Region:Asia

Author(s):Dev

Product Code:KRAC0399

Pages:87

Published On:August 2025

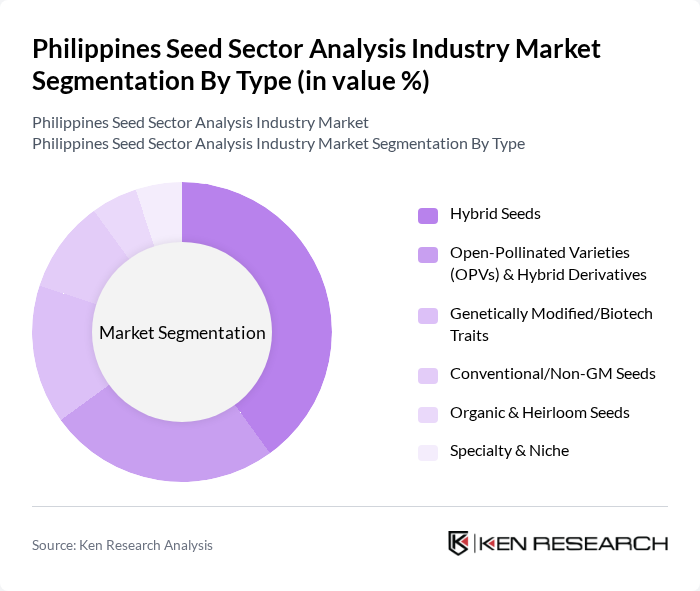

By Type:The seed market can be segmented into various types, including hybrid seeds, open-pollinated varieties (OPVs) and hybrid derivatives, genetically modified/biotech traits, conventional/non-GM seeds, organic & heirloom seeds, and specialty & niche seeds. Each of these subsegments plays a crucial role in meeting the diverse needs of farmers and consumers. Adoption patterns indicate widespread use of OPVs in rice and vegetables alongside growing hybrid penetration in corn and vegetables; biotech trait adoption is focused on approved GM corn events, while vegetable seeds remain predominantly non-GM .

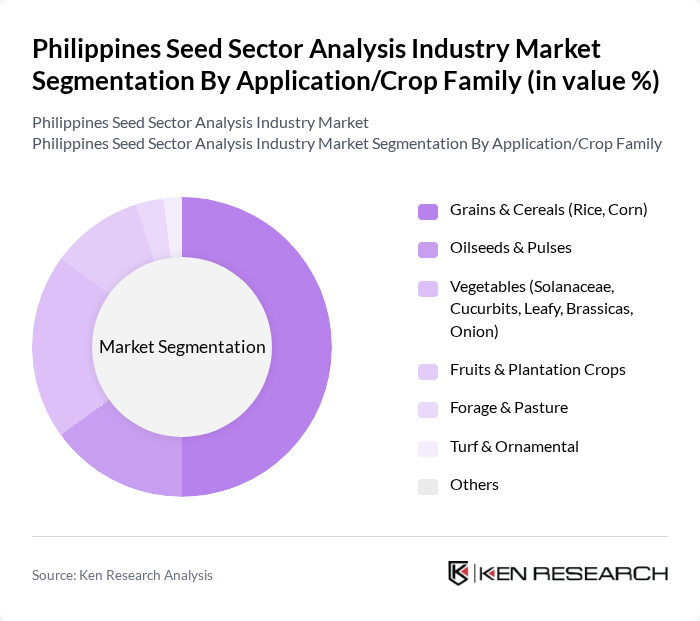

By Application/Crop Family:The seed market is also segmented by application, which includes grains & cereals (such as rice and corn), oilseeds & pulses, vegetables (including solanaceae, cucurbits, leafy greens, brassicas, and onion), fruits & plantation crops, forage & pasture, turf & ornamental, and others. This segmentation reflects the diverse agricultural landscape of the Philippines. Grains and cereals account for the largest share, led by rice as the staple and extensive corn cultivation; vegetables form a significant second pillar with strong commercial seed demand .

The Philippines Seed Sector Analysis Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as East-West Seed Company, Inc., Corteva Agriscience Philippines (Pioneer Hi-Bred), Syngenta Philippines, Inc., Bayer Crop Science Philippines, Inc., BASF (Nunhems) Vegetable Seeds, SeedWorks Philippines, Inc., Allied Botanical Corporation (ABC Seeds), Kaneko Seeds Philippines, Inc., Known-You Seed Philippines, Inc., Rijk Zwaan Philippines, Advanta Seeds (UPL) Philippines, Bioseed Research Philippines, Inc. (DSCL/Biostadt), SL Agritech Corporation, PhilRice (Philippine Rice Research Institute), International Rice Research Institute (IRRI) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Philippines seed sector appears promising, driven by increasing investments in agricultural technology and a growing emphasis on sustainability. As the government continues to support innovation through funding and policy reforms, local seed companies are likely to enhance their product offerings. Furthermore, the rising consumer demand for organic and climate-resilient seeds will encourage the development of new varieties, positioning the Philippines as a competitive player in the regional seed market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hybrid Seeds Open-Pollinated Varieties (OPVs) & Hybrid Derivatives Genetically Modified/Biotech Traits (e.g., insect resistance, herbicide tolerance) Conventional/Non-GM Seeds Organic & Heirloom Seeds Specialty & Niche (e.g., ornamentals, spices, indigenous) |

| By Application/Crop Family | Grains & Cereals (Rice, Corn) Oilseeds & Pulses Vegetables (Solanaceae, Cucurbits, Leafy, Brassicas, Onion) Fruits & Plantation Crops Forage & Pasture Turf & Ornamental Others |

| By Distribution Channel | Direct-to-Farmer (Company Field Teams) Agro-dealers/Retail Outlets Online & Digital Platforms Cooperatives & Farmers’ Associations Government Procurement/Seed Subsidy Programs Others |

| By End-User | Smallholder Farmers Commercial Farms & Agribusinesses Research & Breeding Institutions Government Agencies & LGUs NGOs & Development Programs Others |

| By Region | Luzon (Ilocos, Central Luzon, CALABARZON, Cagayan Valley, etc.) Visayas (Western, Central, Eastern) Mindanao (Northern, Davao, SOCCSKSARGEN, BARMM, etc.) Others |

| By Seed Treatment Method | Chemical Treatment Biological Treatment Physical Treatment Film Coating & Pelleting Untreated Others |

| By Price Band | Value/Low Price Mid Price Premium/High Price Others |

| By Cultivation Mechanism | Open Field Protected Cultivation (Greenhouse/Net-house) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seed Producers | 80 | Farm Owners, Production Managers |

| Seed Distributors | 60 | Distribution Managers, Sales Representatives |

| Farmers | 150 | Crop Farmers, Agricultural Cooperatives |

| Agricultural Extension Workers | 60 | Field Officers, Training Coordinators |

| Research Institutions | 50 | Agronomists, Research Scientists |

The Philippines seed sector is valued at approximately USD 860 million, reflecting strong demand for quality seeds across rice, corn, and vegetables. This valuation is supported by historical analyses and industry trackers indicating a robust market presence.