Region:Asia

Author(s):Dev

Product Code:KRAA8359

Pages:81

Published On:November 2025

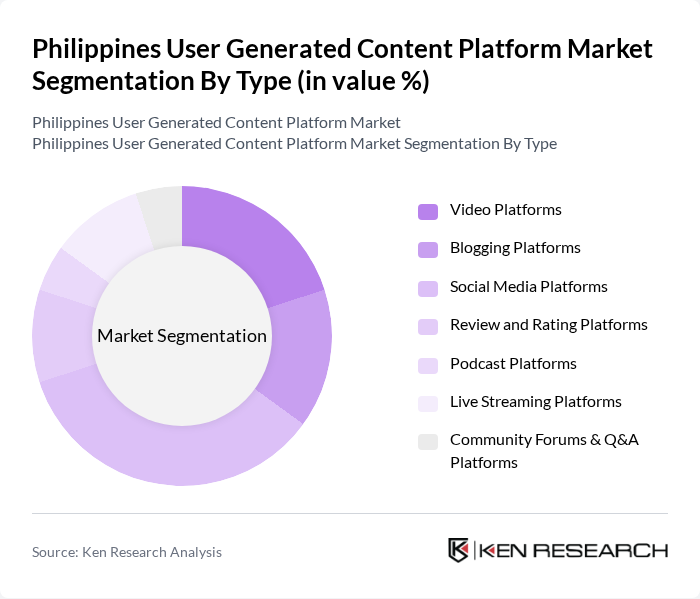

By Type:The market is segmented into platforms that enable user-generated content, including Video Platforms, Blogging Platforms, Social Media Platforms, Review and Rating Platforms, Podcast Platforms, Live Streaming Platforms, and Community Forums & Q&A Platforms. Social Media Platforms dominate due to their extensive reach and high engagement, driven by the popularity of sharing personal experiences, influencer content, and interactive features. Video-based content continues to gain traction, reflecting global trends where video formats account for approximately 30% of user-generated content.

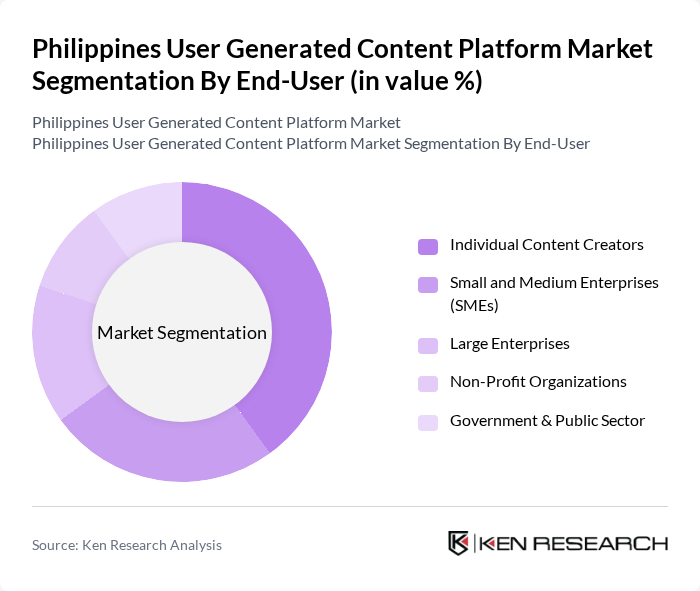

By End-User:End-user segmentation includes Individual Content Creators, Small and Medium Enterprises (SMEs), Large Enterprises, Non-Profit Organizations, and Government & Public Sector. Individual Content Creators lead the market, propelled by the rise of influencers, personal branding, and the accessibility of monetization tools. SMEs and large enterprises increasingly leverage user-generated content for brand engagement and marketing, while non-profit organizations and government entities utilize these platforms for outreach and community engagement.

The Philippines User Generated Content Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Facebook), Google LLC (YouTube), ByteDance Ltd. (TikTok), Meta Platforms, Inc. (Instagram), X Corp. (formerly Twitter, Inc.), Pinterest, Inc., Reddit, Inc., Tumblr, Inc., Medium Corporation, Twitch Interactive, Inc., Snap Inc. (Snapchat), Discord Inc., Quora, Inc., Vimeo.com, Inc., Kumu Holdings, Inc. (Kumu), Lazada Group (Lazada Live), Shopee Pte. Ltd. (Shopee Live) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines user-generated content platform market appears promising, driven by technological advancements and evolving consumer preferences. As internet accessibility continues to expand, particularly in rural areas, more users will engage with these platforms. Additionally, the integration of e-commerce features and collaborations with brands will enhance monetization opportunities for creators, fostering a more vibrant ecosystem. The focus on user privacy and content authenticity will also shape platform development, ensuring sustainable growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Platforms Blogging Platforms Social Media Platforms Review and Rating Platforms Podcast Platforms Live Streaming Platforms Community Forums & Q&A Platforms |

| By End-User | Individual Content Creators Small and Medium Enterprises (SMEs) Large Enterprises Non-Profit Organizations Government & Public Sector |

| By Content Format | Text Images Audio Video Interactive Content (Polls, Quizzes, etc.) |

| By Monetization Model | Ad Revenue Subscription Fees Sponsored Content Donations and Crowdfunding Affiliate Marketing |

| By User Demographics | Age Groups Gender Geographic Location (Metro, Urban, Rural) Interests and Hobbies Socioeconomic Class |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs Gaming Consoles |

| By Engagement Level | Active Users Passive Users Content Contributors Followers/Subscribers Community Moderators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Content Creators on Social Media | 100 | Influencers, Vloggers, Photographers |

| Users of UGC Platforms | 120 | General Users, Active Contributors |

| Brand Managers Utilizing UGC | 60 | Marketing Directors, Brand Strategists |

| Digital Marketing Professionals | 50 | Social Media Managers, Content Strategists |

| Industry Experts and Analysts | 40 | Market Researchers, Digital Analysts |

The Philippines User Generated Content Platform Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased internet penetration and the popularity of social media platforms among the population.