Region:Central and South America

Author(s):Dev

Product Code:KRAC0437

Pages:95

Published On:August 2025

By Type:The grain market in Paraguay is segmented into various types, including Corn (Maize), Rice, Wheat, Sorghum, Barley, Oats, and Others (e.g., rye, triticale). Among these, Corn (Maize) is a leading sub-segment by domestic use because of its central role in animal feed and widespread cultivation; however, soybeans dominate overall oilseed/grain export value, and wheat and rice have posted notable production gains recently, reflecting diversified demand across food, feed, and export channels .

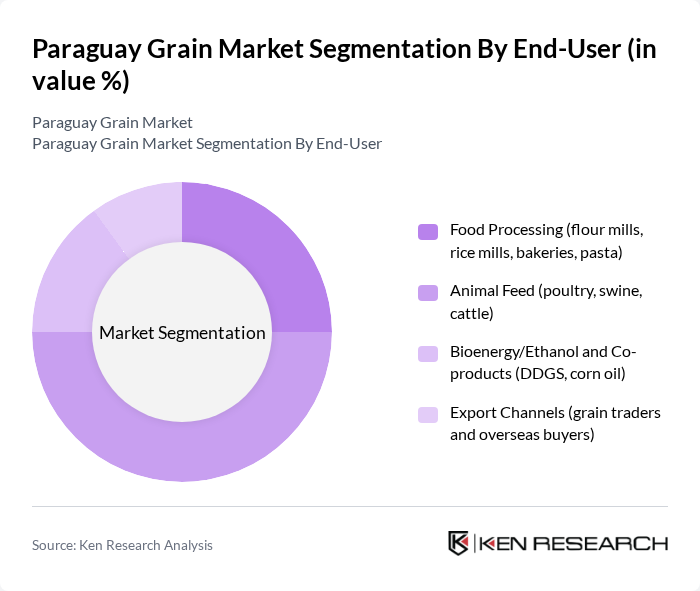

By End-User:The end-user segmentation of the grain market includes Food Processing, Animal Feed, Bioenergy/Ethanol and Co-products, and Export Channels. The Animal Feed segment is currently the most significant, as the livestock and poultry sectors rely heavily on corn-based rations, while food processing remains substantial for wheat flour and milled rice. Export channels have strengthened on the back of improved wheat and rice surpluses and strong regional demand, especially from Brazil .

The Paraguay Grain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Paraguay S.R.L., ADM Paraguay S.R.L. (Archer Daniels Midland), Agrofértil S.A. (Grupo Sarabia), Cooperativa Colonias Unidas Agropecuaria e Industrial, Grupo Los Trigales S.A., Agroganadera Itapúa S.A., Copagra S.A. (Comercial Paraguaya de Granos), Agrotec S.A.E., Louis Dreyfus Company Paraguay S.A., Bunge Paraguay S.A., ContiParaguay S.A. (Grupo ContiParaguay), Industrias Trociuk S.A. (Arroz Trociuk), Molino Harinero Clari S.A., Cooperativa La Holanda Ltda., Girassoil S.A. (aceites y granos) contribute to innovation, geographic expansion, and service delivery in this space.

The Paraguay grain market is poised for significant transformation, driven by increasing domestic consumption and export opportunities. As the population grows and incomes rise, demand for grains is expected to escalate. Additionally, technological advancements will enhance productivity, while sustainable practices gain traction. However, challenges such as climate change and infrastructure limitations must be addressed. Overall, the market is likely to experience robust growth, supported by strategic investments and government initiatives aimed at bolstering the agricultural sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Corn (Maize) Rice Wheat Sorghum Barley Oats Others (e.g., rye, triticale) |

| By End-User | Food Processing (flour mills, rice mills, bakeries, pasta) Animal Feed (poultry, swine, cattle) Bioenergy/Ethanol and Co-products (DDGS, corn oil) Export Channels (grain traders and overseas buyers) |

| By Distribution Channel | Direct Offtake (traders/exporters, crushers, mills) Cooperatives and Associations Wholesale/Bulk Trading Retail and E-commerce |

| By Quality Grade | Export Grade Milling Grade Feed Grade |

| By Packaging Type | Bulk (silos, containers, bulk vessels) Industrial Bags (25–50 kg) Retail Packs (?10 kg) |

| By Price Range | Low Price Mid Price High Price |

| By Region | Eastern Region (Itapúa, Alto Paraná, Canindeyú, Caaguazú) Central Region (Central, Cordillera, Paraguarí) Southern Region (Itapúa Sur, Misiones, Ñeembucú) Northern Region (San Pedro, Concepción, Amambay) Chaco/Western Region (Presidente Hayes, Boquerón, Alto Paraguay) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grain Producers | 150 | Farm Owners, Agricultural Managers |

| Grain Exporters | 100 | Export Managers, Trade Analysts |

| Supply Chain Stakeholders | 80 | Logistics Coordinators, Warehouse Managers |

| Agricultural Policy Makers | 60 | Government Officials, Policy Advisors |

| Market Analysts | 70 | Research Analysts, Economic Advisors |

The Paraguay Grain Market is valued at approximately USD 1.8 billion, reflecting significant growth driven by favorable agricultural conditions, technological advancements, and increasing global demand for key grains such as soybeans, corn, wheat, and rice.