Region:Asia

Author(s):Rebecca

Product Code:KRAD5051

Pages:87

Published On:December 2025

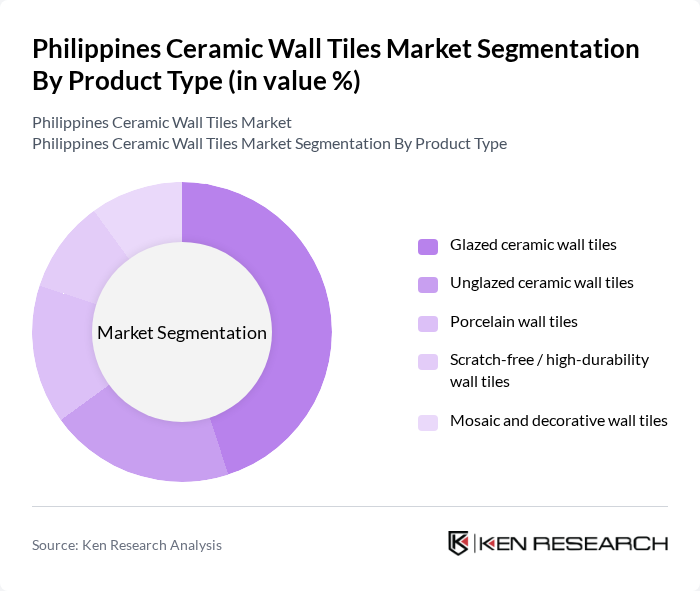

By Product Type:The product type segmentation includes various categories of ceramic wall tiles, each catering to different consumer needs and preferences. The subsegments are Glazed ceramic wall tiles, Unglazed ceramic wall tiles, Porcelain wall tiles, Scratch-free / high-durability wall tiles, and Mosaic and decorative wall tiles. Among these, glazed ceramic wall tiles dominate the market due to their aesthetic appeal, stain resistance, and wide range of digitally printed designs, making them a popular choice for both residential and commercial wall applications, while porcelain-based wall tiles are also gaining share as higher-value products in the overall ceramic tiles mix.

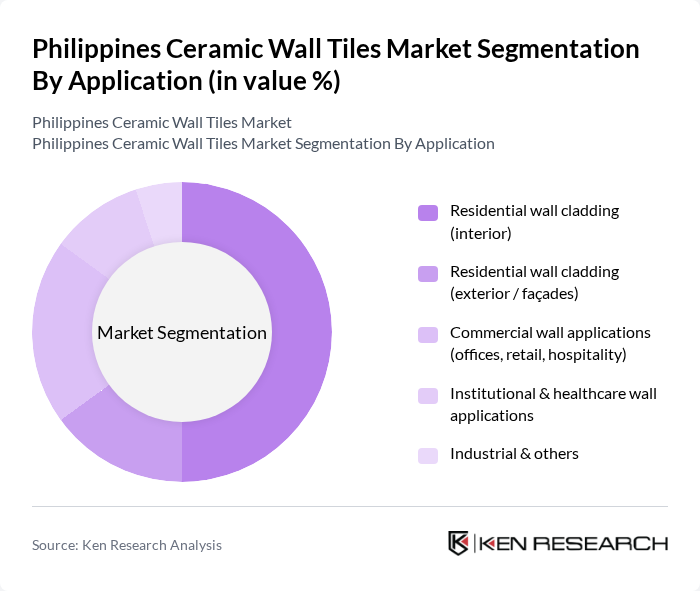

By Application:The application segmentation encompasses various uses of ceramic wall tiles, including Residential wall cladding (interior), Residential wall cladding (exterior / façades), Commercial wall applications (offices, retail, hospitality), Institutional & healthcare wall applications, and Industrial & others. The residential wall cladding segment, particularly for interior applications, is the leading subsegment, driven by the increasing trend of home renovations, rising middle-class incomes, and the desire for stylish and functional living spaces, while commercial and institutional projects also increasingly specify ceramic tiles for hygienic, low?maintenance wall finishes.

The Philippines Ceramic Wall Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mariwasa Siam Ceramics Inc., Eurotiles Industrial Corporation, Formosa Ceramic Tiles Manufacturing Corp. (Ten Zen Tiles), Niro Ceramic Group (Niro Granite Philippines), White Horse Ceramic Industries Berhad (Philippines operations), HCG Philippines (Ho Chung Group), Wilcon Depot Inc., Floor Center (FC Tile Depot), Tile Center Inc., CW Home Depot, AllHome Corp., MC Home Depot, Homeworld Shopping Corporation (SM Group), Matimco, Inc. (tile and surface solutions), Prime Panel Group / other emerging local tile distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines ceramic wall tiles market appears promising, driven by ongoing urbanization and a growing middle class. As more consumers seek stylish and sustainable home solutions, manufacturers are likely to innovate in design and production methods. Additionally, the shift towards online sales channels is expected to enhance market accessibility, allowing consumers to explore a wider range of products. Overall, the market is poised for growth, supported by favorable economic conditions and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Glazed ceramic wall tiles Unglazed ceramic wall tiles Porcelain wall tiles Scratch?free / high?durability wall tiles Mosaic and decorative wall tiles |

| By Application | Residential wall cladding (interior) Residential wall cladding (exterior / façades) Commercial wall applications (offices, retail, hospitality) Institutional & healthcare wall applications Industrial & others |

| By Design & Finish | Marble / stone?look wall tiles Wood?look and concrete?look wall tiles Patterned / printed and decorative wall tiles Plain / minimalist wall tiles |

| By Size Format | Small format wall tiles (? 300x300 mm) Medium format wall tiles (> 300x300 mm to < 600x600 mm) Large format wall tiles (? 600x600 mm and slabs) Custom and modular sizes |

| By Surface Finish | Glossy finish Matte / satin finish Textured / relief finish Anti?slip / functional finishes |

| By Price Range | Economy wall tiles Mid?range wall tiles Premium & designer wall tiles Imported luxury wall tiles |

| By Distribution Channel | Direct sales to projects / contractors Specialty tile & sanitaryware retailers Home improvement / DIY chains Online marketplaces & company webstores Wholesalers & independent dealers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Tile Market | 120 | Homeowners, Interior Designers |

| Commercial Tile Applications | 100 | Facility Managers, Architects |

| Industrial Tile Usage | 60 | Procurement Managers, Construction Engineers |

| Retail Tile Distribution | 90 | Retail Managers, Sales Executives |

| Tile Export Market | 40 | Export Managers, Trade Analysts |

The Philippines Ceramic Wall Tiles Market is valued at approximately USD 1.4 billion, driven by the booming construction sector, urbanization, and consumer preferences for durable and aesthetic wall finishes.