Region:Asia

Author(s):Rebecca

Product Code:KRAA4584

Pages:99

Published On:September 2025

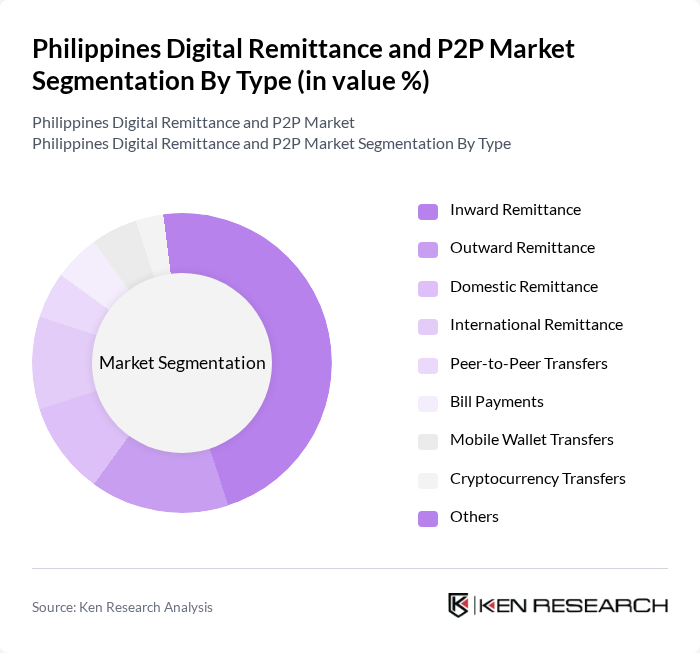

By Type:The digital remittance and P2P market can be segmented into Inward Remittance, Outward Remittance, Domestic Remittance, International Remittance, Peer-to-Peer Transfers, Bill Payments, Mobile Wallet Transfers, Cryptocurrency Transfers, and Others. Among these, Inward Remittance is the most significant segment, driven by the large number of OFWs sending money home. The ease of use and lower transaction costs associated with digital platforms have further fueled this segment's growth.

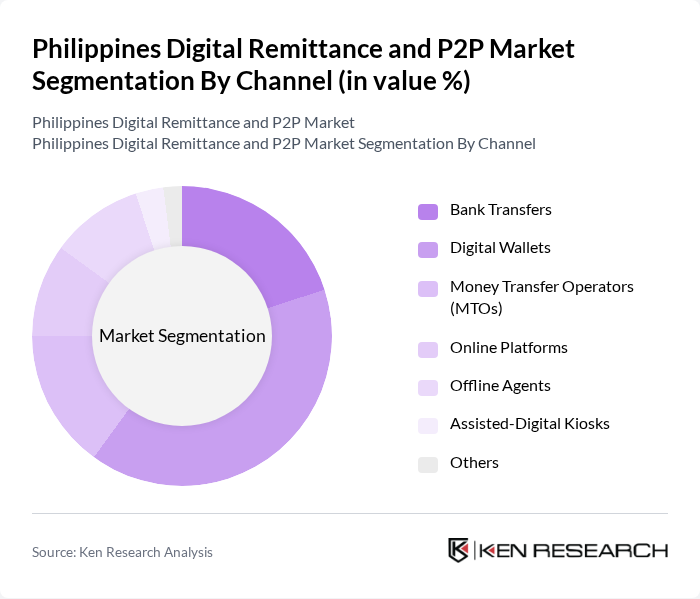

By Channel:The market can also be segmented by channel, including Bank Transfers, Digital Wallets, Money Transfer Operators (MTOs), Online Platforms, Offline Agents, Assisted-Digital Kiosks, and Others. Digital Wallets are currently the leading channel, as they offer convenience and accessibility for users, especially among the younger population who prefer mobile transactions over traditional banking methods.

The Philippines Digital Remittance and P2P Market is characterized by a dynamic mix of regional and international players. Leading participants such as GCash, Maya (formerly PayMaya), Western Union, MoneyGram, Remitly, Xoom (a PayPal service), Coins.ph, LBC Express, Cebuana Lhuillier, Palawan Pawnshop, Smart Padala by PayMaya, Globe Telecom, UnionBank of the Philippines, BDO Unibank, and Rizal Commercial Banking Corporation (RCBC) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines digital remittance and P2P market is poised for significant growth, driven by technological advancements and increasing consumer demand for efficient financial services. As mobile penetration continues to rise and e-commerce expands, more Filipinos will seek convenient digital payment solutions. Additionally, the government's push for financial inclusion will further enhance access to these services, creating a favorable environment for innovation and competition among providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Remittance Outward Remittance Domestic Remittance International Remittance Peer-to-Peer Transfers Bill Payments Mobile Wallet Transfers Cryptocurrency Transfers Others |

| By Channel | Bank Transfers Digital Wallets Money Transfer Operators (MTOs) Online Platforms Offline Agents Assisted-Digital Kiosks Others |

| By End-User | Individual Consumers Migrant Labor Workforce (OFWs) Small Businesses Corporates NGOs Government Agencies Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions Others |

| By Payment Method | Bank Transfers Credit/Debit Cards Mobile Payments Cash Payments Others |

| By Frequency of Use | Daily Users Weekly Users Monthly Users Occasional Users Others |

| By Customer Demographics | Age Groups Income Levels Geographic Locations Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Overseas Filipino Workers (OFWs) Remittance Patterns | 100 | OFWs, Family Members Receiving Remittances |

| Digital Payment Adoption Among Millennials | 60 | Millennial Users of P2P Payment Apps |

| Small Business Owners Utilizing Digital Remittances | 40 | Small Business Owners, Entrepreneurs |

| Consumer Preferences in Remittance Services | 90 | General Consumers, Frequent Remittance Senders |

| Impact of Digital Financial Literacy Programs | 50 | Participants in Financial Literacy Workshops |

The Philippines Digital Remittance and P2P Market is valued at approximately USD 162 billion, driven by the increasing number of Overseas Filipino Workers (OFWs) sending money home and the rapid adoption of digital payment solutions.