Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4121

Pages:95

Published On:December 2025

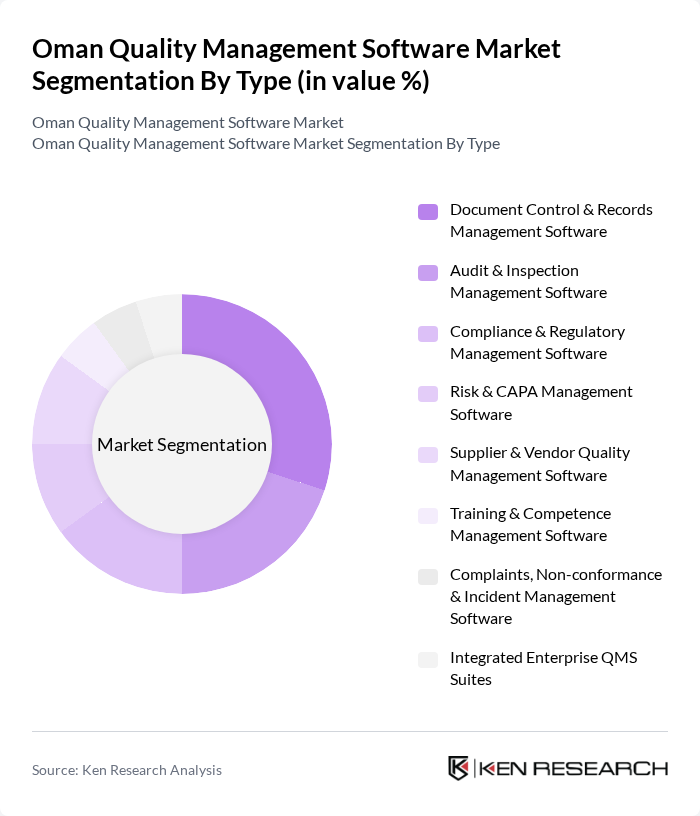

By Type:The market is segmented into various types of quality management software, each catering to specific needs within organizations. The subsegments include Document Control & Records Management Software, Audit & Inspection Management Software, Compliance & Regulatory Management Software, Risk & CAPA Management Software, Supplier & Vendor Quality Management Software, Training & Competence Management Software, Complaints, Non-conformance & Incident Management Software, and Integrated Enterprise QMS Suites. Among these, Document Control & Records Management Software is currently leading the market due to its critical role in maintaining compliance and ensuring efficient documentation processes.

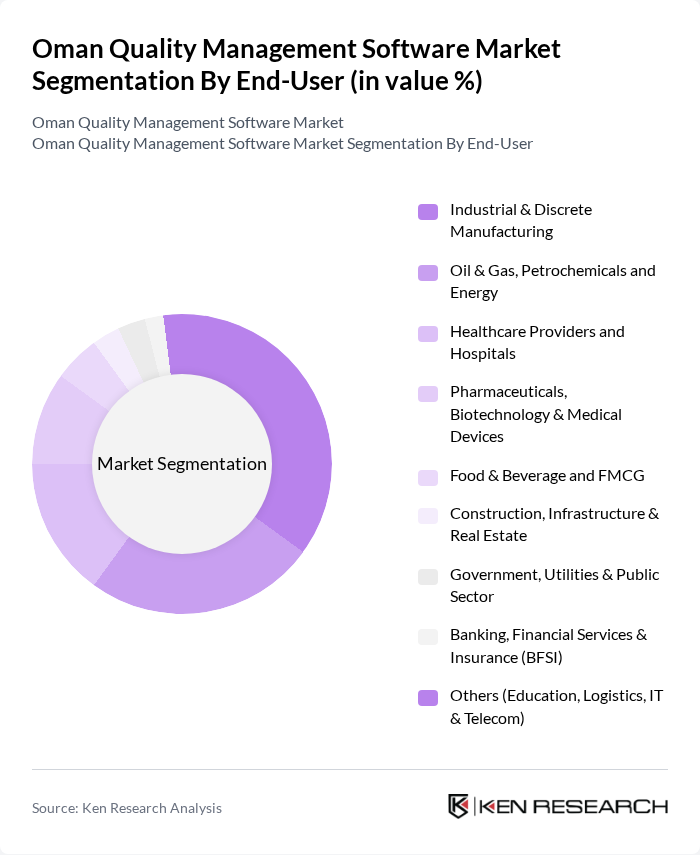

By End-User:The end-user segmentation includes various industries that utilize quality management software to enhance their operational processes. Key segments are Industrial & Discrete Manufacturing, Oil & Gas, Petrochemicals and Energy, Healthcare Providers and Hospitals, Pharmaceuticals, Biotechnology & Medical Devices, Food & Beverage and FMCG, Construction, Infrastructure & Real Estate, Government, Utilities & Public Sector, Banking, Financial Services & Insurance (BFSI), and Others. The Industrial & Discrete Manufacturing sector is the largest end-user, driven by stringent quality standards and the need for efficient production processes.

The Oman Quality Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Siemens AG, Dassault Systèmes SE (including Medidata and Sparta Systems), MasterControl Inc., Veeva Systems Inc., QAD Inc. (QAD EQMS), ETQ, LLC, Intelex Technologies ULC, AssurX, Inc., ComplianceQuest Inc., Greenlight Guru, AmpleLogic contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Quality Management Software Market is poised for significant evolution, driven by the increasing integration of digital technologies and a growing emphasis on customer-centric approaches. As organizations prioritize quality assurance, the demand for innovative software solutions will rise. Additionally, the focus on sustainability and compliance with international standards will further shape the market landscape. By future, the trend towards cloud-based solutions and mobile applications is expected to redefine how quality management is approached, enhancing accessibility and efficiency across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Document Control & Records Management Software Audit & Inspection Management Software Compliance & Regulatory Management Software Risk & CAPA (Corrective and Preventive Action) Management Software Supplier & Vendor Quality Management Software Training & Competence Management Software Complaints, Non?conformance & Incident Management Software Integrated Enterprise QMS Suites |

| By End-User | Industrial & Discrete Manufacturing Oil & Gas, Petrochemicals and Energy Healthcare Providers and Hospitals Pharmaceuticals, Biotechnology & Medical Devices Food & Beverage and FMCG Construction, Infrastructure & Real Estate Government, Utilities & Public Sector Banking, Financial Services & Insurance (BFSI) Others (Education, Logistics, IT & Telecom) |

| By Industry | Oil & Gas and Refining Industrial Manufacturing & Engineering Healthcare & Life Sciences Food & Beverage Processing Construction & Infrastructure Projects Power, Water & Utilities Transportation & Logistics Others |

| By Deployment Model | On-Premises Cloud-Based (Public & Private) Hybrid Managed / Hosted Services |

| By Functionality | Quality Planning & Policy Management Quality Control, Testing & Inspection Continuous Improvement & Lean / Six Sigma Management Regulatory Compliance & Certification Management (e.g., ISO, GMP) Enterprise Risk & Safety Management Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises Government and Semi?Government Entities |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Quality Management | 110 | Quality Managers, Production Supervisors |

| Healthcare Quality Assurance | 90 | Compliance Officers, IT Directors |

| Service Industry Quality Control | 80 | Operations Managers, Customer Experience Leads |

| Education Sector Quality Improvement | 70 | Academic Administrators, IT Coordinators |

| Government Quality Management Initiatives | 60 | Policy Makers, Program Managers |

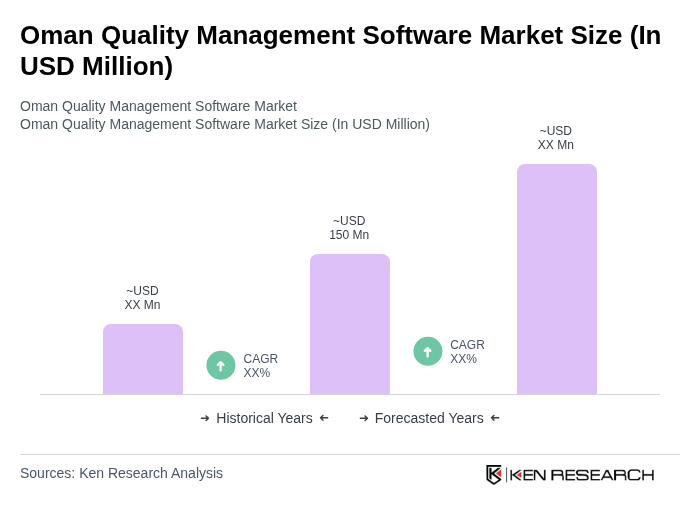

The Oman Quality Management Software Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for operational efficiency and regulatory compliance across various industries.