Region:Asia

Author(s):Rebecca

Product Code:KRAA9223

Pages:82

Published On:November 2025

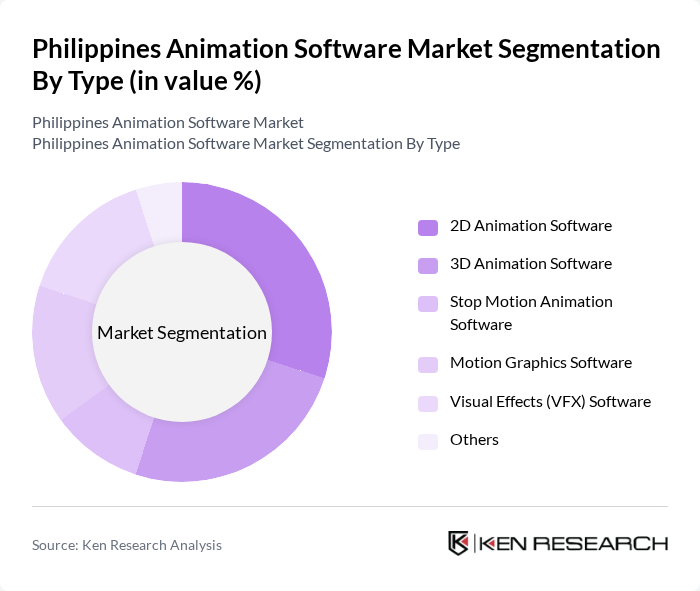

By Type:The animation software market is segmented into 2D Animation Software, 3D Animation Software, Stop Motion Animation Software, Motion Graphics Software, Visual Effects (VFX) Software, and Others. Each segment addresses distinct creative and technical requirements. 2D and 3D animation software remain the most widely adopted, especially in media, entertainment, and advertising, while VFX software is increasingly utilized in film production, gaming, and immersive digital experiences. The adoption of cloud-based animation tools and AI-driven features is also accelerating across all segments .

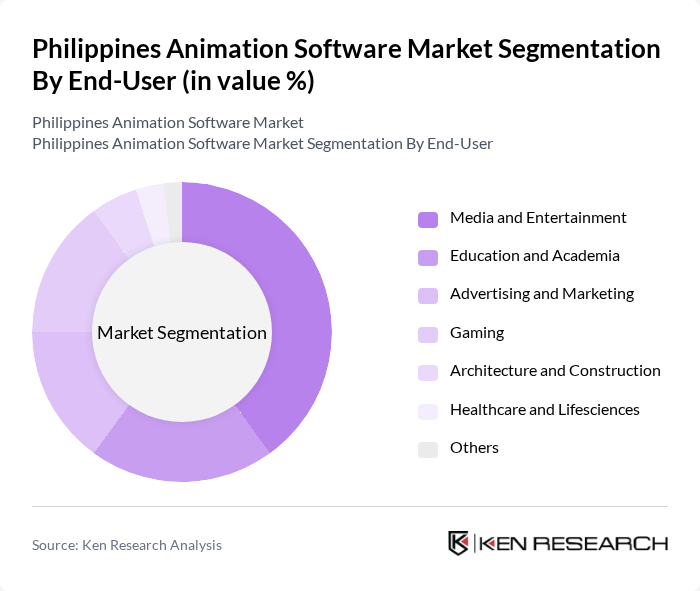

By End-User:End-user segments include Media and Entertainment, Education and Academia, Advertising and Marketing, Gaming, Architecture and Construction, Healthcare and Lifesciences, and Others. Media and entertainment is the largest consumer, driven by animated film and series production, as well as the expansion of digital content platforms. The education sector is also a significant user, leveraging animation for interactive and engaging learning materials. Gaming and advertising are rapidly growing end-user segments, reflecting the broader digital transformation in the Philippines .

The Philippines Animation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toon Boom Animation Inc., Adobe Systems Incorporated, Autodesk, Inc., Blender Foundation, Moho (formerly Anime Studio), Corel Corporation, TVPaint Développement, Smith Micro Software, Inc., OpenToonz, Clip Studio Paint (Celsys, Inc.), Wacom Co., Ltd., Celsys, Inc., Pixologic, Inc., Foundry (Nuke), Pixar Animation Studios (RenderMan), Toon City Animation (Philippines), Top Draw Animation (Philippines), Synergy88 Digital (Philippines) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the animation software market in the Philippines appears promising, driven by technological advancements and increasing digital content consumption. As the demand for high-quality animated content continues to rise, local developers are likely to innovate and adapt to emerging trends, such as cloud-based solutions and AI integration. Furthermore, the government's support for the creative industry is expected to foster a more conducive environment for growth, encouraging investment and collaboration among stakeholders in the animation sector.

| Segment | Sub-Segments |

|---|---|

| By Type | D Animation Software D Animation Software Stop Motion Animation Software Motion Graphics Software Visual Effects (VFX) Software Others |

| By End-User | Media and Entertainment Education and Academia Advertising and Marketing Gaming Architecture and Construction Healthcare and Lifesciences Others |

| By Industry Application | Film Production Television Broadcasting Online Content Creation Corporate Training Virtual Reality/Augmented Reality Others |

| By Distribution Channel | Direct Sales Online Platforms Resellers and Distributors Retail Outlets Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Model Pay-Per-Use Others |

| By User Type | Individual Users Small and Medium Enterprises Large Enterprises Educational Institutions Animation Studios Others |

| By Software Deployment | On-Premise Cloud-Based Hybrid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Animation Studios | 60 | Studio Owners, Creative Directors |

| Freelance Animators | 50 | Independent Artists, Animation Specialists |

| Educational Institutions | 40 | Program Coordinators, Faculty Members |

| Software Developers | 45 | Product Managers, Technical Leads |

| Industry Experts | 40 | Consultants, Market Analysts |

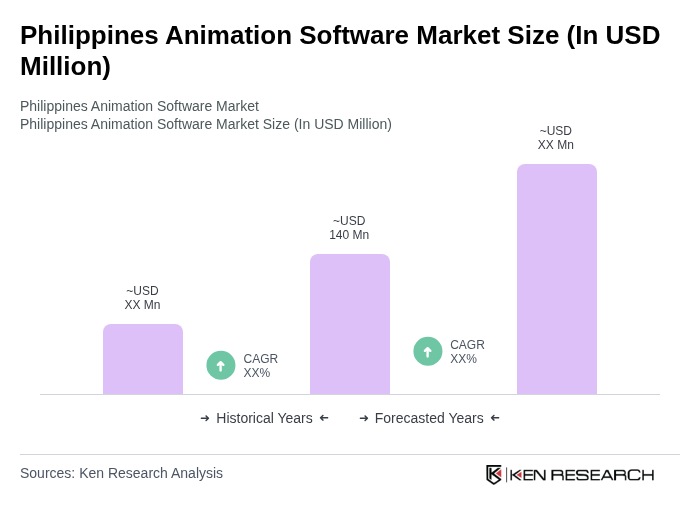

The Philippines Animation Software Market is valued at approximately USD 140 million, driven by the increasing demand for high-quality animated content across various sectors, including media, entertainment, advertising, and education.