Region:Middle East

Author(s):Dev

Product Code:KRAB3143

Pages:94

Published On:October 2025

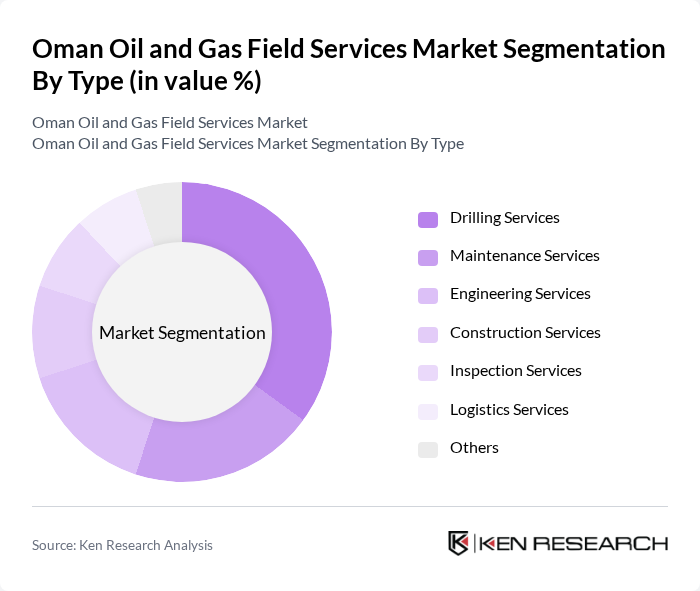

By Type:The market is segmented into various types of services that cater to the diverse needs of the oil and gas industry. The primary segments include drilling services, maintenance services, engineering services, construction services, inspection services, logistics services, and others. Each of these segments plays a crucial role in ensuring the smooth operation and efficiency of oil and gas projects. Among these, drilling services are particularly dominant due to the ongoing exploration activities and the need for advanced drilling technologies to access new reserves.

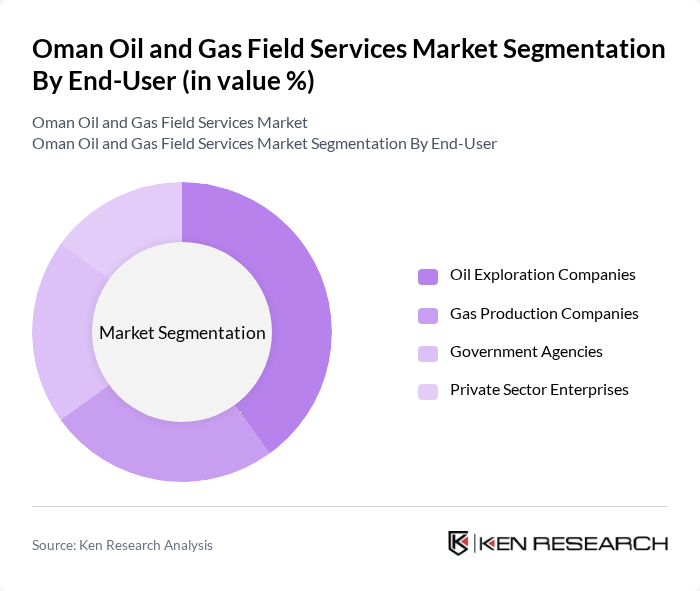

By End-User:The end-user segmentation includes oil exploration companies, gas production companies, government agencies, and private sector enterprises. Each of these end-users has distinct requirements and contributes to the overall demand for field services. Oil exploration companies are the leading end-users, driven by the need for continuous exploration and production activities to meet the growing energy demands. Their investments in advanced technologies and services significantly influence market dynamics.

The Oman Oil and Gas Field Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Petroleum Development Oman, Oman Oil Company, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International, National Oilwell Varco, KBR, Inc., TechnipFMC plc, Saipem S.p.A., Aker Solutions, Petrofac Limited, JGC Corporation, McDermott International, Subsea 7 S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman oil and gas field services market is poised for significant transformation, driven by a combination of technological advancements and a shift towards sustainable practices. As the government emphasizes local content policies, companies will increasingly focus on developing local talent and resources. Additionally, the integration of digital technologies will enhance operational efficiency, enabling firms to adapt to market fluctuations. Overall, the future landscape will be characterized by innovation, sustainability, and strategic partnerships, positioning Oman as a competitive player in the regional energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Drilling Services Maintenance Services Engineering Services Construction Services Inspection Services Logistics Services Others |

| By End-User | Oil Exploration Companies Gas Production Companies Government Agencies Private Sector Enterprises |

| By Application | Onshore Operations Offshore Operations Pipeline Construction Refinery Services |

| By Service Model | Contractual Services Project-Based Services Turnkey Solutions |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Technology | Conventional Technologies Advanced Drilling Technologies Automation Technologies |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drilling Services | 100 | Drilling Engineers, Operations Managers |

| Maintenance and Repair Services | 80 | Maintenance Supervisors, Field Technicians |

| Logistics and Supply Chain Services | 70 | Logistics Coordinators, Supply Chain Managers |

| Environmental and Safety Services | 60 | Safety Officers, Environmental Compliance Managers |

| Consulting and Engineering Services | 90 | Project Managers, Engineering Consultants |

The Oman Oil and Gas Field Services Market is valued at approximately USD 5 billion, reflecting a steady growth driven by increasing energy demand, investments in exploration, and advancements in extraction technologies.