Region:Asia

Author(s):Rebecca

Product Code:KRAB5345

Pages:91

Published On:October 2025

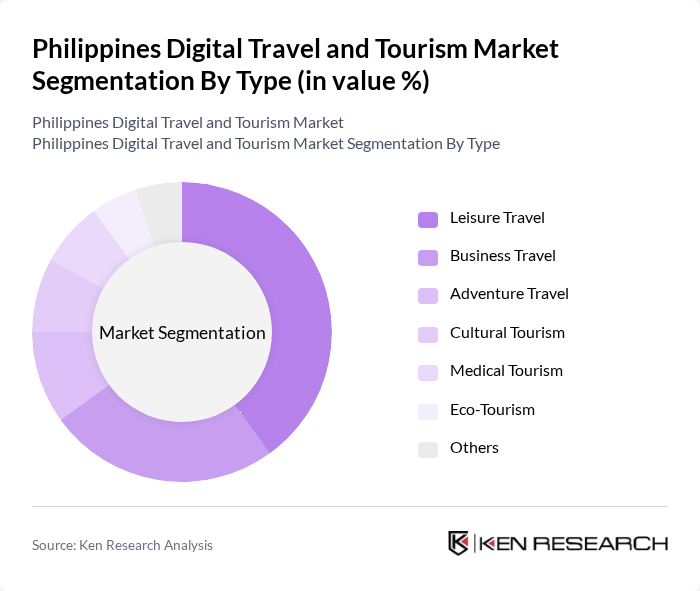

By Type:This segmentation includes various travel types that cater to different consumer preferences and needs.

Leisure travel is the dominant segment in the market, driven by the increasing number of local and international tourists seeking relaxation and recreational activities. The rise of social media and travel influencers has also fueled interest in leisure destinations, leading to a surge in bookings for resorts, beaches, and cultural experiences. This segment's growth is further supported by promotional campaigns and packages offered by travel agencies, making it the leading choice for travelers.

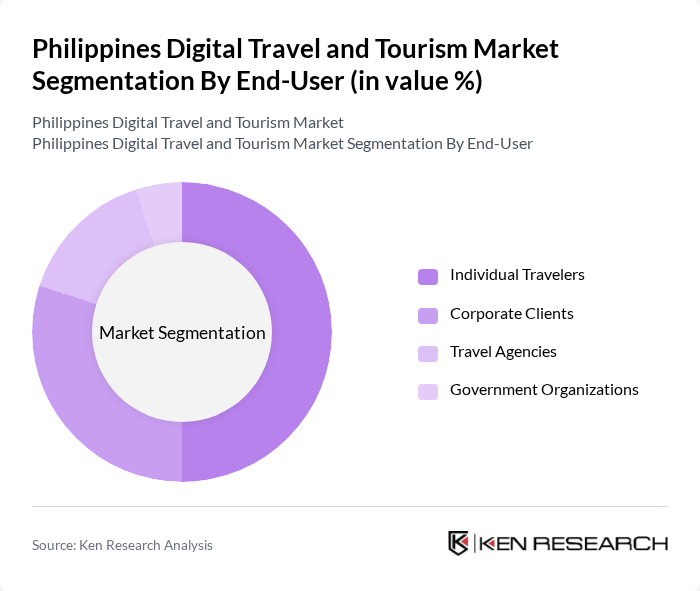

By End-User:This segmentation categorizes the market based on the type of users engaging in travel and tourism activities.

Individual travelers represent the largest segment in the market, driven by the increasing trend of personalized travel experiences and the ease of online booking. The rise of budget airlines and affordable accommodation options has made travel more accessible to a broader audience. Additionally, the growing preference for unique and customized travel experiences has led to a significant increase in individual bookings, making this segment the most influential in shaping market dynamics.

The Philippines Digital Travel and Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Airlines, Cebu Pacific Air, Traveloka, Agoda, Booking.com, Klook, TripAdvisor, Philippine Tourism Authority, AirAsia Philippines, Zomato, GetYourGuide, Expedia, Skyscanner, Trivago, RedDoorz contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines digital travel and tourism market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in travel planning is expected to enhance personalization, improving customer satisfaction. Additionally, the rise of eco-tourism reflects a growing consumer demand for sustainable travel options. As the government continues to invest in infrastructure and digital initiatives, the market is likely to witness increased competitiveness and innovation, positioning the Philippines as a key player in the regional tourism landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Leisure Travel Business Travel Adventure Travel Cultural Tourism Medical Tourism Eco-Tourism Others |

| By End-User | Individual Travelers Corporate Clients Travel Agencies Government Organizations |

| By Sales Channel | Online Travel Agencies Direct Booking Travel Agents Mobile Applications |

| By Destination Type | Domestic Destinations International Destinations |

| By Travel Duration | Short-term Travel Long-term Travel |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers |

| By Customer Demographics | Age Groups Income Levels Travel Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Travelers | 150 | Frequent travelers, Family vacationers |

| International Tourists | 100 | Backpackers, Luxury travelers |

| Travel Agency Professionals | 80 | Travel agents, Tour coordinators |

| Digital Marketing Experts | 60 | Digital marketers, Social media managers |

| Hotel and Accommodation Managers | 70 | Hotel managers, Front desk supervisors |

The Philippines Digital Travel and Tourism Market is valued at approximately USD 8 billion, reflecting significant growth driven by increased digital platform adoption, enhanced internet connectivity, and a rising middle class with disposable income.