Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3815

Pages:81

Published On:November 2025

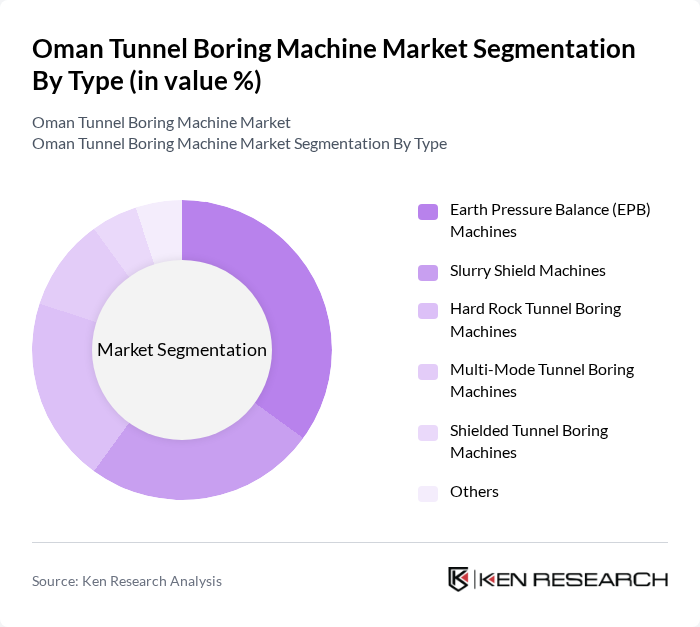

By Type:The market is segmented into various types of tunnel boring machines, including Earth Pressure Balance (EPB) Machines, Slurry Shield Machines, Hard Rock Tunnel Boring Machines, Multi-Mode Tunnel Boring Machines, Shielded Tunnel Boring Machines, and Others. Global market analysis indicates that Slurry Shield Machines currently exhibit strong market dominance due to their effectiveness in soft ground conditions. However, Earth Pressure Balance (EPB) Machines remain highly competitive due to their versatility and efficiency in urban tunneling projects. The increasing complexity of urban infrastructure projects has driven demand for EPB machines, which can operate in various soil conditions while minimizing surface settlement.

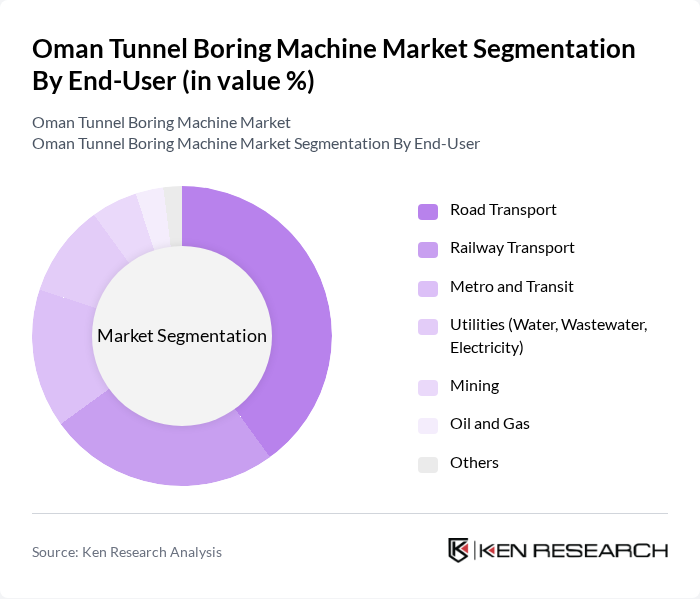

By End-User:The end-user segmentation includes Road Transport, Railway Transport, Metro and Transit, Utilities (Water, Wastewater, Electricity), Mining, Oil and Gas, and Others. The Road Transport segment is currently the dominant end-user, driven by the rapid expansion of road networks and the need for efficient tunneling solutions to accommodate increasing traffic demands. The focus on improving transportation infrastructure has led to a surge in projects requiring tunnel boring machines. Additional growth is being fueled by investments in hydropower infrastructure, underground utility corridors, and mining operations.

The Oman Tunnel Boring Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herrenknecht AG, The Robbins Company, Komatsu Ltd., Terratec Ltd., Hitachi Zosen Corporation, IHI Corporation, China Railway Construction Heavy Industry Corporation Limited, China Railway Engineering Equipment Group Co. Ltd., Sany Heavy Industry Co., Ltd., Sandvik AB, Akkerman Inc., Seli Overseas S.p.A., Bauer AG, Vermeer Corporation, Strabag SE contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Tunnel Boring Machine market is poised for significant growth, driven by ongoing infrastructure projects and urbanization trends. As the government continues to invest in transportation and public works, the demand for advanced tunneling solutions will increase. Additionally, the integration of automation and AI technologies in tunneling operations is expected to enhance efficiency and reduce costs. These developments will likely attract international partnerships, fostering innovation and sustainability in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Earth Pressure Balance (EPB) Machines Slurry Shield Machines Hard Rock Tunnel Boring Machines Multi-Mode Tunnel Boring Machines Shielded Tunnel Boring Machines Others |

| By End-User | Road Transport Railway Transport Metro and Transit Utilities (Water, Wastewater, Electricity) Mining Oil and Gas Others |

| By Project Type | Urban Tunneling Projects Highway and Road Tunnels Rail Tunnels Utility Tunnels Others |

| By Size of Project | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Technology | Conventional Boring Technology Advanced Boring Technology Hybrid Boring Technology Others |

| By Investment Source | Public Sector Investments Private Sector Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 100 | Project Managers, Civil Engineers |

| Mining Sector Tunneling Operations | 60 | Mining Engineers, Operations Managers |

| Utility Tunneling Initiatives | 50 | Utility Managers, Technical Directors |

| Public Sector Infrastructure Planning | 40 | Government Officials, Policy Makers |

| Construction Equipment Suppliers | 70 | Sales Managers, Product Specialists |

The Oman Tunnel Boring Machine market is valued at approximately USD 1.1 billion, reflecting significant growth driven by infrastructure development and government investments in transportation networks, particularly in urban areas.