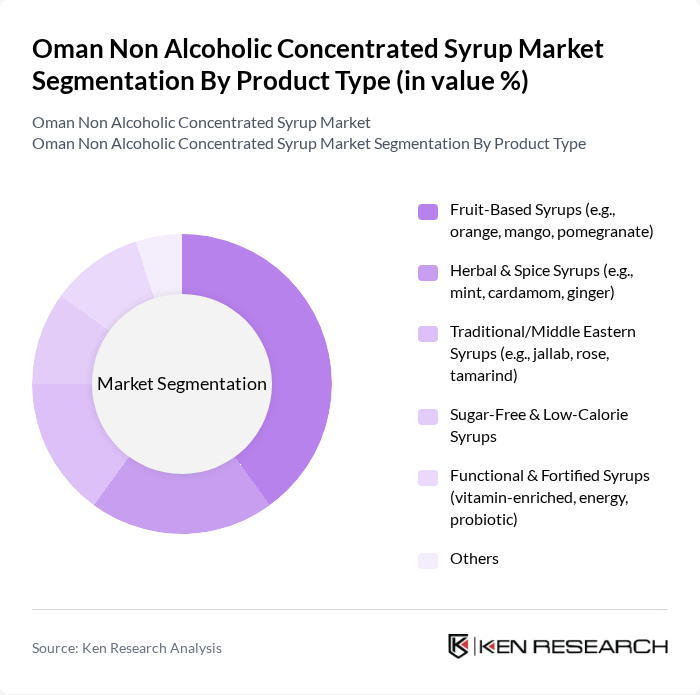

By Product Type:The product type segmentation includes various categories such as fruit-based syrups, herbal & spice syrups, traditional/Middle Eastern syrups, sugar-free & low-calorie syrups, functional & fortified syrups, and others. Among these, fruit-based syrups are the most popular due to their wide appeal and versatility in beverages. Consumers are increasingly gravitating towards natural flavors, which has led to a rise in the demand for fruit-based options. Herbal and spice syrups are also gaining traction, particularly among health-conscious consumers seeking unique flavors and potential health benefits. The market for sugar-free and functional syrups is expanding as consumers become more health-aware, driving innovation in this segment.

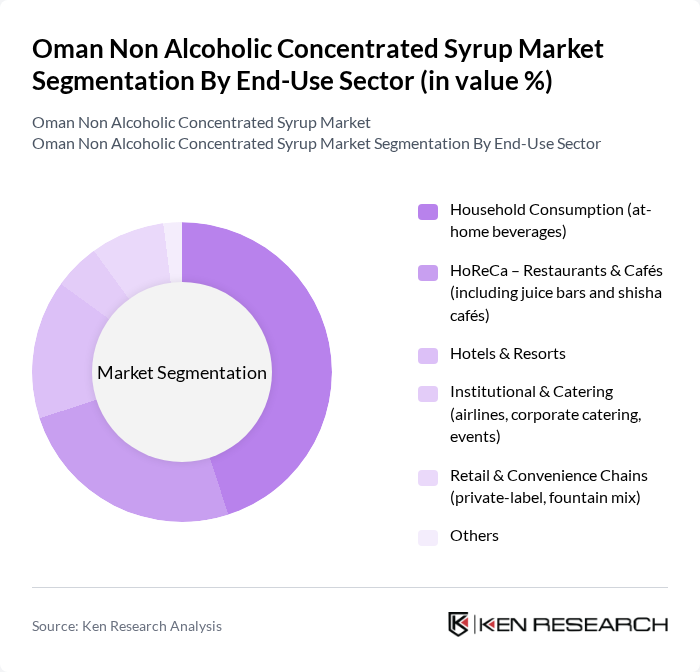

By End-Use Sector:The end-use sector segmentation encompasses household consumption, HoReCa (Hotels, Restaurants, and Cafés), hotels & resorts, institutional & catering, retail & convenience chains, and others. Household consumption is the leading segment, driven by the growing trend of preparing beverages at home, especially during social gatherings and festive occasions. The HoReCa sector is also significant, as restaurants and cafés increasingly offer a variety of flavored drinks to attract customers. The demand from hotels and resorts is rising due to the influx of tourists seeking refreshing beverage options. Retail and convenience chains are expanding their offerings, making it easier for consumers to access these products.

The Oman Non Alcoholic Concentrated Syrup Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Refreshment Company SAOG (PepsiCo franchise – concentrates & syrups), Aujan Group Holding (Rani, Barbican – GCC beverage concentrates), The Coca-Cola Company (Coca-Cola Middle East – fountain and retail syrups), Britvic plc (international soft drink concentrates – regional presence), Monin SAS (Monin Middle East – premium HoReCa syrups), Pioma Industries Pvt. Ltd (Rasna – fruit drink concentrates), Al Rabie Saudi Foods Co. Ltd (regional juice & syrup supplier), Almarai Company (juice concentrates and beverage bases in GCC), National Mineral Water Company SAOG (Oman – beverages & mixers), Al Mudhish (Dhofar Beverages & Food Stuff Co. SAOG – concentrates & powders), Bidfood Oman (foodservice distribution of syrups and beverage bases), Masafi Co. LLC (regional beverages and concentrates supplier), IFFCO Group (food & beverage concentrates and flavor bases), Suntory Holdings Limited (regional soft drink concentrates), Local Omani Private-Label & House-Brand Syrup Producers contribute to innovation, geographic expansion, and service delivery in this space.

The Oman non-alcoholic concentrated syrup market is poised for growth, driven by evolving consumer preferences and increasing health awareness. As the demand for organic and natural products continues to rise, manufacturers are likely to invest in innovative formulations. Additionally, the expansion of e-commerce platforms will facilitate greater market access, allowing brands to reach a broader audience. The tourism sector's recovery is expected to further boost sales, creating a favorable environment for industry players in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fruit-Based Syrups (e.g., orange, mango, pomegranate) Herbal & Spice Syrups (e.g., mint, cardamom, ginger) Traditional/Middle Eastern Syrups (e.g., jallab, rose, tamarind) Sugar-Free & Low-Calorie Syrups Functional & Fortified Syrups (vitamin-enriched, energy, probiotic) Others |

| By End-Use Sector | Household Consumption (at-home beverages) HoReCa – Restaurants & Cafés (including juice bars and shisha cafés) Hotels & Resorts Institutional & Catering (airlines, corporate catering, events) Retail & Convenience Chains (private-label, fountain mix) Others |

| By Distribution Channel | Modern Grocery Retail (supermarkets/hypermarkets) Convenience Stores & Baqalas HoReCa/Institutional Distributors & Cash-and-Carry Online Channels (e-commerce & quick commerce) Direct-to-Consumer & Wholesale Others |

| By Packaging Format | PET Bottles Glass Bottles Bag-in-Box & Foodservice Dispensing Packs Sachets & Pouches Bulk & Institutional Packs Others |

| By Flavor Profile | Citrus (orange, lemon, lime) Berry (strawberry, raspberry, mixed berries) Tropical (mango, pineapple, passion fruit) Floral & Aromatic (rose, orange blossom, hibiscus) Cola & Classic Soft Drink Flavors Others |

| By Consumer Profile | Age Group (Children/Teens, Young Adults, Families) Income Tier (Mass, Mid-Market, Premium) Health Orientation (Health-Conscious, Indulgent, Balanced) National vs Expatriate Consumers Others |

| By Consumption Occasion | Everyday Hydration & Refreshment Social Gatherings & Entertaining at Home Ramadan & Religious/Festive Occasions Tourism & Out-of-Home Leisure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Syrups | 100 | Retail Managers, Beverage Category Buyers |

| Manufacturing Insights | 80 | Production Managers, Quality Control Supervisors |

| Consumer Preferences | 120 | Household Consumers, Health-Conscious Shoppers |

| Market Trends Analysis | 70 | Market Analysts, Beverage Industry Experts |

| Export Opportunities | 60 | Export Managers, Trade Compliance Officers |

The Oman Non Alcoholic Concentrated Syrup Market is valued at approximately USD 140 million, reflecting a growing demand for refreshing beverages, particularly in the hot climate, and an increase in home consumption of flavored drinks.