Region:Middle East

Author(s):Rebecca

Product Code:KRAD6087

Pages:91

Published On:December 2025

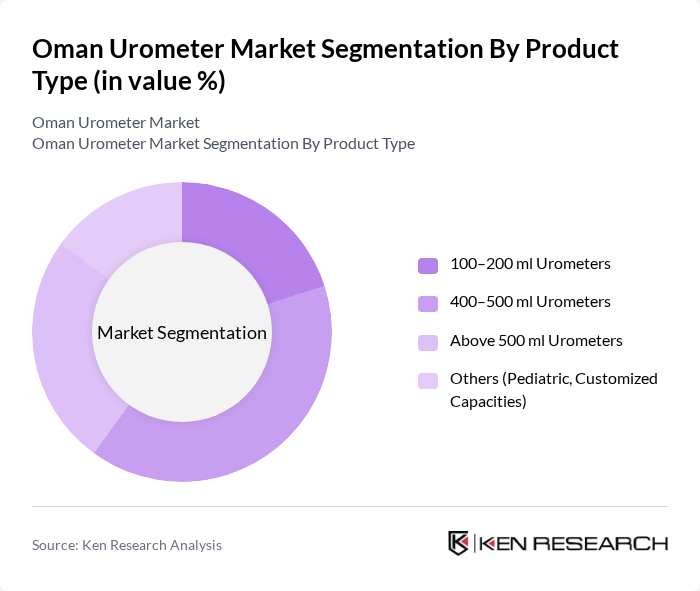

By Product Type:The product type segmentation includes various urometer capacities, catering to different clinical needs. The subsegments are 100–200 ml Urometers, 400–500 ml Urometers, Above 500 ml Urometers, and Others (Pediatric, Customized Capacities). The 400–500 ml Urometers segment is currently dominating the market due to its versatility and suitability for a wide range of patients, including those undergoing surgical procedures. The demand for these urometers is driven by their accuracy and ease of use, making them a preferred choice among healthcare professionals.

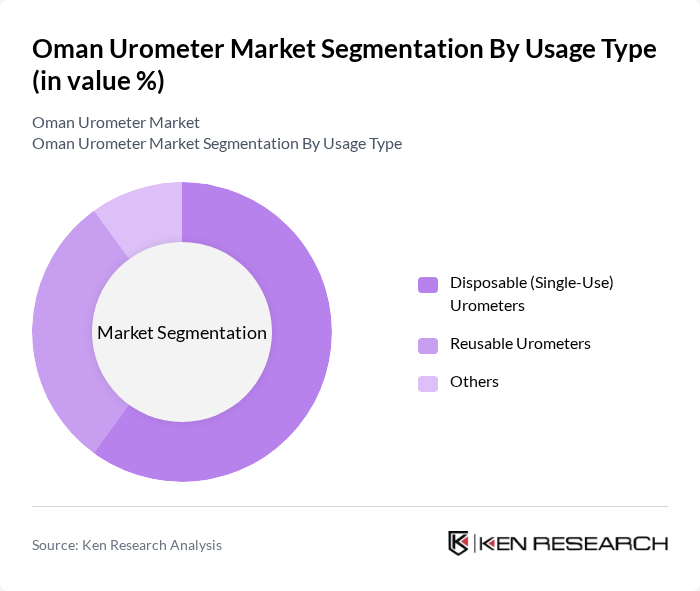

By Usage Type:The usage type segmentation includes Disposable (Single-Use) Urometers, Reusable Urometers, and Others. The Disposable (Single-Use) Urometers segment is leading the market due to their convenience and reduced risk of cross-contamination, which is particularly important in hospital settings. The growing trend towards infection control and patient safety has significantly boosted the demand for disposable options, making them the preferred choice for many healthcare providers.

The Oman Urometer Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Teleflex Incorporated, Medline Industries, LP, Cardinal Health, Inc., Coloplast A/S, Hollister Incorporated, ConvaTec Group Plc, Thermo Fisher Scientific Inc. (Urology Consumables), Amsino International, Inc., Urocare Products, Inc., UroMetric, Inc., Zhejiang Haisheng Medical Device Co., Ltd., Jiangsu Kangjin Medical Instrument Co., Ltd., HospiCare Systems FZ?LLC (Regional Supplier), Gulf Medical Co. LLC (Regional Distributor for Urology Devices) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman urometer market appears promising, driven by ongoing advancements in technology and a growing emphasis on patient-centric healthcare. As the healthcare infrastructure expands, particularly in rural areas, the demand for innovative urometer solutions is expected to rise. Additionally, the integration of artificial intelligence in urometer technology will enhance diagnostic accuracy, further propelling market growth. Stakeholders must focus on addressing challenges to fully capitalize on these emerging trends and opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | –200 ml Urometers –500 ml Urometers Above 500 ml Urometers Others (Pediatric, Customized Capacities) |

| By Usage Type | Disposable (Single-Use) Urometers Reusable Urometers Others |

| By Application | Operative & Post?Operative Procedures Emergency & Critical Care Long?Term & Palliative Care Others |

| By End-User | Public Hospitals (MOH & Government) Private Hospitals Specialty/Urology Clinics Home Care Settings Others |

| By Distribution Channel | Direct Sales to Hospitals Local Medical Device Distributors Online/Procurement Portals Others |

| By Technology | Electronic / Digital Urometers Gravity-Based / Mechanical Urometers Others (Smart / Connected Systems) |

| By Region | Muscat Dhofar (incl. Salalah) Al Batinah (incl. Sohar) Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 90 | Procurement Managers, Supply Chain Coordinators |

| Urology Clinics | 70 | Urologists, Clinic Managers |

| Home Care Providers | 50 | Home Health Care Coordinators, Medical Equipment Suppliers |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Affairs Specialists |

The Oman Urometer Market is valued at approximately USD 14 million, driven by the increasing prevalence of urological disorders, technological advancements in diagnostics, and a growing emphasis on patient care within healthcare facilities.