Region:Europe

Author(s):Rebecca

Product Code:KRAB2911

Pages:90

Published On:October 2025

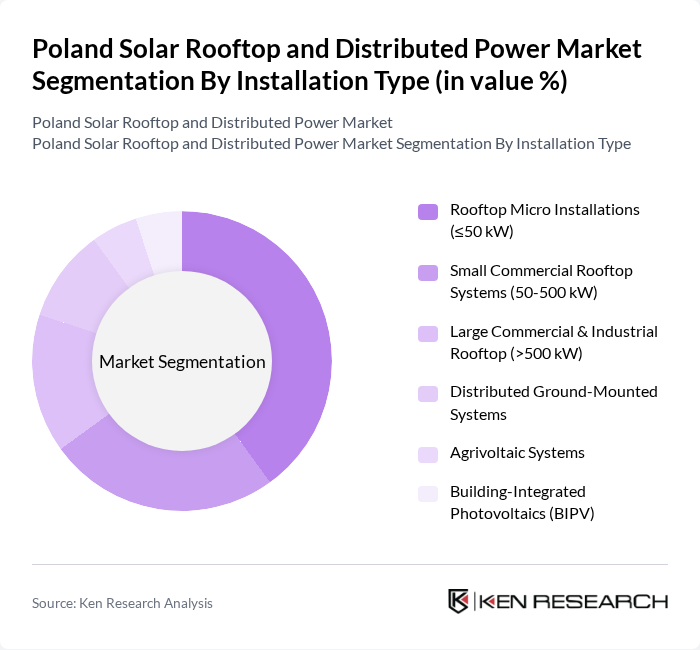

By Installation Type:The installation type segmentation includes various subsegments such as Rooftop Micro Installations (?50 kW), Small Commercial Rooftop Systems (50-500 kW), Large Commercial & Industrial Rooftop (>500 kW), Distributed Ground-Mounted Systems, Agrivoltaic Systems, and Building-Integrated Photovoltaics (BIPV). Among these, Rooftop Micro Installations are leading the market, supported by the high number of residential prosumers and favorable net-billing policies. The trend toward energy independence, increased subsidies for residential solar, and the rapid adoption of battery storage have further fueled the growth of this segment .

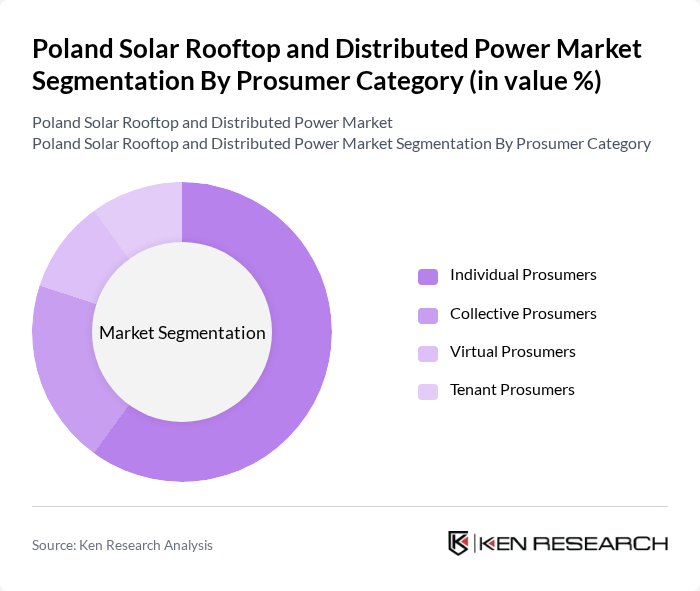

By Prosumer Category:The prosumer category segmentation includes Individual Prosumers, Collective Prosumers, Virtual Prosumers, and Tenant Prosumers. Individual Prosumers dominate the market, driven by the increasing number of homeowners investing in solar energy systems for self-consumption and energy savings. The trend toward sustainability, the availability of government incentives, and the transition from net-metering to net-billing have encouraged more individuals to adopt solar technologies, making this segment the most significant contributor to the overall market growth .

The Poland Solar Rooftop and Distributed Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Columbus Energy S.A., ML System S.A., Photon Energy N.V., Ekoenergetyka-Polska S.A., Green Genius, PGE Energia Odnawialna S.A., RWE Renewables Polska, Enel Green Power Polska, Tauron Ekoenergia, Sun Investment Group, Energa-Operator S.A., E.ON Polska, Orlen Energia, TotalEnergies Polska, Respect Energy S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar rooftop and distributed power market in Poland appears promising, driven by increasing energy demands and supportive government policies. As technological advancements continue to lower costs and improve efficiency, more households and businesses are likely to adopt solar solutions. Additionally, the integration of smart grid technologies and energy storage systems will enhance the reliability and appeal of solar energy, positioning it as a cornerstone of Poland's energy transition strategy.

| Segment | Sub-Segments |

|---|---|

| By Installation Type | Rooftop Micro Installations (?50 kW) Small Commercial Rooftop Systems (50-500 kW) Large Commercial & Industrial Rooftop (>500 kW) Distributed Ground-Mounted Systems Agrivoltaic Systems Building-Integrated Photovoltaics (BIPV) |

| By Prosumer Category | Individual Prosumers Collective Prosumers Virtual Prosumers Tenant Prosumers |

| By Grid Connection | On-Grid Systems Off-Grid Systems Hybrid Grid-Tied with Storage |

| By Technology | Monocrystalline Silicon Polycrystalline Silicon Thin-Film Technologies Bifacial Solar Panels |

| By End-User Sector | Residential Commercial & Office Buildings Industrial & Manufacturing Agricultural Public & Municipal Buildings |

| By Financing Model | Self-Financed Solar Loans Power Purchase Agreements (PPAs) Leasing Models Government Subsidies & Grants |

| By System Size | Micro Systems (<10 kW) Small Systems (10-50 kW) Medium Systems (50-500 kW) Large Systems (>500 kW) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Adoption | 100 | Homeowners, Property Managers |

| Commercial Solar Installations | 80 | Facility Managers, Business Owners |

| Industrial Solar Projects | 60 | Operations Directors, Energy Managers |

| Government Policy Impact | 40 | Regulatory Officials, Policy Analysts |

| Solar Technology Providers | 50 | Product Managers, Sales Executives |

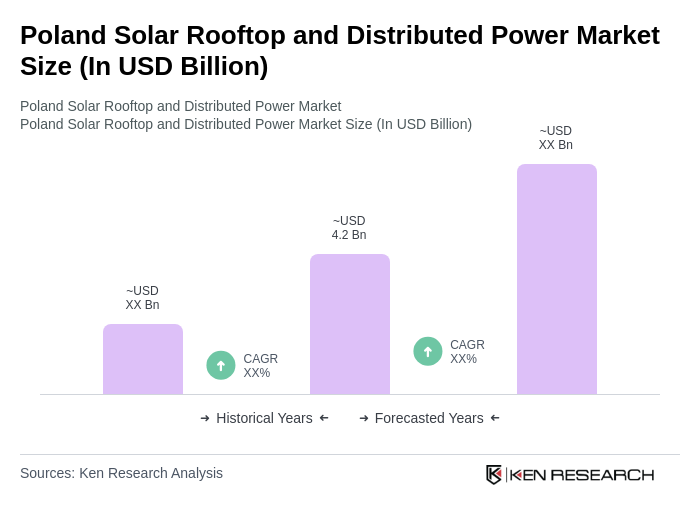

The Poland Solar Rooftop and Distributed Power Market is valued at approximately USD 4.2 billion, reflecting significant growth driven by energy independence, government incentives, and increased consumer awareness of environmental sustainability.