Region:Asia

Author(s):Shubham

Product Code:KRAD3624

Pages:86

Published On:November 2025

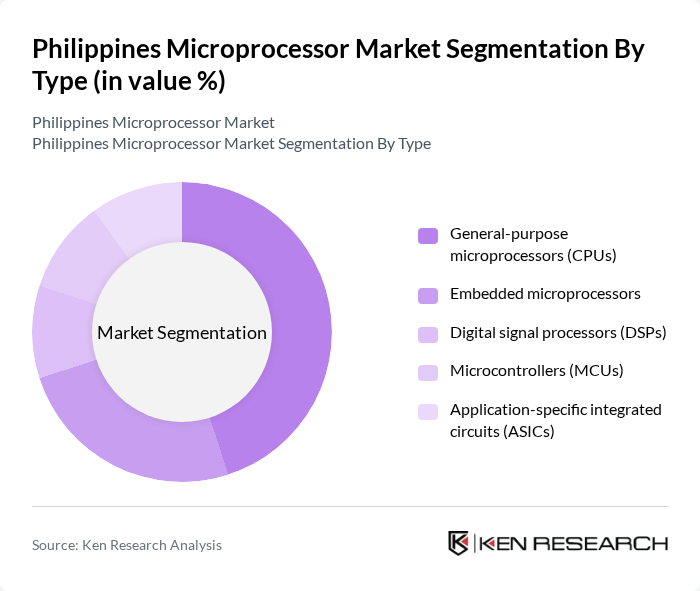

By Type:The microprocessor market is segmented into general-purpose microprocessors (CPUs), embedded microprocessors, digital signal processors (DSPs), microcontrollers (MCUs), and application-specific integrated circuits (ASICs). General-purpose microprocessors hold the leading share, driven by their widespread use in consumer electronics, computing devices, and cloud infrastructure. Embedded microprocessors and microcontrollers are increasingly utilized in automotive and industrial automation, while DSPs and ASICs support specialized functions in telecommunications and advanced electronics .

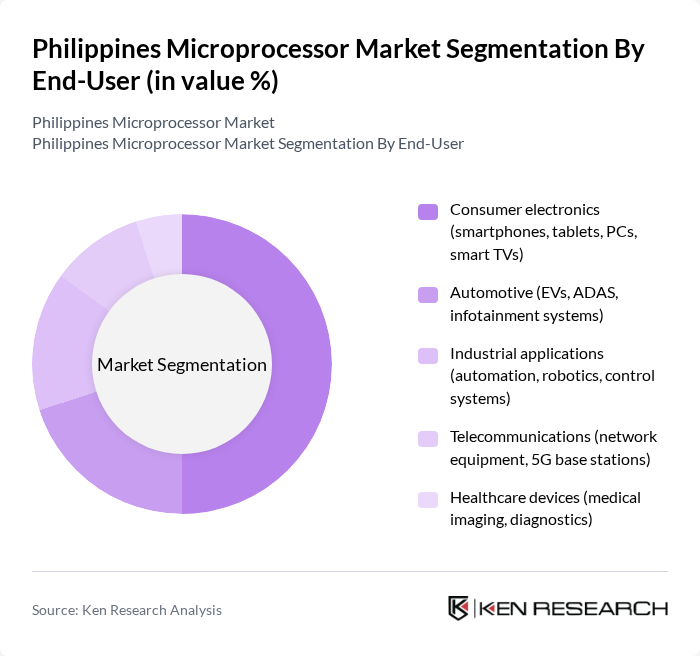

By End-User:The end-user segmentation includes consumer electronics, automotive, industrial applications, telecommunications, healthcare devices, and others. The consumer electronics segment is the largest contributor, driven by increasing demand for smartphones, tablets, smart home devices, and personal computers. Automotive applications are expanding rapidly due to the integration of advanced driver-assistance systems (ADAS) and infotainment platforms. Industrial automation and robotics, telecommunications (especially 5G infrastructure), and healthcare electronics also represent significant growth areas .

The Philippines Microprocessor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Advanced Micro Devices (AMD), Qualcomm Technologies, Inc., MediaTek Inc., NXP Semiconductors, Texas Instruments Incorporated, STMicroelectronics N.V., Broadcom Inc., Infineon Technologies AG, Renesas Electronics Corporation, Microchip Technology Inc., Analog Devices, Inc., ON Semiconductor Corporation, ARM Holdings plc, Amkor Technology Philippines, Inc., Integrated Micro-Electronics, Inc. (IMI), ASE Technology Holding Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines microprocessor market is poised for transformative growth, driven by technological advancements and increasing consumer demand. The integration of artificial intelligence and energy-efficient designs is expected to shape product development, while the expansion of 5G technology will enhance connectivity and performance. Local manufacturers are likely to explore partnerships to bolster production capabilities, addressing supply chain challenges and fostering innovation. As the market evolves, a focus on sustainability and compliance with international standards will be crucial for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | General-purpose microprocessors (CPUs) Embedded microprocessors Digital signal processors (DSPs) Microcontrollers (MCUs) Application-specific integrated circuits (ASICs) |

| By End-User | Consumer electronics (smartphones, tablets, PCs, smart TVs) Automotive (EVs, ADAS, infotainment systems) Industrial applications (automation, robotics, control systems) Telecommunications (network equipment, 5G base stations) Healthcare devices (medical imaging, diagnostics) Others |

| By Application | Mobile devices (smartphones, tablets) Computing devices (laptops, desktops, servers) Home automation (smart home hubs, IoT devices) Wearable technology (smartwatches, fitness trackers) Automotive electronics (ADAS, infotainment, powertrain) Industrial automation (PLCs, controllers) Others |

| By Distribution Channel | Direct sales (OEMs, ODMs) Online retail (e-commerce platforms) Distributors (local and international) Retail stores (electronics retailers) Others |

| By Technology | CMOS technology BiCMOS technology FinFET technology Planar technology Others |

| By Market Segment | Consumer market Commercial/enterprise market Government/defense market Industrial market Others |

| By Policy Support | Government subsidies Tax incentives Research and development grants Export incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Managers, R&D Engineers |

| Automotive Microprocessor Applications | 70 | Automotive Engineers, Supply Chain Managers |

| Industrial Automation Solutions | 50 | Operations Managers, Technical Directors |

| IoT Device Manufacturers | 60 | Product Development Leads, Marketing Managers |

| Academic and Research Institutions | 40 | Research Scientists, Professors in Electronics |

The Philippines Microprocessor Market is valued at approximately USD 950 million, reflecting its significant share within the broader semiconductor market, which has reached USD 7.07 billion. This growth is driven by demand across various sectors, including consumer electronics and automotive.