Region:Asia

Author(s):Shubham

Product Code:KRAD0809

Pages:81

Published On:August 2025

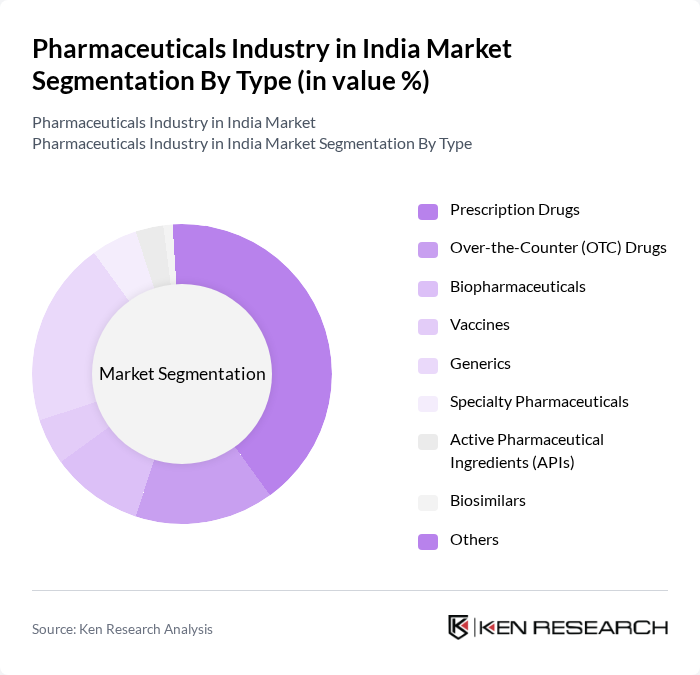

By Type:The Pharmaceuticals Industry in India is segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biopharmaceuticals, Vaccines, Generics, Specialty Pharmaceuticals, Active Pharmaceutical Ingredients (APIs), Biosimilars, and Others. Among these,Prescription DrugsandGenericsare the most significant segments, driven by the increasing prevalence of chronic diseases and the demand for affordable medication. The generics segment is particularly dominant due to India's strong manufacturing capabilities and cost-effective production processes. Conventional drugs (small molecules) account for the largest share, with biologics and biosimilars showing rapid growth due to increased investment in R&D and regulatory support for innovation .

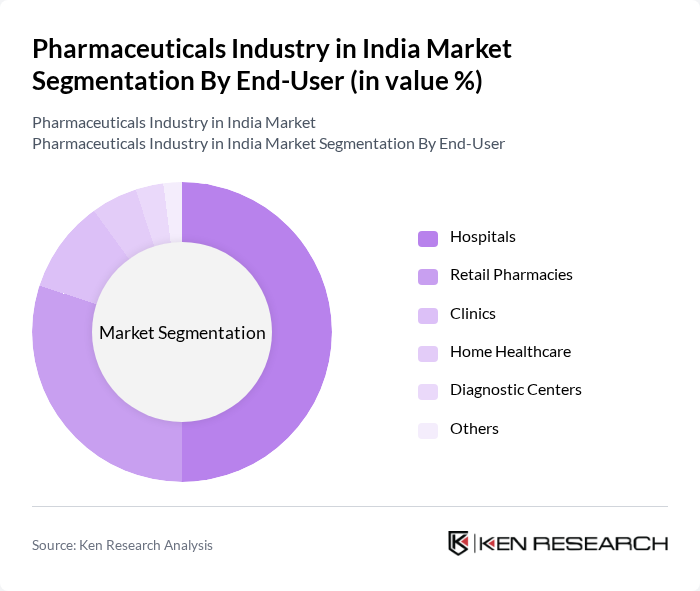

By End-User:The end-user segmentation of the Pharmaceuticals Industry in India includes Hospitals, Retail Pharmacies, Clinics, Home Healthcare, Diagnostic Centers, and Others.HospitalsandRetail Pharmaciesare the leading segments, driven by the increasing number of healthcare facilities and the growing demand for prescription medications. The rise in outpatient services and home healthcare solutions is also contributing to the growth of these segments. Diagnostic centers and clinics are expanding due to improved access to medical services and rising health awareness among rural and urban populations .

The Pharmaceuticals Industry in India Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Cipla Ltd., Lupin Ltd., Aurobindo Pharma Ltd., Zydus Lifesciences Ltd., Glenmark Pharmaceuticals Ltd., Torrent Pharmaceuticals Ltd., Alkem Laboratories Ltd., Biocon Ltd., Wockhardt Ltd., Abbott India Ltd., Intas Pharmaceuticals Ltd., Piramal Enterprises Ltd., Hetero Drugs Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceuticals industry in India appears promising, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence in drug development is expected to streamline processes, reducing time and costs. Additionally, the rise of telemedicine is likely to enhance patient access to pharmaceutical services, particularly in rural areas. These trends indicate a transformative phase for the industry, fostering innovation and improving healthcare delivery across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biopharmaceuticals Vaccines Generics Specialty Pharmaceuticals Active Pharmaceutical Ingredients (APIs) Biosimilars Others |

| By End-User | Hospitals Retail Pharmacies Clinics Home Healthcare Diagnostic Centers Others |

| By Region | North India South India East India West India Central India |

| By Application | Cardiovascular Oncology Neurology Infectious Diseases Diabetes Respiratory Gastroenterology Others |

| By Distribution Channel | Direct Sales Wholesalers Online Pharmacies Retail Pharmacies Hospital Pharmacies Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Research Grants Production Linked Incentive (PLI) Scheme Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Market Access Strategies | 60 | Market Access Managers, Pricing Analysts |

| Healthcare Provider Perspectives | 70 | Doctors, Hospital Administrators |

| Regulatory Compliance Challenges | 40 | Regulatory Affairs Managers, Compliance Officers |

| Pharmaceutical Distribution Channels | 50 | Supply Chain Managers, Distribution Executives |

The Pharmaceuticals Industry in India is valued at approximately USD 61 billion, driven by increasing healthcare expenditure, a rising prevalence of chronic diseases, and a growing demand for generic medications. This positions India as a global leader in pharmaceutical production.