Region:Asia

Author(s):Dev

Product Code:KRAA4663

Pages:81

Published On:September 2025

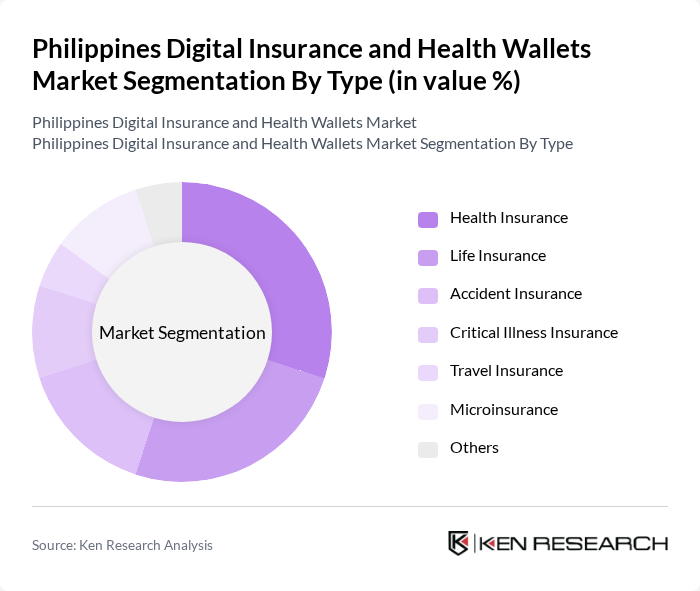

By Type:The market can be segmented into various types of insurance products, including Health Insurance, Life Insurance, Accident Insurance, Critical Illness Insurance, Travel Insurance, Microinsurance, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of insurance offerings in the Philippines.

The Health Insurance segment is currently dominating the market due to the increasing healthcare costs and the rising awareness of health-related issues among the population. Consumers are increasingly seeking comprehensive health coverage to mitigate financial risks associated with medical expenses. The trend towards preventive healthcare and wellness programs is also driving the demand for health insurance products, making it a key focus area for insurers.

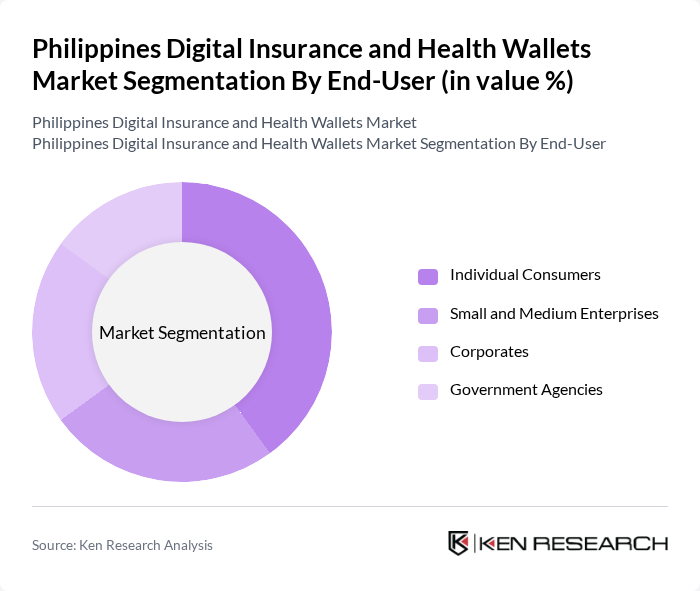

By End-User:The market can be segmented based on end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Agencies. Each segment has unique requirements and preferences, influencing the types of insurance products they seek.

The Individual Consumers segment is leading the market, driven by the growing awareness of personal health and financial security. As more individuals recognize the importance of having insurance coverage, they are increasingly opting for various insurance products tailored to their needs. This trend is further supported by the rise of digital platforms that make purchasing insurance more accessible and convenient.

The Philippines Digital Insurance and Health Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sun Life Financial, AXA Philippines, PhilHealth, FWD Life Insurance, Manulife Philippines, BPI AIA Life Assurance, Insular Life, EastWest Ageas Life, Cocolife, Pioneer Life, Allianz PNB Life, Generali Pilipinas, Union Bank of the Philippines, Axa General Insurance, Standard Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines digital insurance and health wallets market appears promising, driven by technological advancements and increasing consumer demand for convenient health solutions. As the government continues to invest in digital health infrastructure, the integration of telemedicine and AI technologies is expected to enhance service delivery. Additionally, partnerships between digital insurers and fintech companies will likely foster innovation, creating tailored insurance products that meet the evolving needs of consumers in a rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Life Insurance Accident Insurance Critical Illness Insurance Travel Insurance Microinsurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises Corporates Government Agencies |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cash Payments |

| By Customer Segment | Millennials Gen Z Baby Boomers Families |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Policy Duration | Short-term Policies Long-term Policies Pay-as-you-go Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Users | 150 | Policyholders, Insurance Brokers |

| Health Wallet Users | 120 | Consumers, Healthcare Providers |

| Fintech Experts | 80 | Industry Analysts, Financial Advisors |

| Healthcare Administrators | 100 | Hospital Managers, Clinic Directors |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Philippines Digital Insurance and Health Wallets Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies and rising healthcare costs, alongside increased awareness of insurance among the population.