Region:Asia

Author(s):Dev

Product Code:KRAB6122

Pages:81

Published On:October 2025

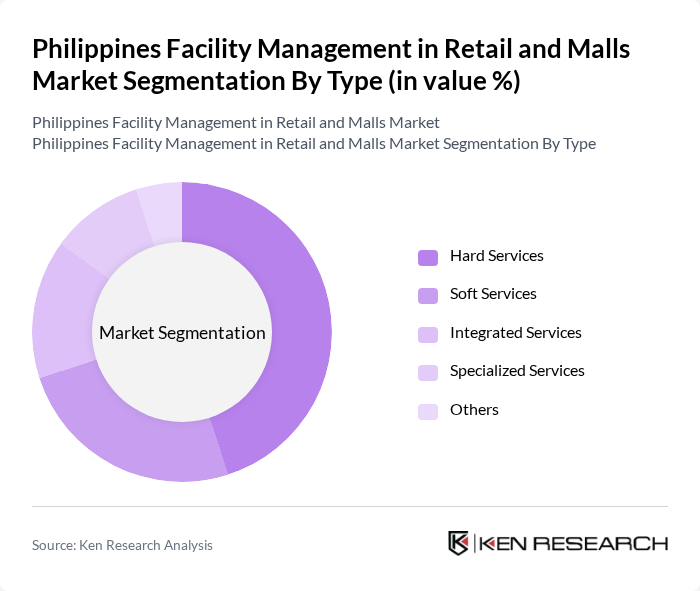

By Type:The facility management market is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services focus on cleaning and support functions. Integrated Services combine both hard and soft services for a comprehensive approach. Specialized Services cater to unique needs, and Others include miscellaneous services that do not fit into the primary categories. Among these, Hard Services dominate the market due to the critical nature of maintenance and repair in ensuring operational efficiency.

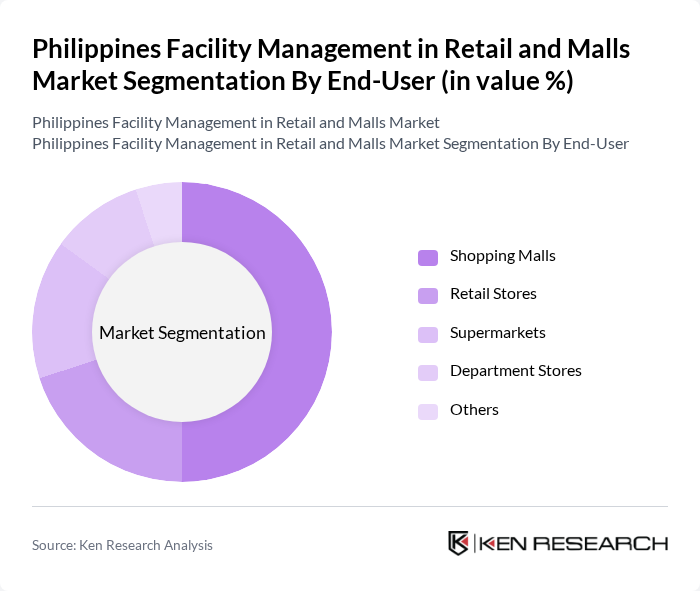

By End-User:The end-user segmentation includes Shopping Malls, Retail Stores, Supermarkets, Department Stores, and Others. Shopping Malls are the largest segment, driven by the increasing number of malls and the need for comprehensive facility management services to maintain high standards of safety and customer experience. Retail Stores and Supermarkets follow closely, as they also require efficient management to handle daily operations and customer interactions effectively.

The Philippines Facility Management in Retail and Malls Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLL Philippines, CBRE Philippines, Colliers International, DTZ Philippines, Savills Philippines, Cushman & Wakefield, Mace Group, ISS Facility Services, Sodexo Philippines, AECOM Philippines, G4S Philippines, Aegis Facility Management, APTIV Solutions, EFS Facilities Services, FM Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in the Philippines retail and malls sector appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technologies, such as IoT and AI, is expected to enhance operational efficiency and customer engagement. Additionally, the growing emphasis on sustainability will likely lead to increased investments in green building practices, positioning facility management as a critical component in the retail landscape. As the market evolves, adaptability and innovation will be key to success.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Shopping Malls Retail Stores Supermarkets Department Stores Others |

| By Service Model | Outsourced Services In-House Services Hybrid Model |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Geographic Presence | Metro Manila Luzon Visayas Mindanao |

| By Service Frequency | Daily Services Weekly Services Monthly Services |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Facility Management in Malls | 150 | Facility Managers, Operations Directors |

| Retail Store Maintenance Services | 100 | Maintenance Supervisors, Store Managers |

| Security Services in Retail | 80 | Security Managers, Risk Assessment Officers |

| Cleaning and Janitorial Services | 70 | Cleaning Supervisors, Facility Coordinators |

| Consumer Expectations on Mall Facilities | 120 | Shoppers, Mall Visitors |

The Philippines Facility Management in Retail and Malls Market is valued at approximately USD 1.2 billion, driven by the growth of retail establishments, increasing consumer spending, and urbanization trends that enhance the demand for efficient facility management services.