Region:Middle East

Author(s):Dev

Product Code:KRAD5174

Pages:99

Published On:December 2025

By Ingredient:The market is segmented into various ingredients used in pore strips, including charcoal-based, non-charcoal, herbal and natural extracts, and medicated/acne-control options. Charcoal-based pore strips are particularly popular due to their effectiveness in deep cleaning pores and removing impurities, reflecting the broader global trend where charcoal products are marketed for deep cleansing and detox benefits. Non-charcoal options, such as those made from silica, polymers, and other non-charcoal actives, are also gaining traction for their gentle formulation and suitability for sensitive or combination skin, consistent with global data showing non-charcoal as a leading segment by value. Herbal and natural extract strips appeal to consumers seeking cleaner-label, plant-based, and eco-conscious products as clean beauty and natural skincare trends gain momentum across the Middle East. Medicated strips, often containing salicylic acid and other acne-control actives, are favored by those with acne-prone or oily skin, aligning with rising incidences of acne and demand for targeted, derm-inspired solutions.

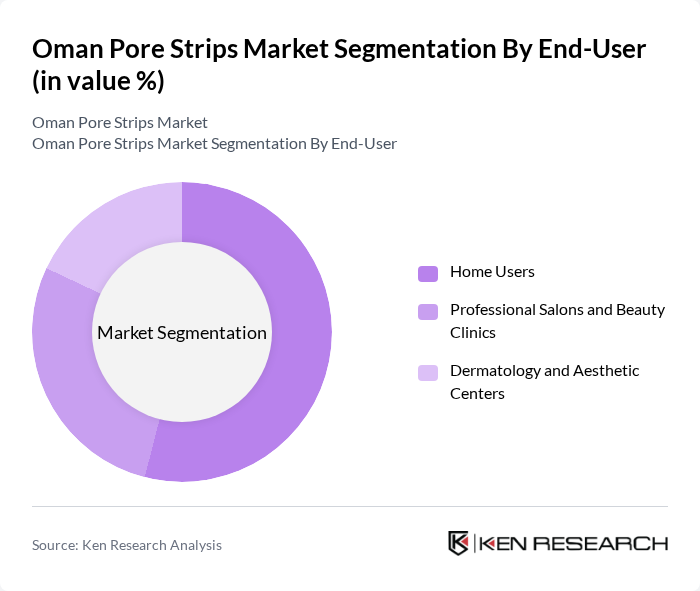

By End-User:The end-user segmentation includes home users, professional salons and beauty clinics, and dermatology and aesthetic centers. Home users dominate the market as more consumers prefer to perform skincare routines at home, supported by global evidence that the home segment accounts for the majority of pore strip consumption due to convenience and affordability. Professional salons and beauty clinics are also significant contributors, as they offer facial and blackhead-removal treatments that can incorporate pore strips or similar pore-cleansing solutions as part of broader service packages. Dermatology and aesthetic centers cater to clients with specific skin concerns, further driving the demand for medicated and specialized pore strips and complementary pore-cleansing products in clinical-grade regimens.

The Oman Pore Strips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kao Corporation (Bioré), The Procter & Gamble Company (Olay), Unilever PLC (Pond's), L'Oréal S.A. (Garnier, L'Oréal Paris), Johnson & Johnson Services, Inc. (Neutrogena, Clean & Clear), Beiersdorf AG (NIVEA), Himalaya Wellness Company (Himalaya Herbals), The Body Shop International Limited, LG Household & Health Care Ltd. (THE FACE SHOP), Innisfree Corporation, Amorepacific Corporation (Etude, Innisfree-related lines), Kiehl's LLC, Clinique Laboratories, LLC (The Estée Lauder Companies Inc.), Shiseido Company, Limited, Local and Regional Private Labels (e.g., pharmacy and supermarket house brands) contribute to innovation, geographic expansion, and service delivery in this space, mirroring their strong participation in the global pore strips and facial skincare market.

The Oman pore strips market is poised for growth, driven by increasing consumer awareness and the rising demand for effective skincare solutions. As e-commerce continues to expand, brands will likely leverage online platforms to reach a broader audience. Additionally, the trend towards eco-friendly products and innovative formulations will shape future offerings, catering to the evolving preferences of health-conscious consumers. Companies that adapt to these trends will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Ingredient | Charcoal-Based Pore Strips Non-Charcoal (Silica, Polymer, etc.) Pore Strips Herbal and Natural Extract Pore Strips Medicated/Acne-Control Pore Strips (e.g., Salicylic Acid) |

| By End-User | Home Users Professional Salons and Beauty Clinics Dermatology and Aesthetic Centers |

| By Distribution Channel | Hypermarkets & Supermarkets (e.g., Carrefour, Lulu, Nesto) Pharmacies & Drugstores (e.g., Muscat Pharmacy, Lifeline Pharmacy) Beauty & Personal Care Specialty Stores E-commerce Platforms & Marketplaces Convenience and Independent Retailers |

| By Packaging Type | Single-Use Sachets Multi-Strip Boxes (Value Packs) Travel and Trial Packs Eco-friendly / Recyclable Packaging |

| By Price Range | Mass / Economy Products Mass Premium / Mid-range Products Premium & Dermatological Brands |

| By Consumer Demographics | Age Group (Teens, Young Adults, Adults) Gender (Female, Male, Unisex) Skin Type (Oily/Acne-Prone, Combination, Normal/Dry, Sensitive) Income Tier (Low, Middle, High Income Households) |

| By Product Features | Hypoallergenic and Dermatologist-Tested Strips Fragrance-Free vs Scented Strips Strips with Added Skincare Benefits (e.g., Soothing, Brightening) Clean-Label / Halal-Certified / Alcohol-Free Strips |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Pore Strips | 100 | Store Managers, Beauty Advisors |

| Consumer Usage Patterns | 120 | Skincare Enthusiasts, General Consumers |

| Dermatological Insights | 50 | Dermatologists, Skincare Specialists |

| Market Trends Analysis | 80 | Market Analysts, Industry Experts |

| Online Retail Insights | 70 | E-commerce Managers, Digital Marketing Specialists |

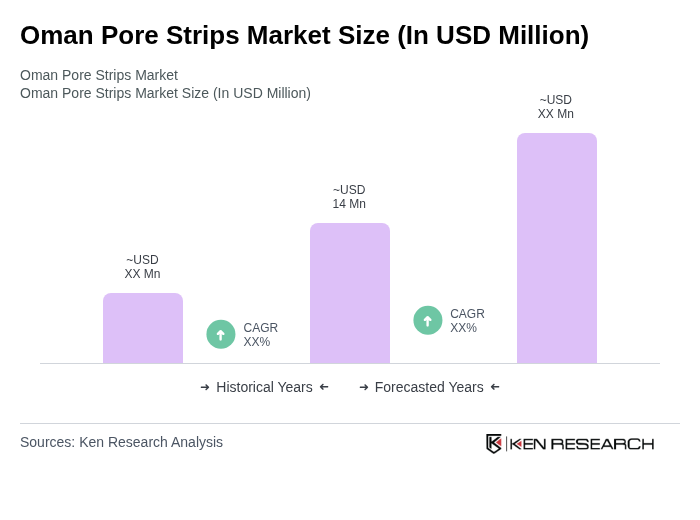

The Oman Pore Strips Market is valued at approximately USD 14 million, reflecting a growing trend in skincare and personal grooming among consumers, particularly influenced by social media and beauty routines.