Region:Middle East

Author(s):Dev

Product Code:KRAD6342

Pages:83

Published On:December 2025

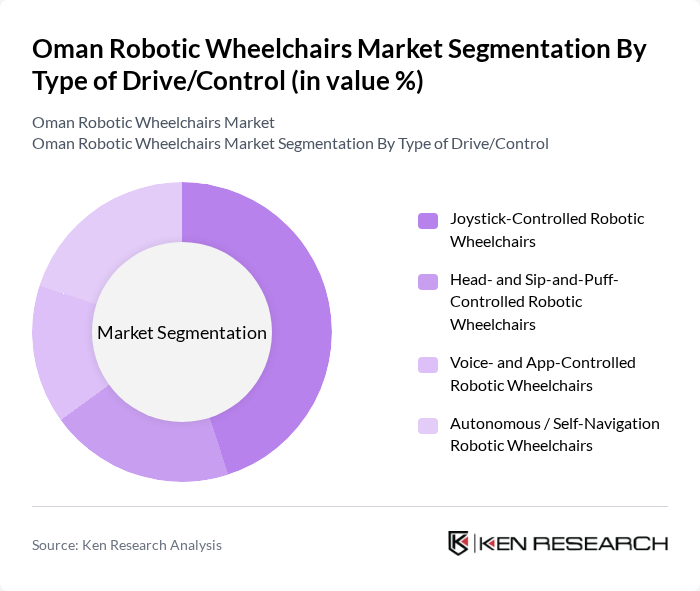

By Type of Drive/Control:The market is segmented into various types of drive/control mechanisms, including joystick-controlled, head- and sip-and-puff-controlled, voice- and app-controlled, and autonomous/self-navigation robotic wheelchairs. Among these, joystick-controlled robotic wheelchairs dominate the market due to their user-friendly interface and widespread acceptance among users. The familiarity and ease of use associated with joystick controls make them a preferred choice for many individuals with mobility impairments.

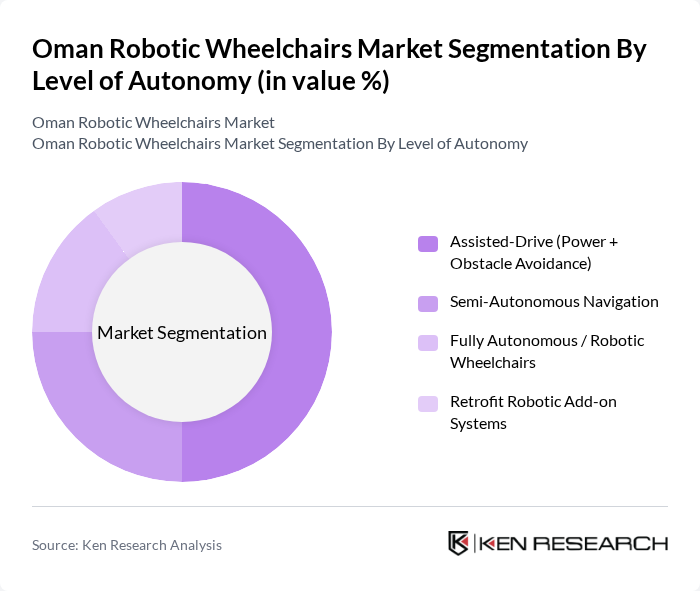

By Level of Autonomy:The segmentation by level of autonomy includes assisted-drive (power + obstacle avoidance), semi-autonomous navigation, fully autonomous robotic wheelchairs, and retrofit robotic add-on systems. The assisted-drive segment leads the market, as it provides a balance between user control and automated features, making it suitable for a wide range of users. This segment's popularity is driven by its ability to enhance safety and ease of use for individuals with varying degrees of mobility impairment.

The Oman Robotic Wheelchairs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Invacare Corporation, Permobil AB, Sunrise Medical (Including Quickie & Magic Mobility Brands), Ottobock SE & Co. KGaA, Pride Mobility Products Corp., MEYRA GmbH, WHILL Inc., DEKA Research & Development Corporation (iBOT Personal Mobility Device), Scewo AG, Cyberdyne Inc., Panasonic Holdings Corporation (Including Resyone Series), Guangdong Dongfang Medical Technology Co., Ltd., Karma Medical Products Co., Ltd., Falcon Mobility (Middle East & Asia), Local & Regional Distributors in Oman (Al Shifa Medical Supplies, Gulf Medical Company Oman, and Other Authorized Mobility Dealers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotic wheelchair market in Oman appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the integration of AI and telehealth services will likely improve accessibility and user experience. Additionally, the focus on rehabilitation technologies will foster innovation, making robotic wheelchairs more appealing to a broader audience. This evolving landscape presents a unique opportunity for manufacturers to cater to the growing needs of the elderly and disabled populations.

| Segment | Sub-Segments |

|---|---|

| By Type of Drive/Control | Joystick-Controlled Robotic Wheelchairs Head- and Sip-and-Puff-Controlled Robotic Wheelchairs Voice- and App-Controlled Robotic Wheelchairs Autonomous / Self-Navigation Robotic Wheelchairs |

| By Level of Autonomy | Assisted-Drive (Power + Obstacle Avoidance) Semi-Autonomous Navigation Fully Autonomous / Robotic Wheelchairs Retrofit Robotic Add?on Systems |

| By Application Environment | Indoor Use (Hospitals, Homes, Long-Term Care) Outdoor / All?Terrain Use Mixed Indoor–Outdoor Use Public Infrastructure & Smart City Use Cases |

| By End-User | Hospitals & Acute Care Facilities Rehabilitation & Long-Term Care Centers Home-Care & Individual Users Government & Military Procurement (MoH, MoSD, MoD, Royal Oman Police) |

| By Mobility Impairment Type | Spinal Cord Injury & Paralysis Neurological Disorders (MS, ALS, Cerebral Palsy, Stroke) Geriatric Mobility Impairment Temporary / Post?Operative Mobility Limitation |

| By Feature Set | Smart Navigation & Obstacle Avoidance IoT & Remote Monitoring Integration Seating, Standing & Positioning Functions Telehealth & Remote Assistance-Enabled Models |

| By Distribution Channel in Oman | Hospital & Rehabilitation Center Procurement Local Medical Device Distributors & Dealers Direct Import / Tender-Based Procurement Online & Regional E?Commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Physiotherapists, Occupational Therapists |

| End-Users of Robotic Wheelchairs | 100 | Individuals with mobility impairments, Caregivers |

| Healthcare Administrators | 80 | Hospital Managers, Rehabilitation Center Directors |

| Policy Makers | 50 | Government Officials, Disability Advocates |

| Manufacturers and Distributors | 70 | Sales Managers, Product Development Leads |

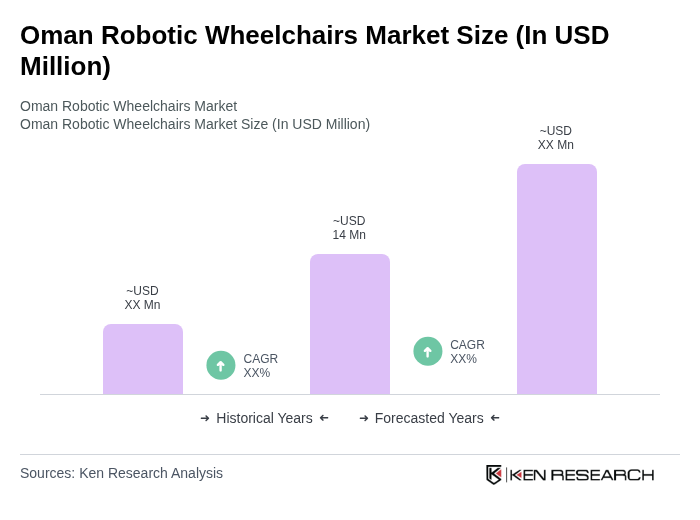

The Oman Robotic Wheelchairs Market is valued at approximately USD 14 million, reflecting a five-year historical analysis. This growth is attributed to factors such as an increasing aging population and advancements in robotic technologies.