Region:Europe

Author(s):Dev

Product Code:KRAB3698

Pages:100

Published On:October 2025

By Type:The market is segmented into various types of software solutions that cater to different aspects of catering and event management. The subsegments include Event Management Software, Catering Management Software, Customer Relationship Management (CRM) Tools, Analytics and Reporting Tools, Payment Processing Solutions, Inventory Management Systems, and Others. Among these, Event Management Software is the leading subsegment, driven by the increasing need for efficient planning and execution of events.

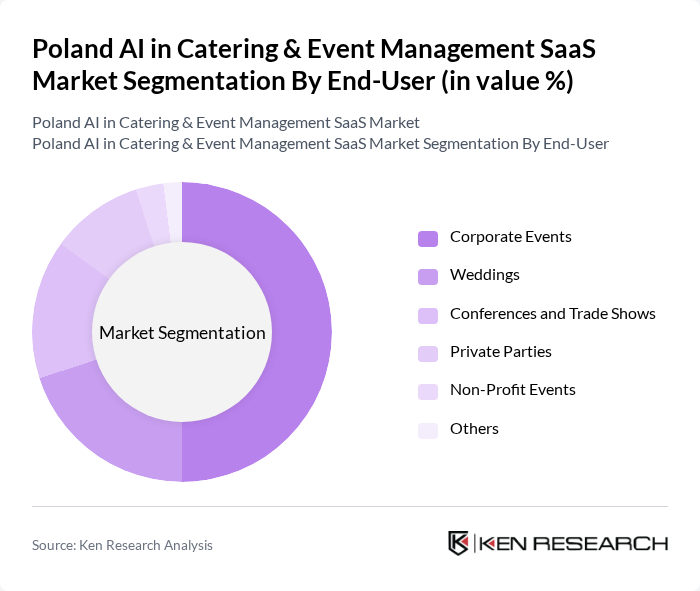

By End-User:The end-user segmentation includes various categories such as Corporate Events, Weddings, Conferences and Trade Shows, Private Parties, Non-Profit Events, and Others. Corporate Events are the dominant segment, as businesses increasingly invest in professional event management solutions to enhance their brand image and engage clients effectively.

The Poland AI in Catering & Event Management SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eventbrite, Cvent, CaterTrax, Social Tables, Gather, Whova, Bizzabo, Planning Pod, 123FormBuilder, Eventzilla, Zkipster, RSVPify, EventMobi, Ticket Tailor, Eventleaf contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI in catering and event management market in Poland appears promising, driven by technological advancements and changing consumer preferences. As hybrid events gain traction, the demand for integrated AI solutions will likely increase. Additionally, the focus on sustainability will push companies to adopt AI tools that optimize resource use. With government incentives for digital transformation, the market is expected to witness significant growth, fostering innovation and enhancing service delivery across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Event Management Software Catering Management Software Customer Relationship Management (CRM) Tools Analytics and Reporting Tools Payment Processing Solutions Inventory Management Systems Others |

| By End-User | Corporate Events Weddings Conferences and Trade Shows Private Parties Non-Profit Events Others |

| By Application | Venue Management Catering Services Guest Management Marketing and Promotion Feedback and Survey Management Others |

| By Sales Channel | Direct Sales Online Sales Distributors and Resellers Partnerships with Event Planners Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Tiered Pricing Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Startups Others |

| By Region | Central Poland Southern Poland Northern Poland Eastern Poland Western Poland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Catering Service Providers | 100 | Business Owners, Operations Managers |

| Event Management Companies | 80 | Event Planners, Project Managers |

| Venue Managers | 60 | Venue Coordinators, Facility Managers |

| Corporate Clients | 70 | Procurement Officers, Event Coordinators |

| Technology Providers in Catering | 50 | Product Managers, Business Development Executives |

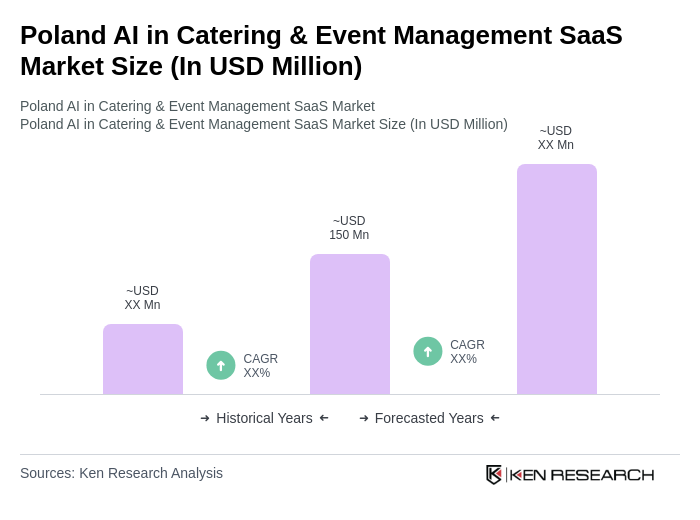

The Poland AI in Catering & Event Management SaaS Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing adoption of technology in these sectors to enhance operational efficiency and customer experience.