Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4141

Pages:85

Published On:December 2025

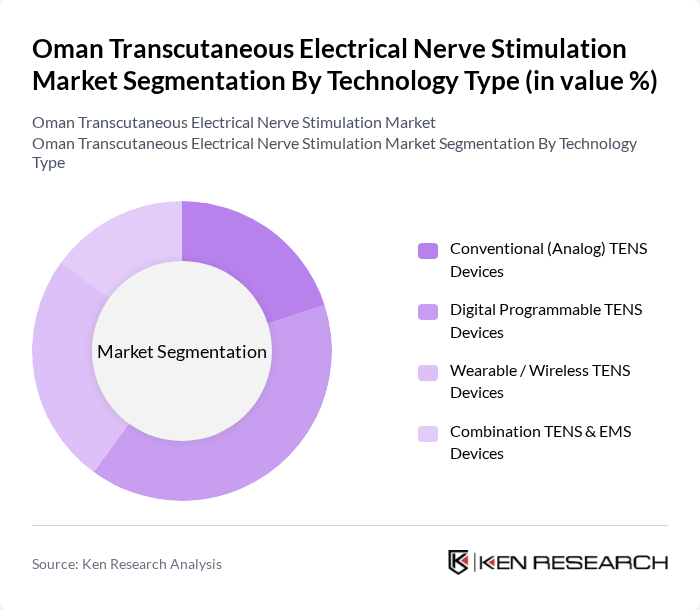

By Technology Type:

The technology type segmentation includes Conventional (Analog) TENS Devices, Digital Programmable TENS Devices, Wearable / Wireless TENS Devices, and Combination TENS & EMS Devices. Among these, Digital Programmable TENS Devices are leading the market due to their advanced features, such as customizable settings, multiple therapy modes, and user-friendly interfaces that align with global preferences for digitally controlled TENS units. The growing trend towards personalized and home?based healthcare solutions, supported by increased consumer familiarity with connected health technologies in Oman, has driven preference toward digital and wearable devices, making them the most sought-after option in non-invasive pain management.

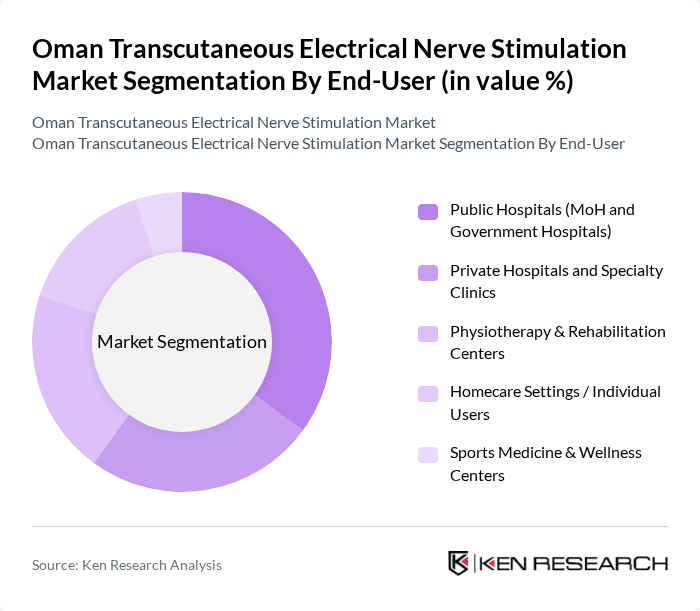

By End-User:

This segmentation includes Public Hospitals (MoH and Government Hospitals), Private Hospitals and Specialty Clinics, Physiotherapy & Rehabilitation Centers, Homecare Settings / Individual Users, and Sports Medicine & Wellness Centers. Public Hospitals are the leading end-user segment, primarily due to their extensive patient base, government funding, and central role in delivering pain management and post?operative rehabilitation services in Oman’s healthcare system. The increasing focus on rehabilitation, orthopedic and musculoskeletal care, and chronic disease management in these facilities, together with structured procurement of medical devices under the Ministry of Health, has further solidified their position as the primary users of TENS devices.

The Oman Transcutaneous Electrical Nerve Stimulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omron Healthcare Co., Ltd., Beurer GmbH, Medtronic plc, Zynex Medical, Inc., DJO Global, Inc. (Enovis Corporation), NeuroMetrix, Inc., BTL Industries Ltd., Chattanooga (DJO / Enovis Brand), TENSCare Ltd., Johari Digital Healthcare Ltd., EMS Physio Ltd., and local medical device distributors in Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the TENS market in Oman appears promising, driven by increasing healthcare investments and a growing focus on patient-centric care. As the government allocates more resources to healthcare infrastructure, the accessibility of TENS devices is expected to improve. Additionally, the integration of smart technology into TENS devices will likely enhance user engagement and treatment outcomes. These trends indicate a shift towards more personalized and effective pain management solutions, positioning TENS devices favorably in the evolving healthcare landscape.

| Segment | Sub-Segments |

|---|---|

| By Technology Type | Conventional (Analog) TENS Devices Digital Programmable TENS Devices Wearable / Wireless TENS Devices Combination TENS & EMS Devices |

| By End-User | Public Hospitals (MoH and Government Hospitals) Private Hospitals and Specialty Clinics Physiotherapy & Rehabilitation Centers Homecare Settings / Individual Users Sports Medicine & Wellness Centers |

| By Clinical Application | Chronic Musculoskeletal Pain (Back, Neck, Joint) Neuropathic Pain Post-Operative & Post-Trauma Pain Obstetrics & Gynecology Pain Management Others (Dental, Migraine, Miscellaneous) |

| By Distribution Channel | Hospital & Clinic Procurement (Tender / Institutional Sales) Medical Device Distributors & Pharmacies E-commerce & Online Marketplaces Direct-to-Consumer Sales |

| By Geography (Within Oman) | Muscat Governorate Dhofar (Salalah) Al Batinah (Sohar & Surrounding Areas) Interior & Other Governorates |

| By Device Configuration | Handheld / Portable TENS Units Clinic-Based / Desktop & Multi-Channel Units Wearable Patch-Type Units |

| By Patient Demographics | Adults (18–59 Years) Geriatric Population (60+ Years) Athletes & Physically Active Population |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 90 | Physiotherapists, Pain Management Specialists |

| Medical Device Distributors | 60 | Sales Managers, Product Managers |

| Patients Using TENS Devices | 110 | Chronic Pain Patients, Rehabilitation Patients |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Authorities |

| Retailers of Medical Devices | 70 | Store Managers, Inventory Managers |

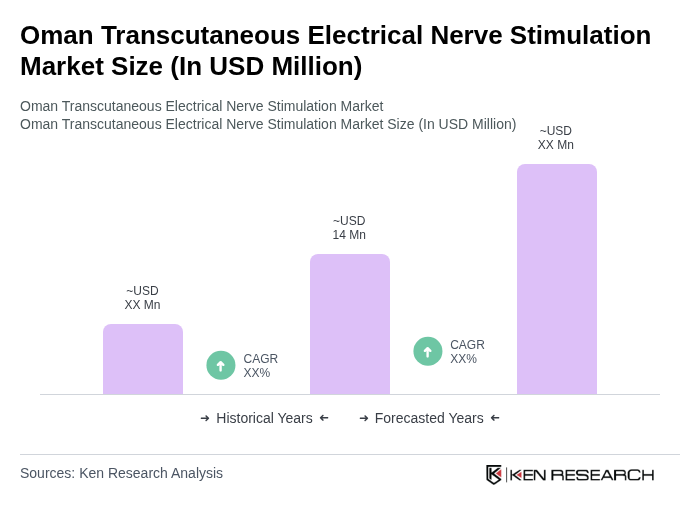

The Oman Transcutaneous Electrical Nerve Stimulation (TENS) market is valued at approximately USD 14 million, reflecting a growing demand for non-invasive pain management solutions amid increasing chronic pain conditions in the region.