Region:Middle East

Author(s):Rebecca

Product Code:KRAD5056

Pages:98

Published On:December 2025

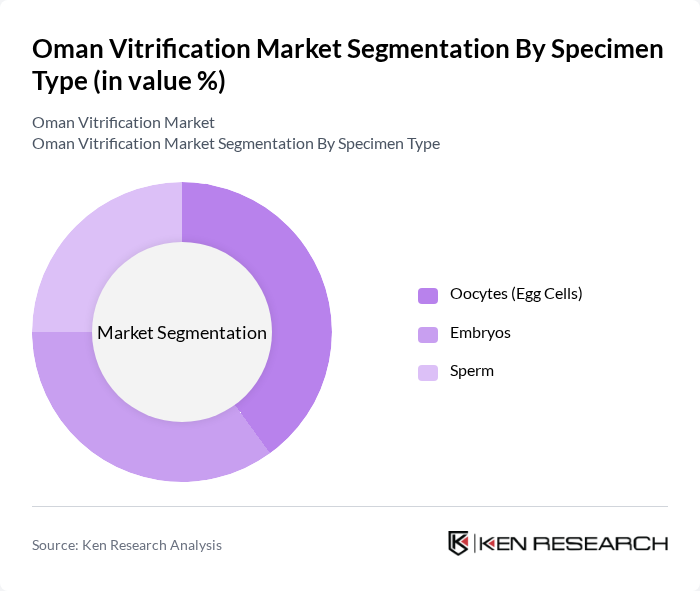

By Specimen Type:The specimen type segmentation includes Oocytes (Egg Cells), Embryos, and Sperm. Each of these subsegments plays a crucial role in the vitrification process, with varying applications in fertility treatments. Oocytes are often prioritized due to their significance in female fertility preservation and their leading share in the global vitrification market by specimen, supported by strong evidence of high survival, fertilization, and live-birth rates after vitrification. Embryos are critical for successful implantation in assisted reproductive technologies and are widely vitrified in routine IVF cycles to optimize cumulative pregnancy rates. Sperm vitrification is also essential for male fertility preservation, particularly in cancer patients and men undergoing gonadotoxic treatments, as well as for use in donor sperm programs.

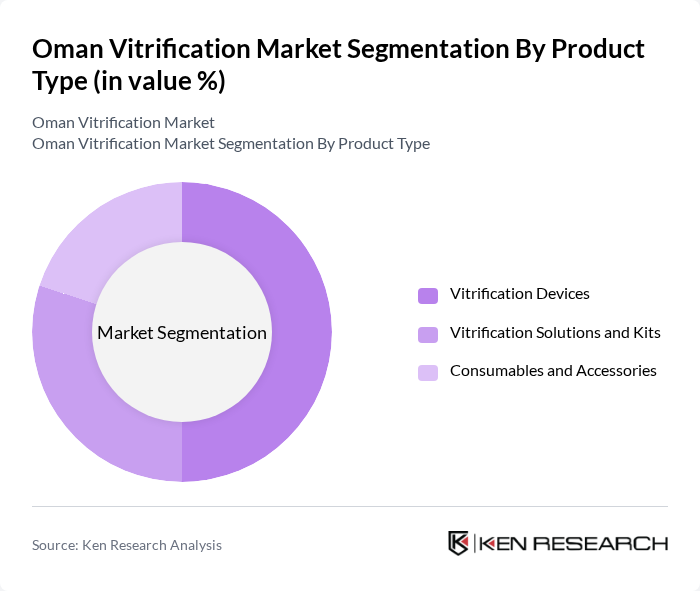

By Product Type:The product type segmentation encompasses Vitrification Devices, Vitrification Solutions and Kits, and Consumables and Accessories. Vitrification devices are essential for the cryopreservation process and typically account for the larger revenue share globally, reflecting demand for advanced equipment, automated systems, and precise temperature-control platforms in IVF laboratories. Vitrification solutions and kits provide the necessary cryoprotectant formulations and stepwise media systems for effective vitrification, with manufacturers continuously optimizing compositions to reduce toxicity and improve cell viability. Consumables and accessories, such as cryo-straws, cryo-tips, storage canes, and liquid nitrogen storage solutions, support the overall process, ensuring that clinics have the tools needed for consistent, standardized, and high-throughput procedures.

The Oman Vitrification Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cooper Surgical, Inc. (Fertility and Reproductive Health Division), Vitrolife AB, Kitazato Corporation, Hamilton Thorne, Inc., Genea Biomedx, Irvine Scientific, Origio (CooperSurgical subsidiary), Medicult (Origio), Esco Micro Pte. Ltd., Thermo Fisher Scientific (Reproductive Health Division), Fujifilm Irvine Scientific, Nidacon International, Embryotech Laboratories, Aga Khan University Hospital (Regional Provider), Middle East Fertility Society Member Institutions contribute to innovation, geographic expansion, and service delivery in this space, leveraging portfolios that span vitrification media, devices, and integrated ART solutions.

The future of the Oman vitrification market appears promising, driven by increasing healthcare expenditure and a growing emphasis on reproductive health. As the government continues to invest in healthcare infrastructure, the number of private IVF clinics is expected to rise, enhancing accessibility. Furthermore, partnerships with international technology providers will likely introduce innovative solutions, improving service quality. Overall, these trends indicate a robust growth trajectory for the vitrification market in Oman, aligning with global advancements in reproductive technologies.

| Segment | Sub-Segments |

|---|---|

| By Specimen Type | Oocytes (Egg Cells) Embryos Sperm |

| By Product Type | Vitrification Devices Vitrification Solutions and Kits Consumables and Accessories |

| By End-User | IVF Clinics and Fertility Centers Biobanks and Specimen Storage Facilities Research and Academic Institutions |

| By Application | Fertility Preservation for Cancer Patients Delayed Parenthood and Family Planning Assisted Reproductive Technology (ART) Programs Research and Development |

| By Technology Platform | Manual Vitrification Systems Automated Micro-Fluidic Vitrification Systems Semi-Automated Systems |

| By Service Model | Equipment Sales Consumables and Reagent Supply Service and Maintenance Contracts |

| By Market Maturity | Emerging Adoption Phase Growth Phase Mature Market Segments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Vitrification Applications | 100 | Project Managers, Site Engineers |

| Waste Management Companies | 80 | Operations Managers, Environmental Compliance Officers |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Research Institutions Focused on Vitrification | 40 | Research Scientists, Academic Professors |

| End-users in Industrial Applications | 70 | Procurement Managers, Facility Managers |

The Oman Vitrification Market is valued at approximately USD 50 million, reflecting a strong growth trajectory influenced by rising infertility rates and the increasing adoption of vitrification techniques over traditional slow-freezing methods.