Region:Asia

Author(s):Shubham

Product Code:KRAB1019

Pages:91

Published On:October 2025

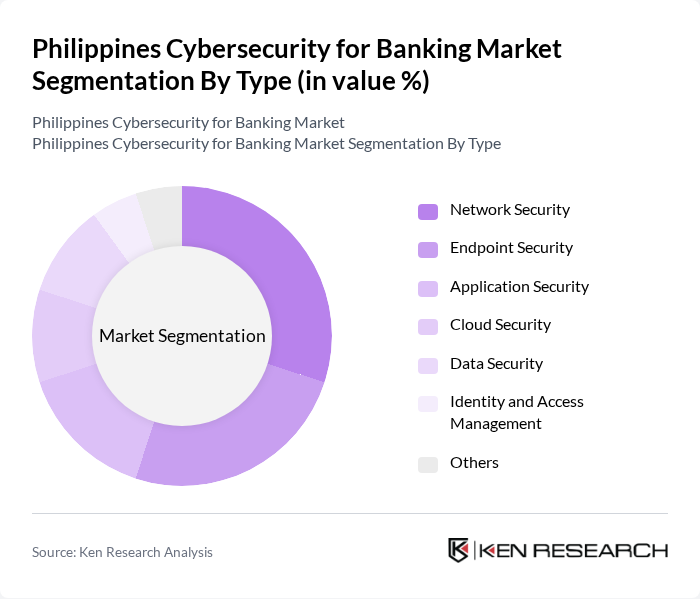

By Type:

The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Security, and Others. Network Security is the leading subsegment, driven by the increasing need to protect networks from unauthorized access and sophisticated cyber threats. Financial institutions are prioritizing investments in network security solutions to safeguard their infrastructure and customer data, reflecting a growing awareness of the importance of robust cybersecurity measures. The integration of AI-powered threat detection and cloud-based security platforms is further shaping investment priorities in this segment .

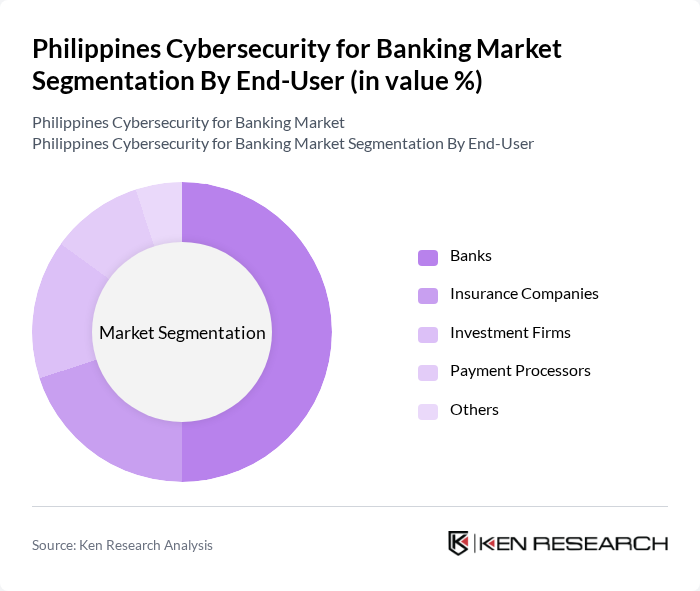

By End-User:

This market is segmented by end-users, including Commercial Banks, Digital/Neo Banks, Investment Banks, Credit Unions, Insurance Companies, Microfinance Institutions, and Others. Commercial Banks dominate this segment, as they are the largest consumers of cybersecurity solutions due to their extensive customer base and the critical nature of their operations. The increasing digitization of banking services and the proliferation of mobile banking applications have heightened the need for robust cybersecurity measures to protect sensitive financial data and ensure regulatory compliance. Digital/Neo Banks and fintech firms are also driving demand for advanced security solutions as they scale operations and expand their service portfolios .

The Philippines Cybersecurity for Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro Incorporated, Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Kaspersky Lab, Sophos Group plc, RSA Security LLC, CyberArk Software Ltd., Proofpoint, Inc., CrowdStrike Holdings, Inc., Darktrace plc, Securemetric Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity landscape in the Philippines banking sector appears promising, driven by increasing investments in technology and regulatory compliance. As banks continue to digitize their services, the demand for advanced cybersecurity solutions will grow. Additionally, the integration of artificial intelligence and machine learning into security protocols is expected to enhance threat detection and response capabilities, making the banking sector more resilient against cyber threats in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Infrastructure Security Others |

| By End-User | Commercial Banks Digital/Neo Banks Investment Banks Credit Unions Insurance Companies Microfinance Institutions Others |

| By Component | Solutions/Software Services Hardware |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Deployment Mode | On-Premises Cloud-Based |

| By Threat Type | Malware Phishing Denial-of-Service (DoS) & DDoS Attacks Man-in-the-Middle (MitM) Attacks Zero-Day Exploits Others |

| By Policy Support | Government Initiatives Tax Incentives Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banks Cybersecurity Strategies | 100 | IT Security Managers, Risk Management Officers |

| Investment Banks Cybersecurity Investments | 60 | Chief Information Security Officers, Compliance Officers |

| Microfinance Institutions Cybersecurity Practices | 40 | Operations Managers, IT Directors |

| Fintech Companies Cybersecurity Solutions | 50 | Product Managers, Cybersecurity Analysts |

| Regulatory Compliance in Banking Cybersecurity | 45 | Regulatory Affairs Specialists, Legal Advisors |

The Philippines Cybersecurity for Banking Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing cyber threats, regulatory compliance, and the rapid adoption of digital banking services.