Region:Asia

Author(s):Dev

Product Code:KRAC0516

Pages:84

Published On:August 2025

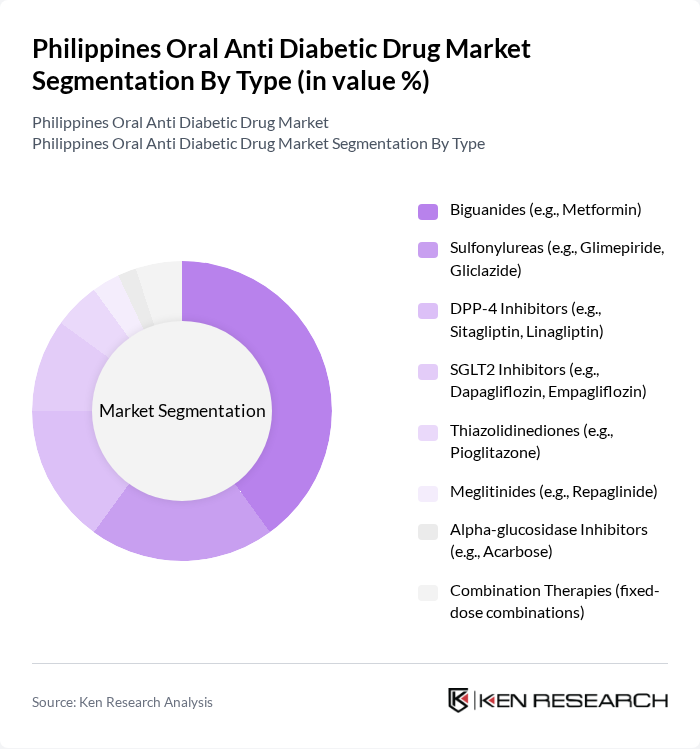

By Type:The market is segmented into various types of oral anti-diabetic drugs, including Biguanides, Sulfonylureas, DPP-4 Inhibitors, SGLT2 Inhibitors, Thiazolidinediones, Meglitinides, Alpha-glucosidase Inhibitors, and Combination Therapies. Among these, Biguanides, particularly Metformin, dominate due to established efficacy, safety, guideline-preferred first-line status, and cost-effectiveness; increasing use of generics sustains this share.

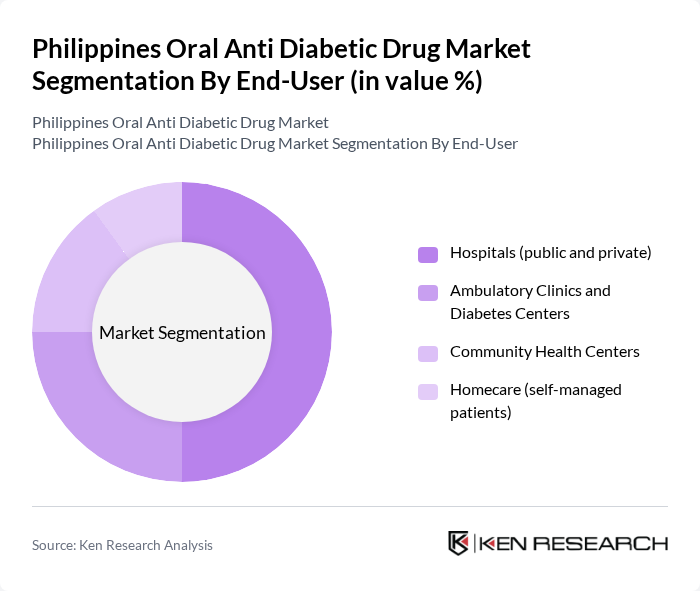

By End-User:The end-user segmentation includes Hospitals (public and private), Ambulatory Clinics and Diabetes Centers, Community Health Centers, and Homecare (self-managed patients). Hospitals lead due to comprehensive diabetes services, formulary breadth, and specialist access; expanding primary care and outpatient benefits also support ambulatory and community settings, while home-managed patients drive retail pharmacy utilization.

The Philippines Oral Anti Diabetic Drug Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi S.A., Merck & Co., Inc. (MSD Philippines), Novo Nordisk A/S, AstraZeneca PLC, Boehringer Ingelheim GmbH, Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Bayer AG, Johnson & Johnson (Janssen), GSK plc, Abbott Laboratories, Astellas Pharma Inc., Pfizer Inc., Novartis AG, Bristol Myers Squibb, Lupin Limited, Sun Pharmaceutical Industries Ltd., Torrent Pharmaceuticals Ltd., Viatris Inc. (Mylan/Upjohn), Unilab (United Laboratories, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oral anti-diabetic drug market in the Philippines appears promising, driven by increasing healthcare investments and a growing focus on chronic disease management. As the government continues to enhance healthcare access and affordability, the market is likely to witness a surge in demand for both innovative and generic therapies. Additionally, the integration of digital health solutions and telemedicine is expected to facilitate better patient engagement and adherence, ultimately improving health outcomes for diabetes patients across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Biguanides (e.g., Metformin) Sulfonylureas (e.g., Glimepiride, Gliclazide) DPP-4 Inhibitors (e.g., Sitagliptin, Linagliptin) SGLT2 Inhibitors (e.g., Dapagliflozin, Empagliflozin) Thiazolidinediones (e.g., Pioglitazone) Meglitinides (e.g., Repaglinide) Alpha-glucosidase Inhibitors (e.g., Acarbose) Combination Therapies (fixed-dose combinations) |

| By End-User | Hospitals (public and private) Ambulatory Clinics and Diabetes Centers Community Health Centers Homecare (self-managed patients) |

| By Distribution Channel | Retail Pharmacies and Drugstores Online Pharmacies Hospital Pharmacies Pharmaceutical Wholesalers/Distributors |

| By Patient Demographics | Adults (18–59 years) Elderly (60+ years) Women (including gestational diabetes post-partum management) |

| By Prescription Type | Prescription-Only Medicines (Rx) Generics vs. Branded-Generics vs. Innovator Brands |

| By Pricing Strategy | PhilHealth-Reimbursable Formulary Products Out-of-Pocket Affordable/Generic Tier Premium/Innovator Tier |

| By Payer/Market Segment | Private Out-of-Pocket Public Sector Procurement (e.g., DOH, LGUs) Health Maintenance Organizations (HMOs) and Private Insurance Corporate/Institutional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists and Diabetes Specialists | 90 | Healthcare Providers, Clinical Researchers |

| Pharmacists in Urban Areas | 80 | Retail Pharmacists, Pharmacy Managers |

| Diabetic Patients on Oral Medications | 140 | Patients, Caregivers |

| Healthcare Policy Makers | 40 | Government Officials, Health Administrators |

| Pharmaceutical Sales Representatives | 60 | Sales Managers, Marketing Executives |

The Philippines Oral Anti Diabetic Drug Market is valued at approximately USD 200 million, reflecting a significant share of the overall diabetes drug landscape in the country, driven by the increasing prevalence of diabetes and rising healthcare expenditures.