Region:Europe

Author(s):Dev

Product Code:KRAB5405

Pages:84

Published On:October 2025

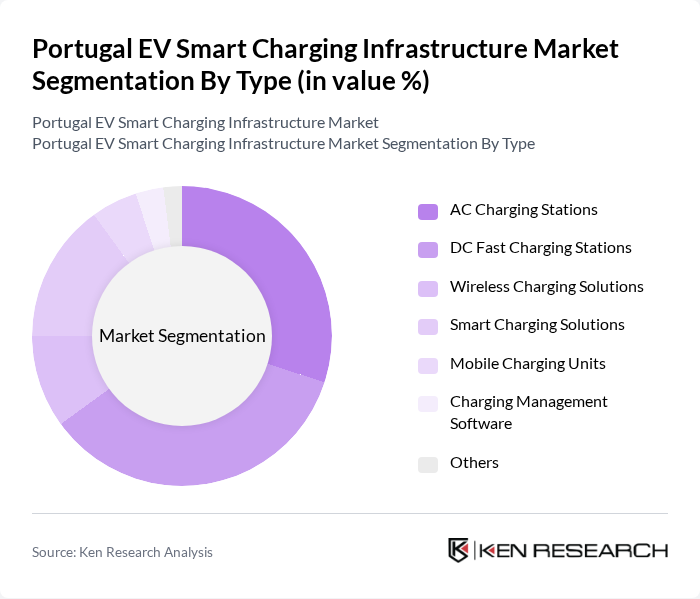

By Type:The market can be segmented into various types of charging solutions, including AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Smart Charging Solutions, Mobile Charging Units, Charging Management Software, and Others. Each of these sub-segments plays a crucial role in meeting the diverse needs of electric vehicle users.

The DC Fast Charging Stations segment is currently dominating the market due to the increasing demand for rapid charging solutions that minimize downtime for electric vehicle users. As more consumers transition to electric vehicles, the need for efficient and quick charging options has become paramount. This segment is particularly favored by commercial fleets and public transport systems, which require high availability and fast turnaround times. The growing network of DC fast chargers across urban and highway locations further supports its leadership in the market.

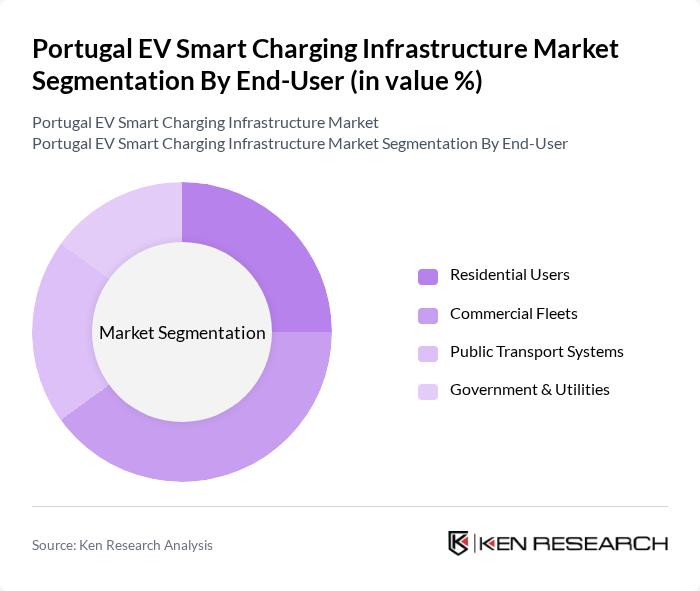

By End-User:The market can be segmented by end-users into Residential Users, Commercial Fleets, Public Transport Systems, and Government & Utilities. Each of these segments has unique requirements and contributes differently to the overall market dynamics.

The Commercial Fleets segment is leading the market as businesses increasingly adopt electric vehicles to reduce operational costs and meet sustainability goals. Companies are investing in charging infrastructure to support their fleets, which drives demand for efficient charging solutions. The trend towards electrification in logistics and delivery services further enhances the growth of this segment, making it a key player in the overall market landscape.

The Portugal EV Smart Charging Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Efacec, Galp Energia, Endesa, Iberdrola, Siemens, Schneider Electric, Greenway, ChargePoint, EVBox, Blink Charging, Tesla, ABB, Alfen, Wallbox, Driivz contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EV smart charging infrastructure market in Portugal appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. As the country continues to expand its renewable energy sources, the integration of clean energy into charging solutions will enhance the appeal of electric vehicles. Furthermore, advancements in charging technology and infrastructure development are expected to address current challenges, paving the way for a more robust and accessible EV ecosystem by 2030.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Smart Charging Solutions Mobile Charging Units Charging Management Software Others |

| By End-User | Residential Users Commercial Fleets Public Transport Systems Government & Utilities |

| By Application | Urban Charging Solutions Highway Charging Networks Destination Charging Fleet Charging Solutions |

| By Investment Source | Private Investments Government Grants Public-Private Partnerships International Funding |

| By Policy Support | Subsidies for Charging Infrastructure Tax Incentives for EV Purchases Grants for Renewable Energy Integration Regulatory Support for Charging Station Deployment |

| By Charging Speed | Level 1 Charging Level 2 Charging Level 3 Charging |

| By User Experience | User-Friendly Interfaces Mobile App Integration Payment Flexibility |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential EV Charging Users | 150 | Homeowners with EVs, EV Enthusiasts |

| Commercial Charging Station Operators | 100 | Business Owners, Facility Managers |

| Municipal Infrastructure Planners | 80 | City Planners, Transportation Officials |

| Energy Providers and Utilities | 70 | Energy Analysts, Utility Managers |

| Automotive Industry Stakeholders | 90 | Automotive Executives, Product Managers |

The Portugal EV Smart Charging Infrastructure Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of electric vehicles, government incentives, and advancements in charging technology and infrastructure development.