Region:Asia

Author(s):Rebecca

Product Code:KRAD4969

Pages:84

Published On:December 2025

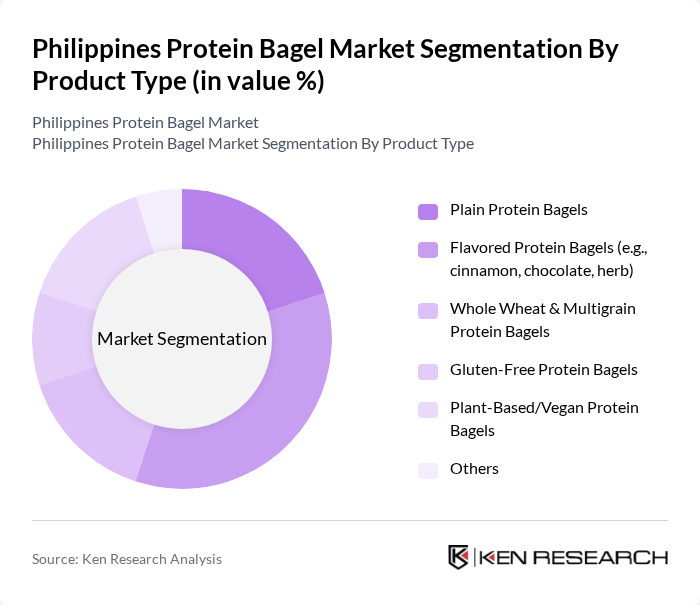

By Product Type:The product type segmentation includes various categories such as Plain Protein Bagels, Flavored Protein Bagels (e.g., cinnamon, chocolate, herb), Whole Wheat & Multigrain Protein Bagels, Gluten-Free Protein Bagels, Plant-Based/Vegan Protein Bagels, and Others. This structure aligns with the way global and Asia Pacific bagel and protein bagel markets segment offerings into plain, flavored, wholegrain, gluten-free, and specialty health-focused variants. Among these, Flavored Protein Bagels are currently described as dominating the market due to their appeal to younger consumers seeking variety and taste in their health foods, which is consistent with broader bagel trends where flavored and specialty variants gain share among urban, experimental consumers. The trend towards personalization in food choices, including mix-ins such as seeds, nuts, and localized flavors, has supported demand for innovative flavors and formats within protein-enriched bakery ranges, making this sub-segment particularly relevant in modern retail and café channels.

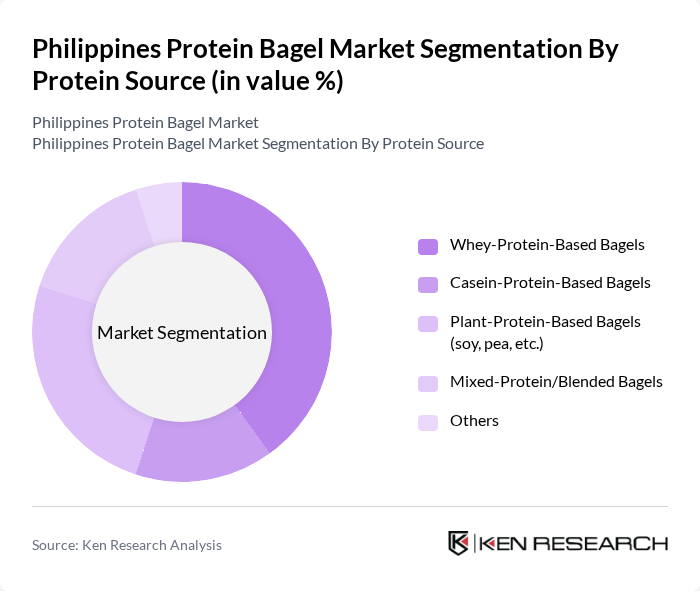

By Protein Source:The protein source segmentation includes Whey-Protein-Based Bagels, Casein-Protein-Based Bagels, Plant-Protein-Based Bagels (soy, pea, etc.), Mixed-Protein/Blended Bagels, and Others. This reflects how protein-enriched bakery products globally are formulated using dairy proteins (whey, casein), plant proteins (soy, pea), and blends to balance texture, cost, and nutritional profile. Whey-Protein-Based Bagels are described as leading this segment due to their high protein content and popularity among fitness enthusiasts, which aligns with the established role of whey in sports nutrition and high-protein snacking worldwide. The increasing awareness of the benefits of whey and other complete proteins for muscle recovery, satiety, and weight management, alongside the rise of plant proteins for flexitarian and vegan consumers, has contributed to the growth of both dairy- and plant-protein-based bakery innovations in the region.

The Philippines Protein Bagel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gardenia Bakeries (Philippines) Inc., Monde Nissin Corporation, Pilmico Foods Corporation (Aboitiz Equity Ventures), Rebisco (Republic Biscuit Corporation) – Bakeshop & Bread Lines, J.CO Donuts & Coffee Philippines, Krispy Kreme Philippines, BreadTalk Philippines, French Baker Inc., Tous les Jours Philippines, Goldilocks Bakeshop Inc., Red Ribbon Bakeshop Inc., The Daily Knead Inc., Wildflour Café + Bakery, Healthy Options Inc. (Retailer & Private-Label Health Bakery Products), Lazada & Shopee Leading Online Grocery/Specialty Sellers (Protein Bakery) contribute to innovation, geographic expansion, and service delivery in this space, primarily through high-fiber, whole grain, and protein-enriched bakery launches and expanded availability via supermarkets, cafés, and e-commerce platforms.

The future of the protein bagel market in the Philippines appears promising, driven by increasing health awareness and the demand for convenient, nutritious food options. As more consumers prioritize protein-rich diets, brands are likely to innovate with diverse flavors and formulations. Additionally, the growth of e-commerce will facilitate wider distribution, allowing consumers to access these products easily. Collaborations with fitness centers and health food stores will further enhance market visibility, positioning protein bagels as a staple in health-conscious diets.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Plain Protein Bagels Flavored Protein Bagels (e.g., cinnamon, chocolate, herb) Whole Wheat & Multigrain Protein Bagels Gluten-Free Protein Bagels Plant-Based/Vegan Protein Bagels Others |

| By Protein Source | Whey-Protein-Based Bagels Casein-Protein-Based Bagels Plant-Protein-Based Bagels (soy, pea, etc.) Mixed-Protein/Blended Bagels Others |

| By End-User | Household/Retail Consumers Gyms, Fitness Centers, and Sports Clubs Cafés, Coffee Chains, and Quick-Service Restaurants Hotels, Restaurants, and Catering (HoReCa) Institutional Buyers (corporate pantries, schools, hospitals) Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores and Mini-marts Bakery Chains and Artisan Bakeries Health Food Stores and Specialty Nutrition Shops Online Retail and E-commerce Platforms Others |

| By Packaging Format | Single-Serve Packs Multi-Pack (Family Packs) Frozen Packs Ready-to-Eat On-the-Go Packs Others |

| By Price Range | Premium Mid-Range Economy/Budget Private Label/Store Brands |

| By Nutritional Positioning | High-Protein (?15 g protein per serving) Moderate-Protein (10–14 g protein per serving) Low-Carb/High-Protein High-Fiber/Protein-Enriched Others |

| By Consumer Demographics | Fitness Enthusiasts and Athletes Young Professionals Families with Children Seniors/Health-Managed Diet Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health-Conscious Consumers | 120 | Fitness Enthusiasts, Nutrition-Focused Individuals |

| Bakery Owners and Managers | 90 | Small to Medium Bakery Operators, Franchise Owners |

| Food Retailers | 70 | Supermarket Managers, Specialty Food Store Owners |

| Dietitians and Nutritionists | 50 | Registered Dietitians, Health Coaches |

| Food Industry Experts | 40 | Market Analysts, Food Scientists |

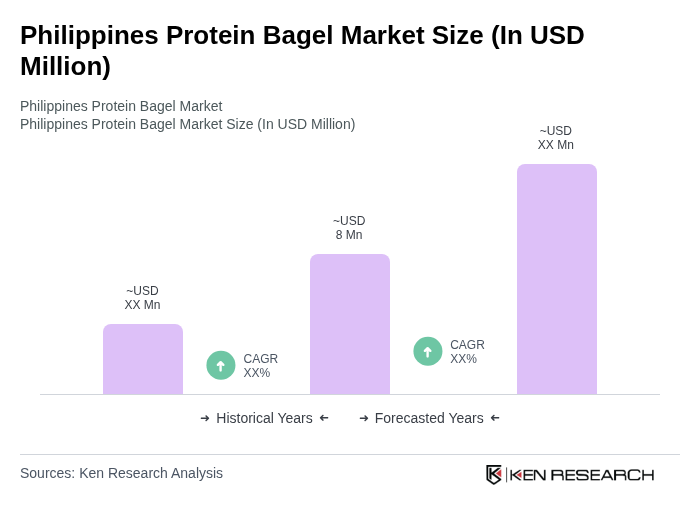

The Philippines Protein Bagel Market is valued at approximately USD 8 million, reflecting a growing trend towards health-conscious eating and the demand for high-protein food options among consumers in the region.