Region:Middle East

Author(s):Rebecca

Product Code:KRAD5050

Pages:100

Published On:December 2025

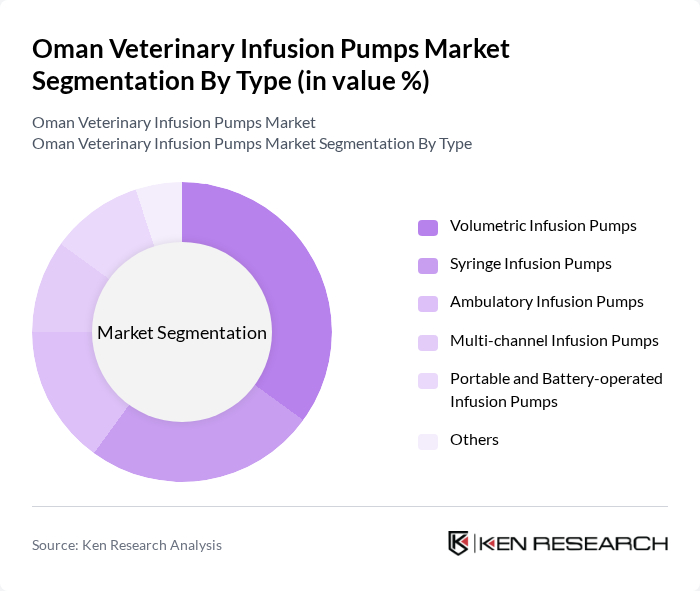

By Type:The market is segmented into various types of infusion pumps, including volumetric infusion pumps, syringe infusion pumps, ambulatory infusion pumps, multi-channel infusion pumps, portable and battery-operated infusion pumps, and others. This structure is consistent with global product categorizations, where syringe and volumetric pumps represent the two core product classes and ambulatory or portable pumps serve more specialized use cases in both companion-animal and mixed-animal practices. Each type serves specific veterinary needs, with volumetric infusion pumps being particularly popular due to their accuracy and reliability in delivering fluids for procedures such as parenteral nutrition, transfusions, and fluid resuscitation.

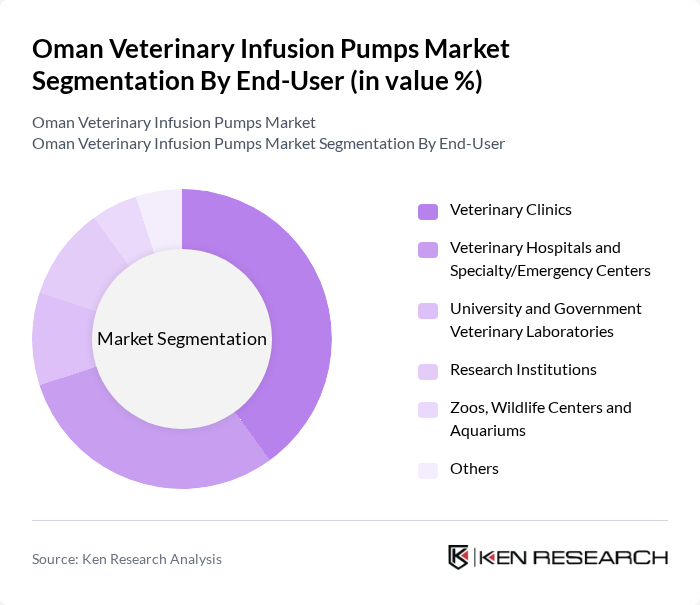

By End-User:The end-user segmentation includes veterinary clinics, veterinary hospitals and specialty/emergency centers, university and government veterinary laboratories, research institutions, zoos, wildlife centers, and aquariums, among others. This segmentation reflects the global demand pattern, where veterinary hospitals and clinics collectively represent the largest customer base for infusion pumps, followed by research and institutional users and zoological or wildlife facilities that require controlled fluid and drug delivery. Veterinary clinics are the leading end-users in Oman due to the increasing number of pet owners seeking professional veterinary care and the growing adoption of advanced equipment in small-animal practices across the Gulf region.

The Oman Veterinary Infusion Pumps Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Baxter International Inc., ICU Medical, Inc., Fresenius Kabi AG, Terumo Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Q Core Medical Ltd., DRE Veterinary (Avante Animal Health), Heska Corporation, Eickemeyer Veterinary Equipment GmbH & Co. KG, Vmed Technology, Dispomed Ltd., Grady Medical Systems, Inc., Jørgen Kruuse A/S, Burtons Medical Equipment Ltd. contribute to innovation, geographic expansion, and service delivery in this space, reflecting the broader global competitive landscape for veterinary infusion pumps and related veterinary equipment.

The future of the veterinary infusion pumps market in Oman appears promising, driven by increasing investments in veterinary healthcare infrastructure and a growing emphasis on animal welfare. As the government continues to support initiatives aimed at enhancing veterinary services, the market is likely to witness a surge in the adoption of advanced technologies. Additionally, the integration of telemedicine in veterinary practices is expected to facilitate remote monitoring and treatment, further expanding the market's potential and accessibility for pet owners.

| Segment | Sub-Segments |

|---|---|

| By Type | Volumetric Infusion Pumps Syringe Infusion Pumps Ambulatory Infusion Pumps Multi-channel Infusion Pumps Portable and Battery-operated Infusion Pumps Others |

| By End-User | Veterinary Clinics Veterinary Hospitals and Specialty/Emergency Centers University and Government Veterinary Laboratories Research Institutions Zoos, Wildlife Centers and Aquariums Others |

| By Animal Type | Companion Animals (Dogs, Cats) Equine Livestock (Cattle, Sheep, Goats, Camelids) Poultry Exotic and Wildlife Species Others |

| By Application | Anesthesia and Analgesia Pain Management and Sedation Fluid Therapy and Blood Transfusion Chemotherapy and Oncology Parenteral Nutrition Others |

| By Distribution Channel | Direct Sales to End Users Local Medical Device Distributors Online and E-commerce Platforms Tender-based Procurement (Public Sector) Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Policy Support | Government Capital Expenditure on Veterinary Infrastructure Import Duty and Tax Incentives on Medical Devices Grants and Soft Loans for Veterinary Practices Public–Private Partnership Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Animal Hospitals | 90 | Veterinary Surgeons, Hospital Administrators |

| Veterinary Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Livestock Management Facilities | 50 | Farm Managers, Veterinary Technicians |

| Veterinary Technicians and Nurses | 70 | Veterinary Technicians, Nursing Supervisors |

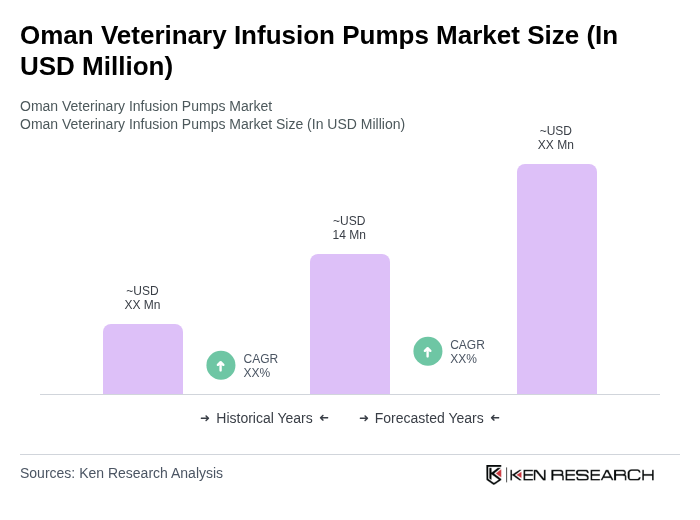

The Oman Veterinary Infusion Pumps Market is valued at approximately USD 14 million, reflecting a growing demand for advanced veterinary care and increased pet ownership in the region.