Region:Asia

Author(s):Geetanshi

Product Code:KRAD4130

Pages:85

Published On:December 2025

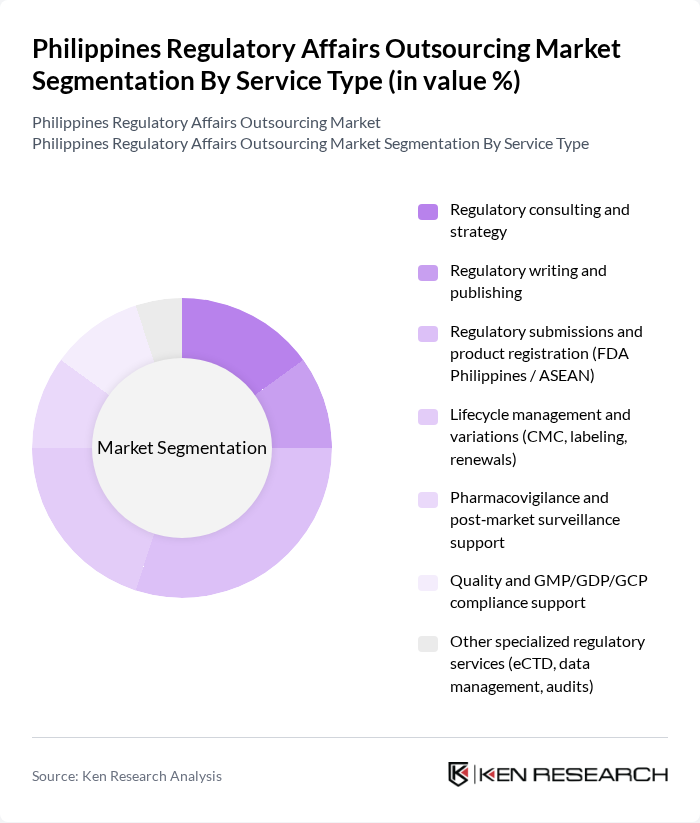

By Service Type:The service type segmentation includes various specialized services that cater to the regulatory needs of the pharmaceutical and biotechnology sectors. The dominant sub-segment is Regulatory submissions and product registration, which is crucial for companies seeking to enter the market and ensure compliance with local regulations. This sub-segment is driven by the increasing number of new drug applications and the need for timely market access.

By Client Type:The client type segmentation encompasses a diverse range of organizations that require regulatory affairs outsourcing services. Multinational pharmaceutical companies represent the largest client segment, driven by their need for comprehensive regulatory support across multiple markets. This segment's dominance is attributed to the increasing complexity of global regulations and the necessity for local expertise in navigating these challenges.

The Philippines Regulatory Affairs Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IQVIA Inc., Parexel International Corporation, ICON plc, Labcorp Drug Development (Covance), Charles River Laboratories International, Inc., Syneos Health, Inc., PharmaLex (an AmerisourceBergen company), Freyr Solutions, Pharlink Consulting, Inc. (Philippines), Otsuka (Philippines) Pharmaceutical, Inc. – regulatory and clinical operations unit, Zuellig Pharma Holdings Pte. Ltd. – regulatory affairs services, Onelife Regulatory Affairs Consultancy (Philippines), MedEthix Incorporated (Philippines) – clinical and regulatory support, SGS Société Générale de Surveillance SA – health sciences & regulatory services, Other emerging local regulatory affairs outsourcing providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines regulatory affairs outsourcing market appears promising, driven by technological advancements and increasing globalization. Companies are expected to adopt integrated regulatory solutions that streamline compliance processes, enhancing efficiency. Additionally, the focus on patient-centric regulations will likely shape service offerings, as firms prioritize safety and efficacy. As the market evolves, the integration of artificial intelligence in regulatory affairs will further transform operations, enabling faster and more accurate compliance management.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Regulatory consulting and strategy Regulatory writing and publishing Regulatory submissions and product registration (FDA Philippines / ASEAN) Lifecycle management and variations (CMC, labeling, renewals) Pharmacovigilance and post?market surveillance support Quality and GMP/GDP/GCP compliance support Other specialized regulatory services (eCTD, data management, audits) |

| By Client Type | Multinational pharmaceutical companies Local generic and branded pharmaceutical manufacturers Biotechnology and biopharmaceutical companies Medical device and diagnostics manufacturers Nutraceutical, food supplement, and cosmetics companies Contract research organizations (CROs) and CDMOs Others |

| By Engagement Model | Full?service, long?term outsourcing Project?based / transactional outsourcing Functional service provider (FSP) model Hybrid or managed service model |

| By Therapeutic / Product Category | Small?molecule pharmaceuticals Biologics and biosimilars Vaccines Medical devices and in vitro diagnostics Consumer health, OTC, and nutraceuticals Cosmetics and personal care products Food and beverage products Others |

| By Regulatory Geography Supported | Philippines national (FDA Philippines) ASEAN region and ASEAN Common Technical Dossier (ACTD/ACTR) Other Asia?Pacific markets Europe, North America, and global submissions |

| By Client Size | Large enterprises Medium?sized enterprises Small and emerging companies / startups Others |

| By Regulatory Focus Area | Clinical trial applications and approvals Marketing authorization applications and renewals Post?approval changes, variations, and lifecycle management Pharmacovigilance and safety reporting Quality systems and inspection readiness Data privacy and real?world evidence / registry support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Regulatory Affairs | 100 | Regulatory Affairs Managers, Compliance Officers 3 |

| Medical Device Compliance | 80 | Quality Assurance Managers, Regulatory Specialists |

| Food & Beverage Regulatory Outsourcing | 70 | Product Development Managers, Regulatory Compliance Leads 3 |

| Biotechnology Regulatory Services | 60 | Research & Development Managers, Regulatory Affairs Directors 2 |

| Clinical Trials Regulatory Support | 90 | Clinical Operations Managers, Regulatory Affairs Consultants 4 |

The Philippines Regulatory Affairs Outsourcing Market is valued at approximately USD 1.2 billion, based on a five-year historical analysis. This figure is an internally derived estimate and reflects the growing demand for regulatory compliance in the region.