Region:Middle East

Author(s):Rebecca

Product Code:KRAC3943

Pages:89

Published On:October 2025

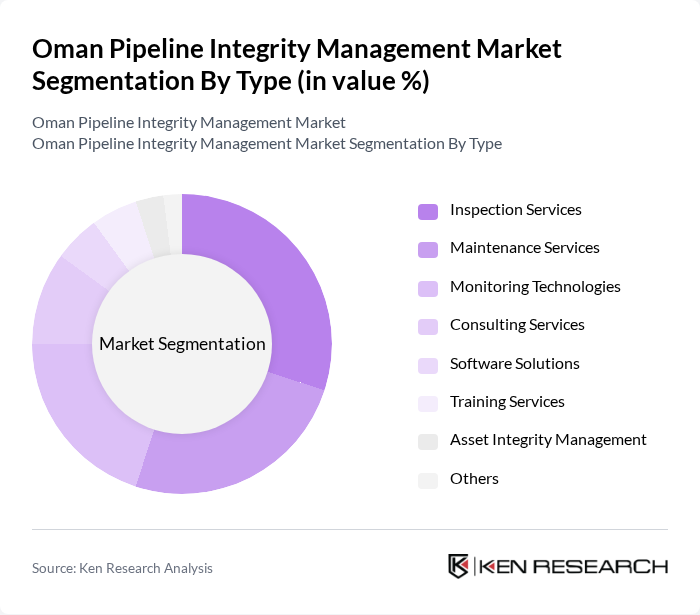

By Type:The market is segmented into Inspection Services, Maintenance Services, Monitoring Technologies, Consulting Services, Software Solutions, Training Services, Asset Integrity Management, and Others. Inspection Services and Maintenance Services remain the largest segments, reflecting the critical need for regular assessment and upkeep of pipeline assets. Monitoring Technologies, including advanced sensors and AI-driven analytics, are experiencing rapid adoption as operators seek to enhance real-time visibility and predictive maintenance capabilities .

By End-User:The end-user segmentation includes Oil and Gas Operators, Water Utilities, Petrochemical Companies, Government Regulatory Bodies, EPC (Engineering, Procurement, Construction) Firms, and Others. Oil and Gas Operators represent the largest share, driven by the scale of Oman’s upstream and midstream activities. Water Utilities and Petrochemical Companies are increasingly investing in integrity management to address aging infrastructure and regulatory compliance .

The Oman Pipeline Integrity Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ (Oman Oil Company S.A.O.C.), Petroleum Development Oman (PDO), Oman Gas Company S.A.O.C. (now OQ Gas Networks), Daleel Petroleum LLC, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Aker Solutions ASA, Wood plc, DNV AS, Emerson Electric Co., SGS S.A., Honeywell International Inc., ABB Ltd., Applus+ Velosi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman pipeline integrity management market appears promising, driven by ongoing technological advancements and increased government focus on safety regulations. As the oil and gas sector continues to expand, the demand for innovative solutions will likely rise. Companies are expected to invest in predictive maintenance and data analytics, enhancing operational efficiency. Furthermore, the integration of IoT technologies will facilitate real-time monitoring, significantly improving pipeline safety and reducing environmental risks associated with leaks and failures.

| Segment | Sub-Segments |

|---|---|

| By Type | Inspection Services Maintenance Services Monitoring Technologies Consulting Services Software Solutions Training Services Asset Integrity Management Others |

| By End-User | Oil and Gas Operators Water Utilities Petrochemical Companies Government Regulatory Bodies EPC (Engineering, Procurement, Construction) Firms Others |

| By Application | Pipeline Inspection Leak Detection Corrosion Management Risk Assessment Asset Management Regulatory Compliance Others |

| By Service Model | On-site Services Remote Monitoring Consulting Services Software as a Service (SaaS) Others |

| By Technology | Non-Destructive Testing (NDT) Smart Pigging Drones and UAVs Sensors and IoT Devices Acoustic Monitoring Fiber Optic Sensing Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) International Aid Others |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Grants for Research and Development Regulatory Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Pipeline Integrity Management | 100 | Pipeline Integrity Managers, Safety Officers |

| Gas Pipeline Maintenance Strategies | 80 | Operations Managers, Compliance Officers |

| Water Pipeline Integrity Solutions | 50 | Environmental Engineers, Project Managers |

| Regulatory Compliance in Pipeline Operations | 60 | Regulatory Affairs Specialists, Legal Advisors |

| Technological Innovations in Pipeline Monitoring | 70 | R&D Managers, Technology Officers |

The Oman Pipeline Integrity Management Market is valued at approximately USD 220 million, based on historical analysis and regional market share estimates from the global pipeline integrity management market, which exceeds USD 2.2 billion.