Region:Asia

Author(s):Shubham

Product Code:KRAD6784

Pages:89

Published On:December 2025

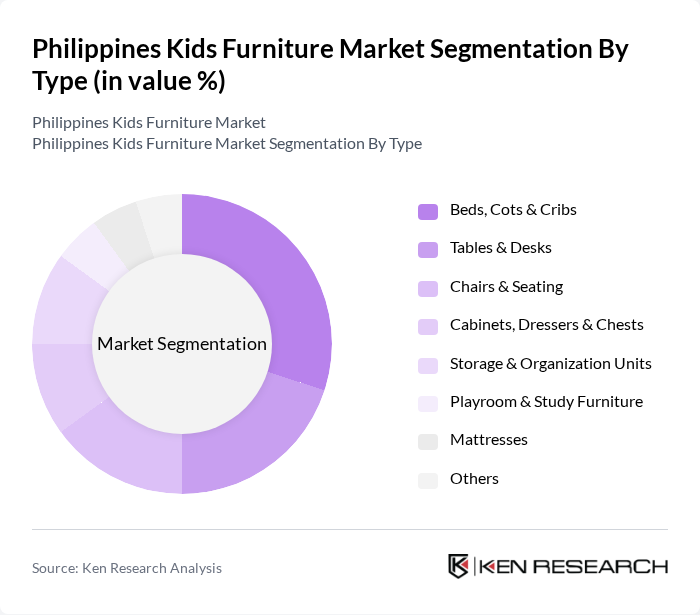

By Type:The market is segmented into various types of kids' furniture, including beds, cots & cribs, tables & desks, chairs & seating, cabinets, dressers & chests, storage & organization units, playroom & study furniture, mattresses, and others. Among these, beds, cots & cribs are the most popular due to their essential role in child safety and comfort. The increasing trend of themed bedrooms also drives demand for specialized furniture.

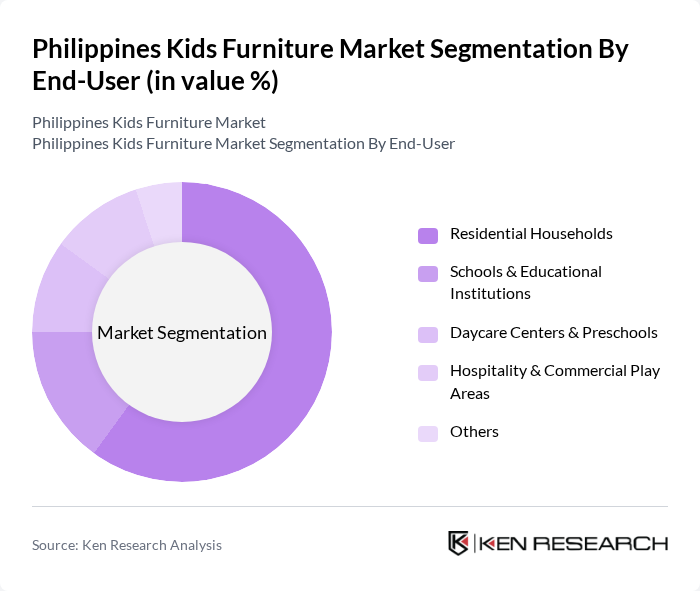

By End-User:The end-user segmentation includes residential households, schools & educational institutions, daycare centers & preschools, hospitality & commercial play areas, and others. Residential households dominate the market, driven by the increasing number of families investing in quality furniture for their children. The trend of creating dedicated play and study areas at home further fuels this demand.

The Philippines Kids Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mandaue Foam Industries, Inc., RGC/Uratex Group (Uratex Foam & Uratex Monoblock), Furniture Republic, Inc., AllHome Corp., SM Home (SM Department Store / SM Store), IKEA Philippines (Ikano Retail), Homeworks The Home Center, Blims Fine Furniture (Blauerhauser Furniture Corp.), Our Home (HomeWorld Shopping Corp.), Wilcon Depot, Inc., Ace Hardware Philippines, Inc., Landers Superstore (Landers Central, Inc.), Robinsons Department Store / Robinsons Builders, Lazada Philippines, Shopee Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines kids' furniture market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The trend towards multifunctional and space-saving furniture is expected to gain momentum, catering to urban families with limited living space. Additionally, the integration of smart technology into furniture design will likely attract tech-savvy parents, enhancing functionality and safety. As sustainability becomes a priority, manufacturers will increasingly focus on eco-friendly materials, aligning with global trends and consumer expectations for responsible production practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Beds, Cots & Cribs Tables & Desks Chairs & Seating Cabinets, Dressers & Chests Storage & Organization Units Playroom & Study Furniture Mattresses Others |

| By End-User | Residential Households Schools & Educational Institutions Daycare Centers & Preschools Hospitality & Commercial Play Areas Others |

| By Material | Solid Wood Engineered Wood & Laminates Metal Plastic & Polymer Upholstered / Fabric Hybrid & Others |

| By Design | Traditional Contemporary / Modern Thematic & Licensed Characters Ergonomic & Multifunctional Others |

| By Distribution Channel | Specialty Kids Furniture Stores General Furniture & Home Centers Hypermarkets & Warehouse Clubs Online Marketplaces & Brand Webstores Others |

| By Price Range | Economy / Budget Mass-Market / Mid-Range Premium Luxury / Designer |

| By Age Group | Infants (0–2 Years) Toddlers (3–5 Years) Children (6–9 Years) Pre-teens (10–12 Years) Teenagers (13–17 Years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Kids' Furniture | 150 | Store Managers, Sales Representatives |

| Manufacturing Insights | 100 | Production Managers, Quality Control Officers |

| Consumer Preferences Survey | 120 | Parents, Guardians of Children Aged 0-12 |

| Interior Design Trends | 75 | Interior Designers, Home Decor Specialists |

| Online Retail Analysis | 100 | E-commerce Managers, Digital Marketing Specialists |

The Philippines Kids Furniture Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and increased demand for safe and aesthetically pleasing furniture for children.