Region:Asia

Author(s):Geetanshi

Product Code:KRAD3816

Pages:89

Published On:November 2025

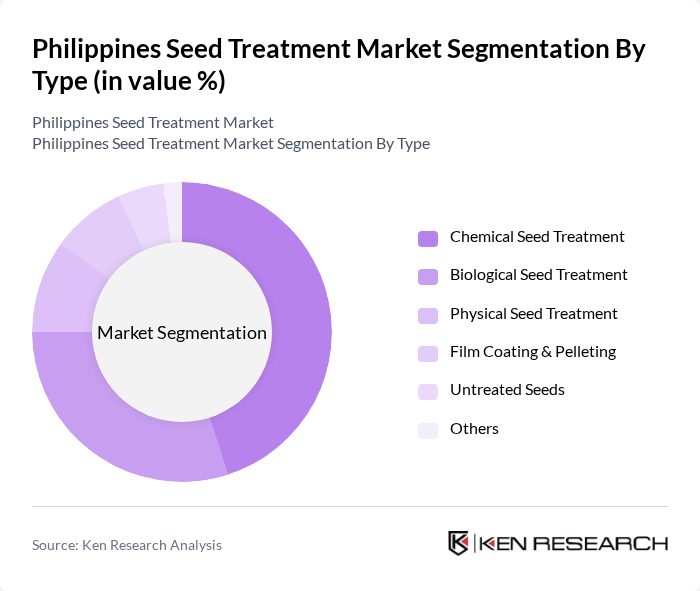

By Type:The seed treatment market can be segmented into various types, including Chemical Seed Treatment, Biological Seed Treatment, Physical Seed Treatment, Film Coating & Pelleting, Untreated Seeds, and Others. Among these, Chemical Seed Treatment is the most widely used due to its effectiveness in controlling seed-borne diseases and pests. However, Biological Seed Treatment is gaining traction as farmers increasingly seek sustainable and eco-friendly options, supported by government initiatives and rising demand for organic farming .

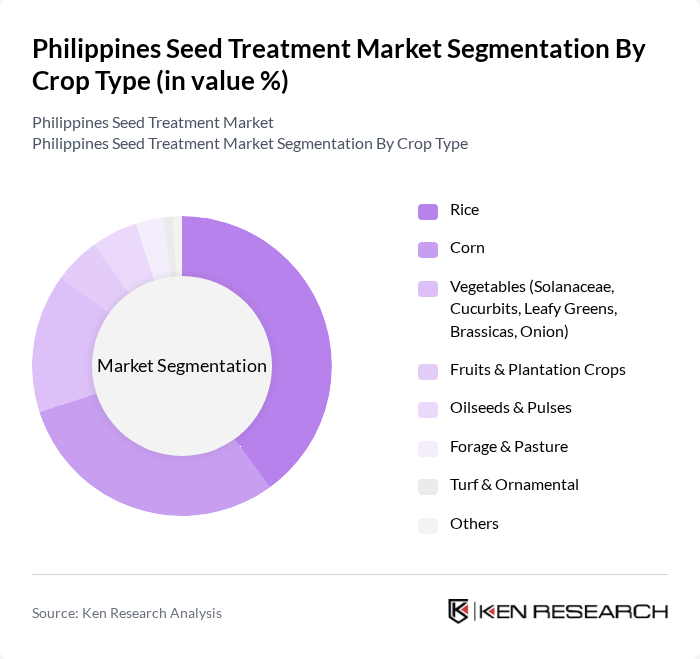

By Crop Type:The market is also segmented by crop type, which includes Rice, Corn, Vegetables (Solanaceae, Cucurbits, Leafy Greens, Brassicas, Onion), Fruits & Plantation Crops, Oilseeds & Pulses, Forage & Pasture, Turf & Ornamental, and Others. Rice and Corn are the dominant crops in the Philippines, driving the demand for seed treatments due to their significance in the local diet and economy. Government programs and private sector investments are further boosting the adoption of treated seeds in these key crops .

The Philippines Seed Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta Philippines, Inc., Bayer CropScience Philippines, BASF Philippines, Inc., Corteva Agriscience Philippines, FMC Philippines, Inc., Adama Philippines, Inc., UPL Philippines, Inc., SeedWorks Philippines, Inc., East-West Seed Company, Pioneer Hi-Bred Philippines, Inc., Greenhouse Seed Company Philippines, Bioseed Research Philippines, Inc., International Seed Company Philippines, Philippine Seed Industry Association, All-Asia Seed Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines seed treatment market appears promising, driven by increasing investments in agricultural technology and a growing emphasis on sustainable practices. As the government continues to support innovation through funding and policy initiatives, the adoption of advanced seed treatment solutions is expected to rise. Additionally, the integration of digital technologies in agriculture will likely enhance efficiency and productivity, paving the way for a more resilient agricultural sector in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Seed Treatment Biological Seed Treatment Physical Seed Treatment Film Coating & Pelleting Untreated Seeds Others |

| By Crop Type | Rice Corn Vegetables (Solanaceae, Cucurbits, Leafy Greens, Brassicas, Onion) Fruits & Plantation Crops Oilseeds & Pulses Forage & Pasture Turf & Ornamental Others |

| By Application Method | Seed Coating Seed Soaking Seed Pelleting Film Coating Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Government Distribution Programs Agricultural Cooperatives Others |

| By Region | Luzon Visayas Mindanao |

| By End-User | Commercial Farmers Smallholder Farmers Agricultural Cooperatives Community Seed Banks Others |

| By Product Formulation | Liquid Formulations Granular Formulations Powder Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Seed Producers | 60 | Production Managers, Agronomists |

| Smallholder Farmers | 120 | Farm Owners, Agricultural Workers |

| Agrochemical Distributors | 50 | Sales Representatives, Supply Chain Managers |

| Research Institutions | 40 | Research Scientists, Policy Analysts |

| Government Agricultural Agencies | 40 | Policy Makers, Program Coordinators |

The Philippines Seed Treatment Market is valued at approximately USD 250 million, reflecting a significant growth trend driven by advanced agricultural practices, crop protection awareness, and the demand for higher yields to ensure food security.