Region:Asia

Author(s):Geetanshi

Product Code:KRAB5849

Pages:90

Published On:October 2025

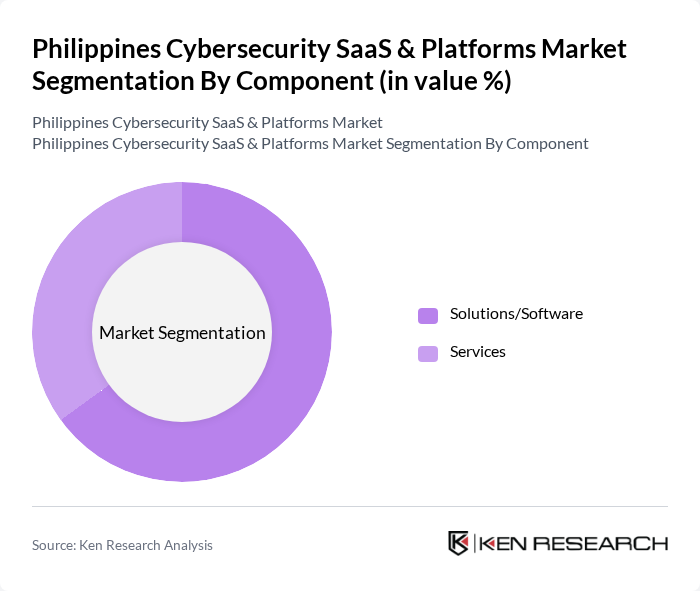

By Component:

The components of the market include Solutions/Software and Services. TheSolutions/Softwaresegment is currently dominating the market due to the increasing need for automated, scalable, and efficient cybersecurity measures. Organizations are investing heavily in software solutions that provide real-time threat detection, incident response, and compliance management. The Services segment, while growing, is primarily driven by the demand for managed security services, consulting, and continuous monitoring, as companies seek expert guidance in navigating complex cybersecurity landscapes .

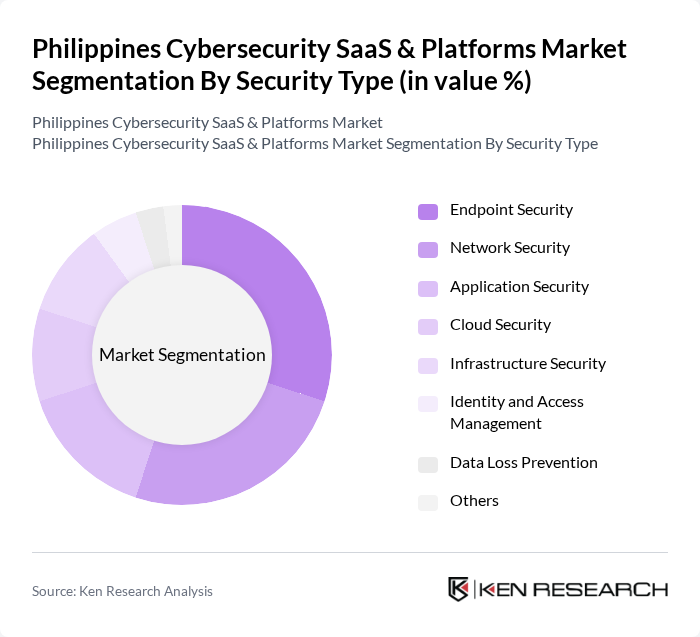

By Security Type:

The Security Type segmentation includes Endpoint Security, Network Security, Application Security, Cloud Security, Infrastructure Security, Identity and Access Management, Data Loss Prevention, and Others.Endpoint Securityis leading the market as organizations increasingly focus on securing devices that access their networks, especially with the rise in remote and hybrid work arrangements. Network Security and Cloud Security are also significant contributors, driven by the growing adoption of cloud services, digital payment systems, and the need to protect sensitive data transmitted over networks. The market is further shaped by the integration of AI-driven threat detection and the proliferation of IoT devices, which require comprehensive security frameworks .

The Philippines Cybersecurity SaaS & Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro Incorporated, Palo Alto Networks, Inc., Fortinet, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Kaspersky Lab, Sophos Group plc, CrowdStrike Holdings, Inc., Zscaler, Inc., CyberArk Software Ltd., RSA Security LLC, Proofpoint, Inc., ePLDT Inc., Pointwest Technologies Corporation, Nexusguard Limited, Securemetric Technology Inc., Microgenesis Business Systems, DTSI Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cybersecurity SaaS and platforms market in the Philippines appears promising, driven by increasing digital transformation initiatives and heightened awareness of cyber threats. As businesses continue to embrace cloud technologies and remote work, the demand for advanced cybersecurity solutions will likely grow. Furthermore, government support and regulatory frameworks will enhance the market's resilience, fostering innovation and collaboration among local and international firms, ultimately leading to a more secure digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions/Software Services |

| By Security Type | Endpoint Security Network Security Application Security Cloud Security Infrastructure Security Identity and Access Management Data Loss Prevention Others |

| By Type of Threat | Malware Denial-of-Service (DOS) Distributed Denial-of-Service (DDoS) Zero-Day Exploits Man-in-the-Middle (MITM) Attacks Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By End-User Vertical | Government/Public Sector Financial Services (BFSI) Healthcare Retail Education Manufacturing Energy and Utilities Telecommunications Automotive Transportation and Logistics IT Others |

| By Enterprise Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Application | Unified Vulnerability Management Governance, Risk & Compliance Data Security & Privacy Identity & Access Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity Solutions | 85 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection Services | 75 | Healthcare IT Directors, Data Privacy Officers |

| Retail Sector Cybersecurity Platforms | 65 | eCommerce Managers, IT Operations Heads |

| Government Cybersecurity Initiatives | 55 | Policy Makers, Cybersecurity Program Managers |

| SME Cybersecurity Adoption | 80 | Business Owners, IT Consultants |

The Philippines Cybersecurity SaaS & Platforms Market is valued at approximately USD 1.3 billion, driven by increasing cyber threats, digital transformation, and heightened awareness of data privacy regulations among businesses.