Region:Asia

Author(s):Geetanshi

Product Code:KRAB4612

Pages:92

Published On:October 2025

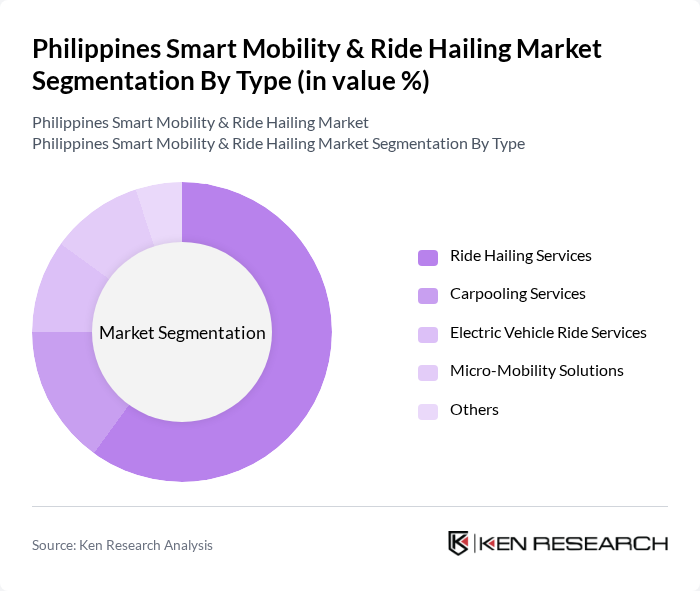

By Type:The market is segmented into various types, including Ride Hailing Services, Carpooling Services, Electric Vehicle Ride Services, Micro-Mobility Solutions, and Others. Among these, Ride Hailing Services dominate the market due to their convenience and flexibility, catering to a wide range of consumers. The increasing adoption of smartphones and mobile applications has further fueled the growth of this segment, making it the preferred choice for urban commuters.

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, and Tourists. Individual Consumers represent the largest segment, driven by the increasing need for convenient and affordable transportation options. The rise in urbanization and the growing trend of on-demand services have made ride-hailing a popular choice among daily commuters, further solidifying its dominance in the market.

The Philippines Smart Mobility & Ride Hailing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab Philippines, Angkas, JoyRide, Move It, Hype, Micab, U-Hop, GoJek, TaxiGo, EasyTaxi, Biyahero, OWTO, Lalamove, Transportify, inDrive contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines smart mobility and ride-hailing market appears promising, driven by technological advancements and increasing urbanization. As the government continues to invest in infrastructure and regulatory frameworks, the market is expected to evolve significantly. Innovations in electric vehicles and AI integration will likely enhance service efficiency and user experience. Additionally, the growing trend towards sustainable transport solutions will shape the market landscape, encouraging companies to adopt eco-friendly practices and technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride Hailing Services Carpooling Services Electric Vehicle Ride Services Micro-Mobility Solutions Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tourists |

| By Vehicle Type | Sedans SUVs Motorcycles Electric Vehicles Vans |

| By Service Model | On-Demand Services Pre-Booked Services Subscription Services |

| By Payment Method | Cash Payments Mobile Wallets Credit/Debit Cards |

| By Geographic Coverage | Metro Manila Cebu Davao Others |

| By Customer Segment | Students Professionals Families Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuter Preferences | 100 | Daily commuters, occasional ride-hailing users |

| Ride-Hailing Service Providers | 50 | Operations Managers, Marketing Managers |

| Government Transportation Officials | 40 | Policy Makers, Urban Planning Experts |

| Technology Adoption in Mobility | 60 | IT Managers, Innovation Officers |

| Consumer Satisfaction and Feedback | 80 | Ride-hailing users, customer service representatives |

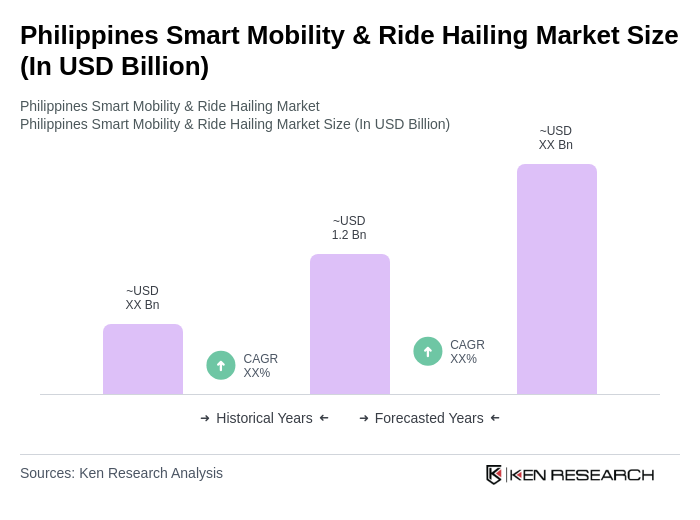

The Philippines Smart Mobility & Ride Hailing Market is valued at approximately USD 1.2 billion, driven by urban population growth, smartphone penetration, and demand for convenient transportation solutions. This market is expected to continue expanding significantly in the coming years.