Region:Asia

Author(s):Geetanshi

Product Code:KRAD4054

Pages:91

Published On:December 2025

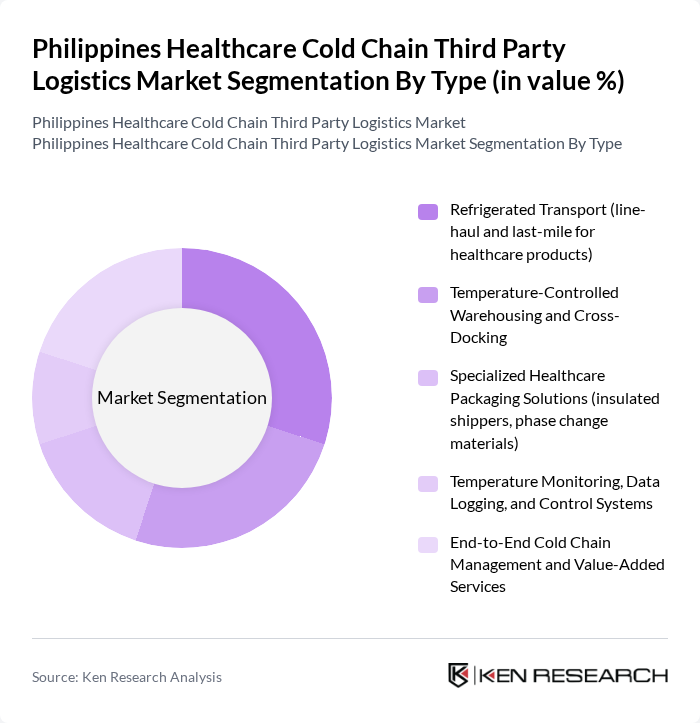

By Type:The market can be segmented into various types, including Refrigerated Transport, Temperature-Controlled Warehousing, Specialized Healthcare Packaging Solutions, Temperature Monitoring Systems, and End-to-End Cold Chain Management.

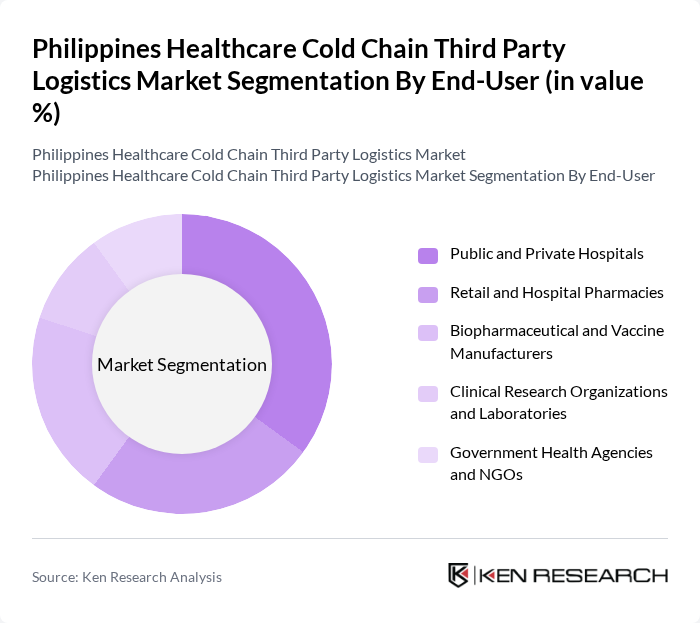

By End-User:The end-users of the market include Public and Private Hospitals, Retail and Hospital Pharmacies, Biopharmaceutical and Vaccine Manufacturers, Clinical Research Organizations, and Government Health Agencies.

The Philippines Healthcare Cold Chain Third Party Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zuellig Pharma Corporation (Zuellig Pharma Philippines), DHL Supply Chain Philippines, UPS Healthcare (United Parcel Service Philippines), FedEx Express Philippines, Kuehne + Nagel Philippines, Inc., Yusen Logistics (Philippines) Inc., Fast Logistics Group (Fast Services Corporation), Royal Cargo, Inc., Jentec Storage, Inc., Orca Cold Chain Solutions, Inc., LBC Express Holdings, Inc. (Healthcare and Cold Chain Services), Air21 (AIRFREIGHT 2100, Inc.), DB Schenker Philippines (Schenker Philippines, Inc.), CEVA Logistics Philippines, Agility Logistics Philippines (part of DSV) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines healthcare cold chain third-party logistics market appears promising, driven by technological advancements and increasing healthcare demands. The integration of IoT technologies for real-time monitoring is expected to enhance operational efficiency and product safety. Additionally, the government's commitment to improving healthcare access in underserved regions will likely stimulate investments in cold chain logistics, ensuring that temperature-sensitive products reach all corners of the country effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport (line-haul and last-mile for healthcare products) Temperature-Controlled Warehousing and Cross-Docking Specialized Healthcare Packaging Solutions (insulated shippers, phase change materials) Temperature Monitoring, Data Logging, and Control Systems End-to-End Cold Chain Management and Value-Added Services |

| By End-User | Public and Private Hospitals Retail and Hospital Pharmacies Biopharmaceutical and Vaccine Manufacturers Clinical Research Organizations and Laboratories Government Health Agencies and NGOs |

| By Region | Luzon (including Metro Manila) Visayas Mindanao |

| By Application | Vaccines and Immunization Products Blood, Plasma, and Other Blood Products Prescription Pharmaceuticals and Biologics Temperature-Sensitive Medical Devices and Diagnostics Clinical Trial Materials and Others |

| By Service Type | Transportation and Distribution Services Cold Storage and Warehousing Services Inventory Management, Order Fulfilment, and Value-Added Services Lane Validation, Qualification, and Consultancy Services |

| By Technology | Active Refrigerated Transport and Container Systems Passive Packaging Systems Hybrid Temperature-Control Solutions Real-Time Visibility, IoT, and Control Tower Platforms |

| By Policy Support | Government Subsidies and Infrastructure Programs Tax Incentives for Cold Chain Investments Regulatory Support and Good Distribution Practice (GDP) Guidelines Public–Private Partnerships and Donor-Supported Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Logistics | 110 | Logistics Managers, Supply Chain Directors |

| Vaccine Distribution Networks | 95 | Operations Managers, Healthcare Administrators |

| Biologics Handling and Storage | 85 | Warehouse Managers, Quality Assurance Officers |

| Healthcare Facility Cold Chain Requirements | 100 | Facility Managers, Procurement Officers |

| Third-Party Logistics Providers | 90 | Business Development Managers, Compliance Officers |

The Philippines Healthcare Cold Chain Third Party Logistics Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive healthcare products, including vaccines and biologics, and the expansion of healthcare infrastructure in the country.