Region:Middle East

Author(s):Rebecca

Product Code:KRAD5065

Pages:93

Published On:December 2025

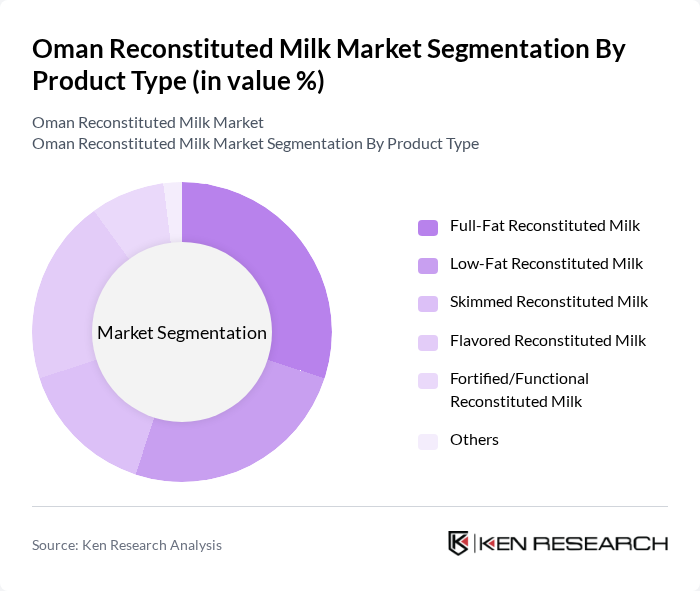

By Product Type:The product type segmentation includes various forms of reconstituted milk, catering to diverse consumer preferences. The subsegments are Full-Fat Reconstituted Milk, Low-Fat Reconstituted Milk, Skimmed Reconstituted Milk, Flavored Reconstituted Milk, Fortified/Functional Reconstituted Milk, and Others. Full-Fat Reconstituted Milk is popular among consumers seeking rich taste and energy-dense nutrition, particularly for families with children, while Low-Fat and Skimmed options cater to health-conscious individuals looking to manage fat and calorie intake in line with global trends toward reduced-fat dairy. Flavored varieties attract younger demographics and on-the-go consumers, as flavored recombined and UHT milks are widely used as ready-to-drink beverages in the Middle East, and fortified options appeal to those looking for added health benefits such as added vitamins, minerals, and functional ingredients.

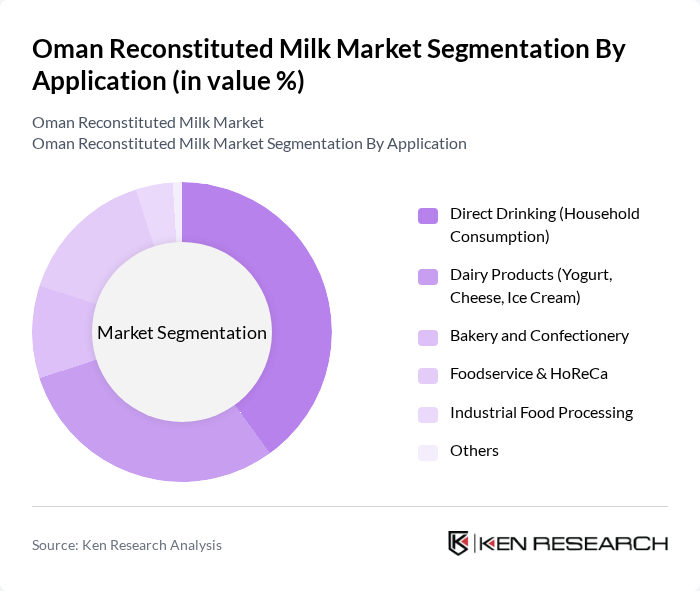

By Application:The application segmentation encompasses various uses of reconstituted milk, including Direct Drinking (Household Consumption), Dairy Products (Yogurt, Cheese, Ice Cream), Bakery and Confectionery, Foodservice & HoReCa, Industrial Food Processing, and Others. Direct Drinking is the leading application, driven by the growing trend of healthy living, demand for long-life ambient milk, and convenience for households that rely on UHT and powdered milk reconstitution as a primary drinking milk source. The dairy products segment also shows significant demand, as reconstituted milk is a key ingredient in yogurt, cheese, ice cream, and other recombined dairy lines commonly used in the Middle East and Africa, while bakery, confectionery, and broader food processing increasingly use milk powder and reconstituted milk for formulation consistency, cost efficiency, and shelf-life extension.

The Oman Reconstituted Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as A’Saffa Foods SAOG (Dhofar Global Brands Subsidiary – Dairy & Beverages), Mazoon Dairy Company SAOC, Al Maraai Dairy & Beverages (Oman), Almarai Company (Saudi Arabia – Regional Supplier), National Dairy Products Manufacturing Company LLC (Oman), Dhofar Cattle Feed Co. SAOG (Dhofar Dairy & Juice Products), A’Safwah Dairy (Part of Atyab Food Industries), Nadec – National Agricultural Development Company, Al Safi Danone, Al Ain Farms, Lactalis Group, Arla Foods amba, Fonterra Co?operative Group Limited, FrieslandCampina N.V., Nestlé S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman reconstituted milk market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, manufacturers are likely to focus on product innovation, including fortified and organic options. Additionally, the growth of e-commerce is expected to reshape distribution channels, making reconstituted milk more accessible. With the government's support for local dairy farmers, the market may also see increased production capacity, enhancing competitiveness against imports and fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Full-Fat Reconstituted Milk Low-Fat Reconstituted Milk Skimmed Reconstituted Milk Flavored Reconstituted Milk Fortified/Functional Reconstituted Milk Others |

| By Application | Direct Drinking (Household Consumption) Dairy Products (Yogurt, Cheese, Ice Cream) Bakery and Confectionery Foodservice & HoReCa Industrial Food Processing Others |

| By Packaging Format | Aseptic Cartons (Tetra Pak and Equivalent) Plastic Bottles (HDPE/PET) Flexible Pouches/Sachets Metal Cans Bulk Packs (Bags-in-Box, Industrial Sacks) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Small Groceries Traditional Trade (Baqqalah/Neighborhood Stores) Online Retail & E?Commerce HoReCa & Institutional Procurement Others |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah (North & South) Ad Dakhiliyah & Al Dhahirah Other Governorates (Al Sharqiyah, Al Wusta, Musandam) |

| By Consumer Segment | Household Consumers Expatriate Population Institutional Buyers (Schools, Hospitals, Camps) Foodservice Operators Others |

| By Nutritional & Functional Positioning | Standard Reconstituted Milk High-Protein/Performance Low-Fat/Low-Calorie Fortified with Vitamins & Minerals Lactose-Reduced/Lactose-Free Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Reconstituted Milk | 100 | Store Managers, Category Buyers |

| Dairy Production Insights | 80 | Production Managers, Quality Control Supervisors |

| Consumer Preferences in Urban Areas | 120 | Household Decision Makers, Health-Conscious Consumers |

| Market Trends from Distributors | 70 | Sales Representatives, Logistics Coordinators |

| Health and Nutrition Perspectives | 60 | Nutritionists, Health Advisors |

The Oman Reconstituted Milk Market is valued at approximately USD 160 million, based on a historical analysis of the packaged milk and broader dairy products market, which generates around USD 150160 million annually from milk alone.