Region:Middle East

Author(s):Shubham

Product Code:KRAD5449

Pages:91

Published On:December 2025

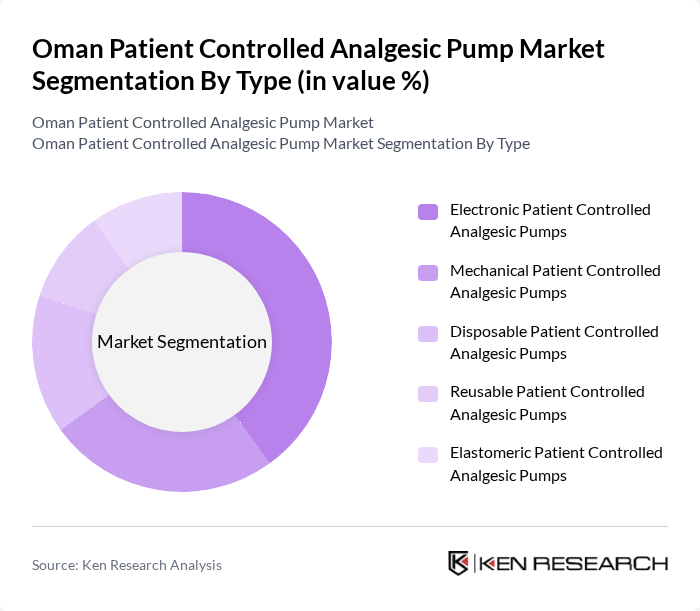

By Type:The market is segmented into various types of patient-controlled analgesic pumps, including electronic, mechanical, disposable, reusable, and elastomeric pumps. Each type serves different patient needs and healthcare settings, influencing their adoption rates, with electronic and smart pumps increasingly aligned with Oman’s broader digital health initiatives and hospital information systems.

The electronic patient-controlled analgesic pumps dominate the market due to their advanced features, including programmable settings, dose-limiting safety algorithms, and real-time monitoring or connectivity capabilities that align with Oman’s expanding digital health infrastructure. These pumps enhance patient safety and comfort, making them the preferred choice in tertiary and secondary hospitals. The increasing trend towards automation in healthcare, use of integrated electronic medical records, and demand for precise post?operative and oncology pain management solutions further bolster the adoption of electronic pumps. Mechanical pumps, while still significant in lower?acuity or resource?constrained settings, are gradually being replaced by electronic and smart PCA devices that offer higher efficiency, data capture, and user?friendliness for clinicians and patients.

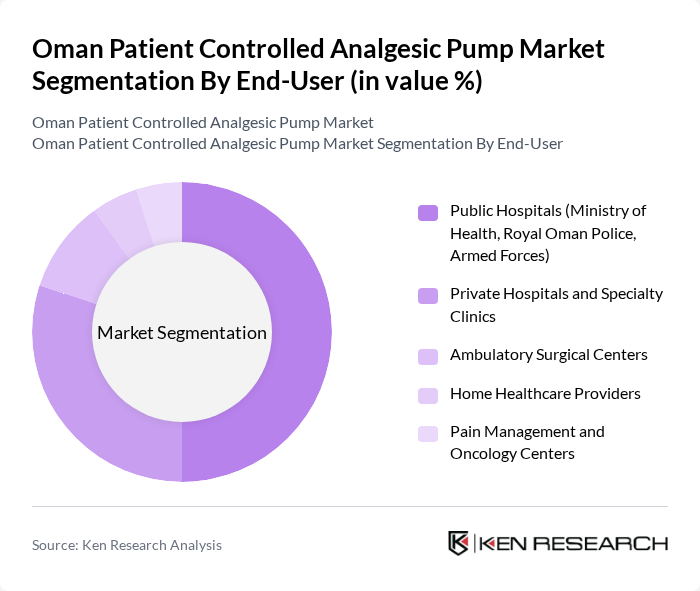

By End-User:The market is segmented based on end-users, including public hospitals, private hospitals and specialty clinics, ambulatory surgical centers, home healthcare providers, and pain management and oncology centers. Each segment has unique requirements and influences the overall market dynamics in the context of Oman’s expanding hospital network and shift toward more day?care and ambulatory procedures.

Public hospitals are the leading end-users of patient-controlled analgesic pumps, accounting for a significant share of the market. This dominance is attributed to the high patient volume, concentration of surgical and trauma services, and the strong role of Ministry of Health funding and planning in tertiary care. Public facilities, including armed forces and Royal Oman Police hospitals, manage a large proportion of complex surgeries, oncology, and critical care, where PCA use is standard for postoperative and cancer pain. Private hospitals and specialty clinics also contribute substantially, driven by growing investment, expansion of high?end surgical services, and a strong focus on patient-centered care and advanced pain management techniques. The growing trend of outpatient and day?surgery, supported by e?eligibility and e?claims platforms and policy emphasis on decongesting inpatient wards, is boosting demand in ambulatory surgical centers, while home healthcare providers and dedicated pain and oncology centers are gradually emerging as niche segments for ambulatory PCA and elastomeric pumps.

The Oman Patient Controlled Analgesic Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun SE (B. Braun Melsungen AG), Baxter International Inc., Fresenius Kabi AG, ICU Medical, Inc. (including Smiths Medical), BD (Becton, Dickinson and Company), Terumo Corporation, Nipro Corporation, Hospira, Inc. (Pfizer Inc.), Micrel Medical Devices SA, Vygon SA, Mindray Medical International Limited, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. – Infusion Systems, Moog Inc. – Medical Devices (Curlin Infusion), Zyno Medical LLC, Local and Regional Distributors in Oman (e.g., Al-Maha Medical Supplies, National Medical Supplies Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Patient Controlled Analgesic Pump market in Oman appears promising, driven by ongoing advancements in healthcare technology and a growing emphasis on patient-centered care. As healthcare infrastructure continues to expand, the integration of digital health solutions will likely enhance the effectiveness of pain management strategies. Furthermore, increased collaboration between healthcare providers and technology developers is expected to foster innovation, leading to more efficient and accessible pain management options for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Patient Controlled Analgesic Pumps Mechanical Patient Controlled Analgesic Pumps Disposable Patient Controlled Analgesic Pumps Reusable Patient Controlled Analgesic Pumps Elastomeric Patient Controlled Analgesic Pumps |

| By End-User | Public Hospitals (Ministry of Health, Royal Oman Police, Armed Forces) Private Hospitals and Specialty Clinics Ambulatory Surgical Centers Home Healthcare Providers Pain Management and Oncology Centers |

| By Application | Postoperative Pain Management (General & Orthopedic Surgery) Cancer and Palliative Care Pain Management Chronic Non?malignant Pain Management Obstetric and Labor Analgesia Trauma and Emergency Pain Management |

| By Distribution Channel | Direct Tenders to Government Hospitals Local Medical Device Distributors/Importers Group Purchasing Organizations and Hospital Networks Online Procurement Portals Retail and Hospital Pharmacies |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah North & South Al Dakhiliyah Governorate Other Governorates (Al Sharqiyah, Al Dhahirah, Al Wusta, Musandam) |

| By Technology | Continuous Rate Infusion with Patient-Controlled Bolus Demand-Responsive / Intermittent Bolus Technology Smart PCA Pumps with Dose Error-Reduction Software Wireless / Network-Integrated PCA Systems |

| By Policy Support | Inclusion in Ministry of Health Equipment Procurement Plans Reimbursement and Funding Support for PCA Therapies Clinical Guidelines and Protocols for PCA Use Training and Capacity-Building Initiatives for PCA |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals Utilizing PCA Pumps | 90 | Anesthesiologists, Pain Management Specialists |

| Healthcare Procurement Departments | 70 | Procurement Managers, Supply Chain Coordinators |

| Patients with PCA Experience | 60 | Post-operative Patients, Chronic Pain Patients |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

| Medical Device Distributors | 50 | Sales Representatives, Product Managers |

The Oman Patient Controlled Analgesic Pump Market is valued at approximately USD 1617 million, reflecting a significant growth trajectory influenced by the increasing prevalence of chronic pain and advancements in medical technology within the healthcare sector.