Region:Europe

Author(s):Geetanshi

Product Code:KRAB5706

Pages:84

Published On:October 2025

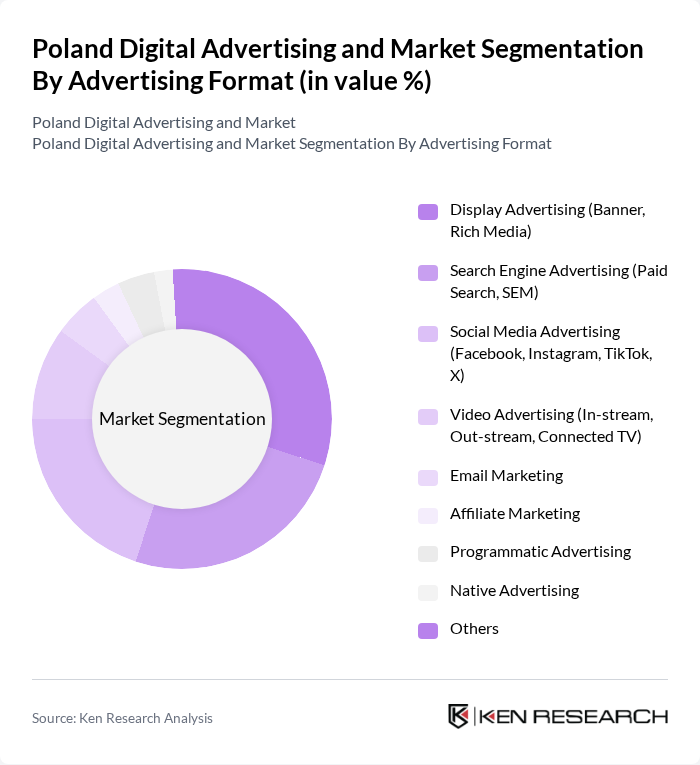

By Advertising Format:The advertising format segment includes various methods through which digital advertising is delivered to consumers. Display advertising, search engine advertising, and social media advertising are among the most prominent formats. Display advertising, which includes banner and rich media ads, is particularly effective in capturing user attention. Search engine advertising, including paid search and SEM, allows businesses to target specific keywords, driving relevant traffic to their sites. Social media advertising leverages platforms like Facebook, Instagram, TikTok, and X to engage users directly, making it a vital component of modern marketing strategies. Video advertising is also growing rapidly, with high viewability rates and engagement, while programmatic and native formats continue to expand their presence in the Polish market .

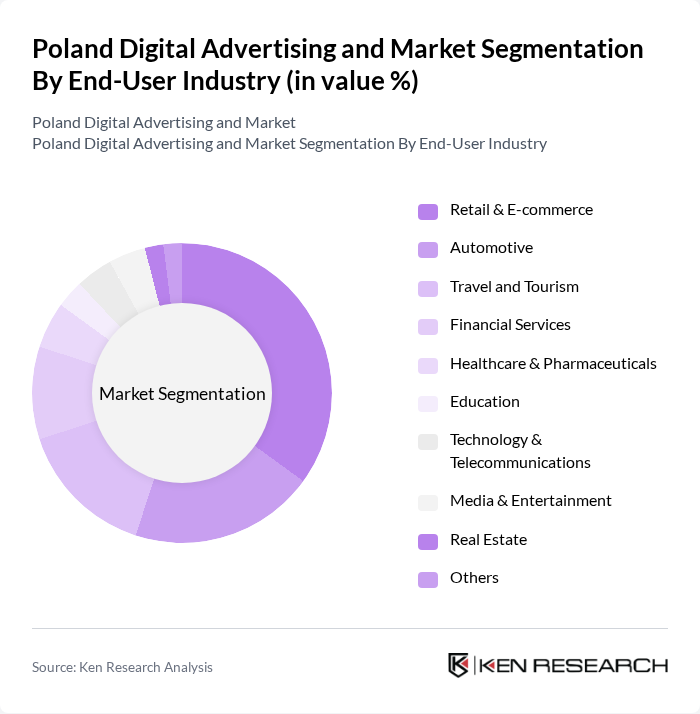

By End-User Industry:The end-user industry segment encompasses various sectors that utilize digital advertising services. Retail and e-commerce lead this segment, driven by the increasing shift towards online shopping and omnichannel marketing strategies. The automotive industry also invests heavily in digital marketing to showcase new models and features. Other significant sectors include travel and tourism, financial services, and healthcare, each leveraging digital platforms to reach their target audiences effectively. The diverse applications of digital advertising across industries highlight its importance in contemporary marketing strategies. Retail, in particular, accounts for the largest share of digital ad contacts and investment .

The Poland Digital Advertising and Marketing SaaS market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Poland Sp. z o.o., Meta Platforms Poland (Facebook, Instagram), Adform Sp. z o.o., Criteo Polska Sp. z o.o., Allegro.pl Sp. z o.o., Wirtualna Polska Holding S.A., Onet.pl (Ringier Axel Springer Polska Sp. z o.o.), Ringier Axel Springer Polska Sp. z o.o., GroupM Poland Sp. z o.o., Publicis Groupe Poland Sp. z o.o., Havas Media Group Poland, Zenith Media Polska Sp. z o.o., K2 Precise (K2 Group S.A.), MediaCom Warszawa Sp. z o.o., OMD Poland Sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital advertising in Poland appears promising, driven by technological advancements and evolving consumer preferences. As personalization becomes increasingly vital, advertisers are expected to leverage data analytics to create tailored campaigns. Additionally, the integration of augmented reality and immersive experiences will likely enhance engagement. With a growing focus on sustainability, brands that adopt eco-friendly practices in their advertising strategies may gain a competitive edge, appealing to environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Advertising Format | Display Advertising (Banner, Rich Media) Search Engine Advertising (Paid Search, SEM) Social Media Advertising (Facebook, Instagram, TikTok, X) Video Advertising (In-stream, Out-stream, Connected TV) Email Marketing Affiliate Marketing Programmatic Advertising Native Advertising Others |

| By End-User Industry | Retail & E-commerce Automotive Travel and Tourism Financial Services Healthcare & Pharmaceuticals Education Technology & Telecommunications Media & Entertainment Real Estate Others |

| By Campaign Objective | Brand Awareness Lead Generation Product Launch Seasonal Promotions Performance Marketing Others |

| By Sales Channel | Direct Sales (In-house Marketing Teams) Online Platforms (Self-serve Ad Platforms) Agencies (Media Buying, Creative Agencies) Resellers & Partners Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas National Campaigns Regional Campaigns Others |

| By Customer Segment | B2B B2C Non-Profit Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising Insights | 80 | Social Media Managers, Digital Marketing Specialists |

| Search Engine Marketing Strategies | 60 | SEO Specialists, PPC Campaign Managers |

| Display Advertising Effectiveness | 40 | Brand Managers, Advertising Analysts |

| Consumer Engagement Metrics | 50 | Market Researchers, Consumer Insights Analysts |

| Emerging Digital Platforms | 45 | Innovation Managers, Digital Strategy Consultants |

The Poland Digital Advertising and Marketing SaaS market is valued at approximately USD 1.7 billion, reflecting significant growth driven by the increasing adoption of digital technologies and the rise of e-commerce.