Philippines Auto Loan Market Outlook to 2029

Philippines Auto Loan Market: Growth Drivers, Trends & Future Outlook to 2030

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1527

August 2025

90

About the Report

Philippines Auto Loan Market Overview

- The Philippines Auto Loan Market is valued at approximately PHP 650 billion, based on a five-year historical analysis. This reflects the scale of outstanding auto financing and new loan disbursements reported by industry trackers, aligned with a rebound in vehicle sales and rising financing penetration among banks and captive lenders. The market growth is fueled by increasing vehicle ownership, expanding credit access, and supportive economic and infrastructural developments.

- Metro Manila leads auto loan credit disbursement due to its dense population, concentration of banks, and dealership networks. Cebu and Davao benefit from expanding urban economies and rising vehicle ownership, supporting growing demand for auto financing.

- In 2023, the Philippine government advanced policies supporting the automotive industry and sustainable transport, including the implementation of the Electric Vehicle Industry Development Act (EVIDA) and related incentives promoting EV and hybrid adoption. These measures, complemented by the Comprehensive Roadmap for Electric Vehicle Industry (CREVI), include mandates for government fleet electrification and dedicated financing products. Together, they align with broader industrial roadmaps to accelerate automotive development and sustainable mobility.

Philippines Auto Loan Market Segmentation

By Type: The market is segmented into various types of auto loans, including new vehicle financing, used vehicle financing, dealer/OEM captive financing programs, and loan refinancing and balance transfer. The new vehicle financing segment dominates the market, driven by the increasing preference for brand-new cars among consumers. This trend is influenced by the availability of attractive financing options from banks and captives, promotional offers from dealerships tied to sustained growth in new vehicle sales, and consumer demand for updated tech and safety features.

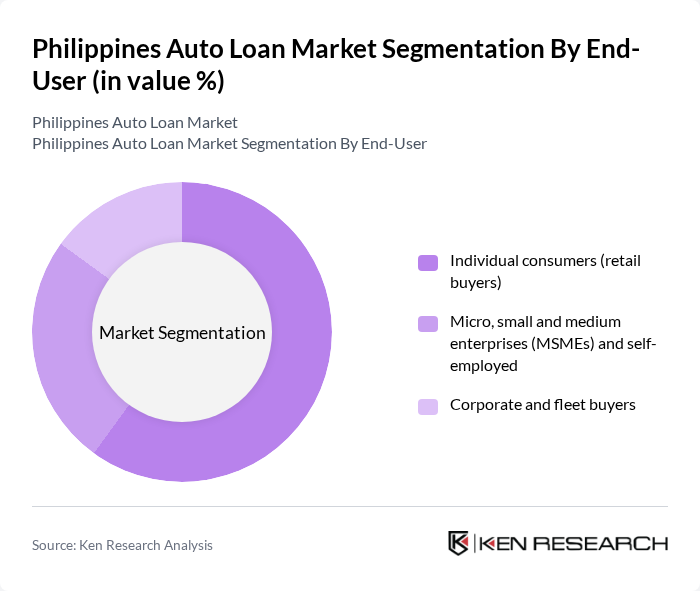

By End-User: The auto loan market is segmented by end-users, including individual consumers, micro, small, and medium enterprises (MSMEs), and corporate and fleet buyers. Individual consumers represent the largest segment in the auto loan market, driven by the increasing need for personal transportation and the growing trend of vehicle ownership among Filipinos. The rise in disposable income and the availability of flexible financing options have made it easier for individuals to purchase vehicles, aided by faster digital onboarding and online applications offered by banks and captives.

Philippines Auto Loan Market Competitive Landscape

The Philippines Auto Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Unibank, Inc., Bank of the Philippine Islands (BPI), Metropolitan Bank & Trust Company (Metrobank), Security Bank Corporation, Union Bank of the Philippines (UnionBank), contribute to innovation, geographic expansion, and service delivery in this space, with digitization initiatives and EV-oriented financing products gaining traction.

| BDO Unibank, Inc. | 1968 | Makati City, Philippines | – | – | – | – | – | – |

| Bank of the Philippine Islands (BPI) | 1851 | Makati City, Philippines | – | – | – | – | – | – |

| Metropolitan Bank & Trust Company (Metrobank) | 1962 | Makati City, Philippines | – | – | – | – | – | – |

| Security Bank Corporation | 1951 | Makati City, Philippines | – | – | – | – | – | – |

| Union Bank of the Philippines (UnionBank) | 1982 | Pasig City, Philippines | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Portfolio size (auto loans outstanding, PHP) | Disbursements (annual new auto loans, PHP) | Approval rate (%) | Average interest rate (APR or add-on, %) | Average processing time (application to release, days) | NPL ratio/default rate (%) |

|---|

Philippines Auto Loan Market Industry Analysis

Growth Drivers

- Increasing Disposable Income: The Philippines has seen a steady rise in disposable income, with average family income projected to reach around PHP 373,000 by 2025. This growing financial flexibility enables more consumers to consider auto loans. As more Filipinos enter the middle class, the propensity to finance vehicle purchases through loans is expected to grow significantly, driving demand for auto loans.

- Expanding Automotive Market: The automotive market in the Philippines is projected to grow, with vehicle sales. This growth is fueled by increasing urbanization and infrastructure development, which enhances accessibility to car ownership. As the automotive sector expands, the demand for auto loans will rise correspondingly, as consumers seek financing options to purchase new and used vehicles, thus stimulating the auto loan market.

- Competitive Interest Rates: The average interest rate for auto loans in the Philippines currently ranges around 7.8% to 9.5%, reflecting competitive terms compared to previous years. With the Bangko Sentral ng Pilipinas maintaining a stable monetary policy, these favorable rates are expected to persist. Lower borrowing costs encourage consumers to take out loans for vehicle purchases, making auto loans more attractive. This competitive environment is likely to drive higher loan uptake as consumers seek affordable financing options.

Market Challenges

- High Default Rates: The Philippines faces challenges with auto loan defaults, posing growing risks for lenders. Economic uncertainties such as inflation and fluctuating employment contribute to borrowers financial strain. If these trends persist, lenders may tighten credit conditions, making it more difficult for consumers to secure auto loans, ultimately impacting overall market growth.

- Limited Financial Literacy Among Consumers: A substantial portion of the Filipino population lacks adequate financial literacy, hindering consumers from making informed decisions regarding auto loans. As more financial products become available, the inability to comprehend loan terms and conditions may lead to poor financial choices, resulting in higher default rates and a reluctance to engage with financial institutions for auto loans.

Philippines Auto Loan Market Future Outlook

The Philippines auto loan market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. The rise of digital platforms will facilitate easier access to loans, while the increasing focus on sustainable financing will align with global trends. Additionally, as the automotive market shifts towards electric vehicles, lenders will need to adapt their offerings to meet the evolving demands of environmentally conscious consumers. Overall, the market is expected to evolve dynamically, presenting both challenges and opportunities for stakeholders.

Market Opportunities

- Growth in Online Loan Applications: The shift towards digitalization has led to a significant surge in online auto loan applications, with a notable increase in the previous year. This trend is expected to continue, as more consumers prefer the convenience of applying for loans online. Financial institutions that enhance their digital platforms can capture this growing segment, improving customer engagement and streamlining the loan approval process.

- Partnerships with Automotive Dealers: Collaborations between lenders and automotive dealers are increasingly prevalent, with a significant share of auto loans now originated through dealer partnerships. These alliances provide consumers with seamless financing options at the point of sale, enhancing the purchasing experience. Expanding these partnerships will be crucial for lenders to effectively tap into the growing automotive market.

Scope of the Report

| By Type |

New vehicle financing (brand-new passenger cars and light commercial vehicles) Used vehicle financing (pre-owned cars) Dealer/OEM captive financing programs Loan refinancing and balance transfer |

| By End-User |

Individual consumers (retail buyers) Micro, small, and medium enterprises (MSMEs) and self-employed Corporate and fleet buyers |

| By Loan Amount |

Below PHP 500,000 PHP 500,000 - PHP 1,000,000 Above PHP 1,000,000 |

| By Loan Tenure |

Short-term loans (1-3 years) Medium-term loans (4-5 years) Long-term loans (6-7 years) |

| By Interest Rate Type |

Fixed interest rates Variable interest rates |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Bangko Sentral ng Pilipinas, Department of Trade and Industry)

Automobile Manufacturers and Producers

Automobile Dealerships

Financial Institutions (e.g., Banks, Credit Unions)

Insurance Companies

Automotive Industry Associations

Fintech Companies

Companies

Players Mentioned in the Report:

BDO Unibank, Inc.

Bank of the Philippine Islands (BPI)

Metropolitan Bank & Trust Company (Metrobank)

Security Bank Corporation

Union Bank of the Philippines (UnionBank)

Philippine National Bank (PNB)

Rizal Commercial Banking Corporation (RCBC)

EastWest Banking Corporation

China Banking Corporation (Chinabank)

Maybank Philippines, Inc.

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. Philippines Auto Loan Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 Philippines Auto Loan Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. Philippines Auto Loan Market Analysis

3.1 Growth Drivers

3.1.1 Increasing disposable income

3.1.2 Expanding automotive market

3.1.3 Competitive interest rates

3.1.4 Government incentives for vehicle ownership

3.2 Market Challenges

3.2.1 High default rates

3.2.2 Regulatory compliance issues

3.2.3 Limited financial literacy among consumers

3.2.4 Economic fluctuations affecting consumer spending

3.3 Market Opportunities

3.3.1 Growth in online loan applications

3.3.2 Partnerships with automotive dealers

3.3.3 Expansion of digital payment solutions

3.3.4 Increasing demand for electric vehicles

3.4 Market Trends

3.4.1 Rise of fintech solutions in lending

3.4.2 Shift towards sustainable financing options

3.4.3 Increased consumer preference for flexible payment terms

3.4.4 Growth of peer-to-peer lending platforms

3.5 Government Regulation

3.5.1 Implementation of stricter lending guidelines

3.5.2 Introduction of consumer protection laws

3.5.3 Tax incentives for auto loan providers

3.5.4 Regulation of interest rates on auto loans

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. Philippines Auto Loan Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. Philippines Auto Loan Market Segmentation

8.1 By Type

8.1.1 New vehicle financing (brand-new passenger cars and light commercial vehicles)

8.1.2 Used vehicle financing (pre-owned cars)

8.1.3 Dealer/OEM captive financing programs

8.1.4 Loan refinancing and balance transfer

8.2 By End-User

8.2.1 Individual consumers (retail buyers)

8.2.2 Micro, small and medium enterprises (MSMEs) and self-employed

8.2.3 Corporate and fleet buyers

8.3 By Loan Amount

8.3.1 Below PHP 500,000

8.3.2 PHP 500,000 - PHP 1,000,000

8.3.3 Above PHP 1,000,000

8.4 By Loan Tenure

8.4.1 Short-term loans (1-3 years)

8.4.2 Medium-term loans (4-5 years)

8.4.3 Long-term loans (6-7 years)

8.5 By Interest Rate Type

8.5.1 Fixed interest rates

8.5.2 Variable interest rates

9. Philippines Auto Loan Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Portfolio size (auto loans outstanding, PHP)

9.2.3 Disbursements (annual new auto loans, PHP)

9.2.4 Approval rate (%)

9.2.5 Average interest rate (APR or add-on, %)

9.2.6 Average processing time (application to release, days)

9.2.7 NPL ratio/default rate (%)

9.2.8 Average loan tenure (months)

9.2.9 Average loan-to-value (LTV, %)

9.2.10 Channel mix (dealer vs direct vs digital, %)

9.2.11 Market penetration (share of new car sales financed, %)

9.2.12 Customer satisfaction/NPS

9.2.13 Partnerships (OEM/dealer tie-ups count)

9.2.14 Revenue growth rate (YoY, %)

9.2.15 Geographic coverage (branches/DSAs, regions)

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 BDO Unibank, Inc.

9.5.2 Bank of the Philippine Islands (BPI)

9.5.3 Metropolitan Bank & Trust Company (Metrobank)

9.5.4 Security Bank Corporation

9.5.5 Union Bank of the Philippines (UnionBank)

9.5.6 Philippine National Bank (PNB)

9.5.7 Rizal Commercial Banking Corporation (RCBC)

9.5.8 EastWest Banking Corporation

9.5.9 China Banking Corporation (Chinabank)

9.5.10 Maybank Philippines, Inc.

10. Philippines Auto Loan Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government vehicle procurement policies

10.1.2 Budget allocation for transportation

10.1.3 Preference for local dealerships

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in fleet expansion

10.2.2 Budgeting for employee vehicle loans

10.3 Pain Point Analysis by End-User Category

10.3.1 High-interest rates

10.3.2 Lengthy approval processes

10.4 User Readiness for Adoption

10.4.1 Awareness of financing options

10.4.2 Digital literacy levels

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Impact on operational efficiency

10.5.2 Customer feedback mechanisms

11. Philippines Auto Loan Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market gaps identification

1.2 Value proposition development

1.3 Revenue model exploration

1.4 Customer segment targeting

1.5 Key partnerships

1.6 Cost structure analysis

1.7 Channels for delivery

2. Marketing and Positioning Recommendations

2.1 Branding strategies

2.2 Product USPs

2.3 Target audience engagement

2.4 Digital marketing tactics

2.5 Offline marketing strategies

3. Distribution Plan

3.1 Urban retail vs rural NGO tie-ups

3.2 Online vs offline distribution channels

3.3 Partnerships with automotive dealers

3.4 Logistics and supply chain considerations

4. Channel & Pricing Gaps

4.1 Underserved routes

4.2 Pricing bands

4.3 Competitor pricing analysis

4.4 Customer willingness to pay

5. Unmet Demand & Latent Needs

5.1 Category gaps

5.2 Consumer segments

5.3 Emerging trends

5.4 Feedback from potential customers

6. Customer Relationship

6.1 Loyalty programs

6.2 After-sales service

6.3 Customer engagement strategies

6.4 Feedback and improvement loops

7. Value Proposition

7.1 Sustainability

7.2 Integrated supply chains

7.3 Unique selling points

7.4 Customer-centric approach

8. Key Activities

8.1 Regulatory compliance

8.2 Branding

8.3 Distribution setup

8.4 Training and development

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product mix

9.1.2 Pricing band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target countries

9.2.2 Compliance roadmap

10. Entry Mode Assessment

10.1 JV

10.2 Greenfield

10.3 M&A

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven analysis

13.2 Long-term sustainability

14. Potential Partner List

14.1 Distributors

14.2 JVs

14.3 Acquisition targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone tracking

15.2.2 Activity scheduling

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of government reports on automotive financing trends in the Philippines

- Review of industry publications and market analysis reports specific to auto loans

- Examination of financial statements and disclosures from major banks and lending institutions

Primary Research

- Interviews with financial analysts specializing in automotive financing

- Surveys conducted with auto loan customers to understand preferences and pain points

- Focus group discussions with dealership finance managers to gather insights on loan offerings

Validation & Triangulation

- Cross-validation of findings with data from the Bangko Sentral ng Pilipinas (BSP)

- Triangulation of insights from primary interviews with secondary data trends

- Sanity checks through expert reviews from industry stakeholders and economists

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of total auto loan market size based on national vehicle sales data

- Segmentation of market by vehicle type (e.g., passenger cars, commercial vehicles)

- Incorporation of macroeconomic indicators such as GDP growth and consumer confidence

Bottom-up Modeling

- Analysis of loan disbursement data from leading banks and financial institutions

- Estimation of average loan amounts and terms based on customer demographics

- Calculation of market share for different lending products and services

Forecasting & Scenario Analysis

- Multi-variable forecasting using historical growth rates and economic indicators

- Scenario analysis based on potential regulatory changes affecting lending practices

- Development of optimistic, pessimistic, and baseline forecasts through 2028

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Auto Loan Customers | 150 | Individuals who have taken auto loans in the last 2 years |

| Bank Loan Officers | 100 | Loan officers from major banks and financial institutions |

| Automobile Dealerships | 80 | Finance managers and sales executives at car dealerships |

| Financial Analysts | 50 | Analysts specializing in automotive finance and lending |

| Regulatory Bodies | 40 | Officials from the Bangko Sentral ng Pilipinas and other regulatory agencies |

Frequently Asked Questions

What is the current value of the Philippines Auto Loan Market?

The Philippines Auto Loan Market is valued at approximately PHP 650 billion, reflecting the scale of outstanding auto finance and disbursements, driven by a rebound in vehicle sales and financing penetration among banks and captive finance companies.

Which regions dominate the Philippines Auto Loan Market?

Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Auto Loan Market. Metro Manila leads in auto loan credit disbursement due to its dense population and concentration of banks and dealerships, while Cebu and Davao benefit from expanding urban economies.

What are the key segments in the Philippines Auto Loan Market?

The market is segmented into new vehicle financing, used vehicle financing, dealer/OEM captive financing programs, and loan refinancing. Each segment caters to different consumer needs, with new vehicle financing currently dominating due to consumer preferences for brand-new cars.

How is the Philippines Auto Loan Market expected to grow?

The market is projected to grow significantly, driven by increasing disposable income, expanding vehicle sales, and competitive interest rates. The average household income is expected to rise, enabling more consumers to consider auto loans for vehicle purchases.

What challenges does the Philippines Auto Loan Market face?

The market faces challenges such as high default rates, currently around 5.5%, and limited financial literacy among consumers. Economic uncertainties and a lack of understanding of loan terms can hinder consumer engagement and increase default risks.

What role does government policy play in the auto loan market?

The Philippine government supports the automotive industry through policies like the Electric Vehicle Industry Development Act (EVIDA), which promotes electric vehicle adoption and related financing products. These initiatives aim to enhance sustainable transport and stimulate the auto loan market.

What are the average interest rates for auto loans in the Philippines?

The average interest rate for auto loans in the Philippines is around 8.0%. This competitive rate is maintained by the Bangko Sentral ng Pilipinas' stable monetary policy, encouraging consumers to finance vehicle purchases through loans.

Who are the major players in the Philippines Auto Loan Market?

Key players in the Philippines Auto Loan Market include BDO Unibank, Bank of the Philippine Islands (BPI), Metropolitan Bank & Trust Company (Metrobank), and Security Bank Corporation. These institutions contribute to innovation and service delivery in auto financing.

What is the impact of digitalization on auto loan applications?

The shift towards digitalization has led to a 35% increase in online auto loan applications. Consumers prefer the convenience of applying online, prompting financial institutions to enhance their digital platforms to capture this growing segment effectively.

How do partnerships with automotive dealers benefit auto loan providers?

Partnerships between lenders and automotive dealers facilitate seamless financing options at the point of sale, enhancing the purchasing experience for consumers. Over 45% of auto loans are now originated through these dealer partnerships, making them crucial for market growth.

What is the expected future outlook for the Philippines Auto Loan Market?

The Philippines Auto Loan Market is expected to undergo significant transformation, driven by technological advancements and a focus on sustainable financing. The rise of electric vehicles and digital platforms will shape the market, presenting both challenges and opportunities for stakeholders.

What types of auto loans are available in the Philippines?

Auto loans in the Philippines include new vehicle financing, used vehicle financing, dealer/OEM captive financing programs, and loan refinancing. Each type caters to different consumer needs, reflecting the diverse landscape of auto financing in the country.

What factors contribute to the increasing demand for auto loans in the Philippines?

Factors contributing to the rising demand for auto loans include increasing disposable income, expanding urbanization, competitive interest rates, and a growing middle class. These elements enable more consumers to finance vehicle purchases, driving market growth.

How does financial literacy affect auto loan uptake in the Philippines?

Limited financial literacy among Filipinos, with only 30% understanding basic financial concepts, affects auto loan uptake. This gap can lead to poor financial decisions regarding loans, resulting in higher default rates and reluctance to engage with financial institutions.

What is the significance of the Electric Vehicle Industry Development Act (EVIDA)?

The Electric Vehicle Industry Development Act (EVIDA) is significant as it promotes the adoption of electric vehicles in the Philippines. It provides incentives for EV financing, aligning with global trends towards sustainable transport and enhancing the auto loan market's growth potential.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.