Region:Europe

Author(s):Shubham

Product Code:KRAB5098

Pages:96

Published On:October 2025

By Type:The market is segmented into various types, including Mobile Banking, Online Banking, Digital Wallets, Peer-to-Peer Lending, Robo-Advisory Services, Cryptocurrency Services, and Others. Among these, Mobile Banking and Online Banking are the most prominent segments, driven by the increasing smartphone usage and the demand for convenient banking solutions. Digital Wallets are also gaining traction as consumers seek seamless payment options.

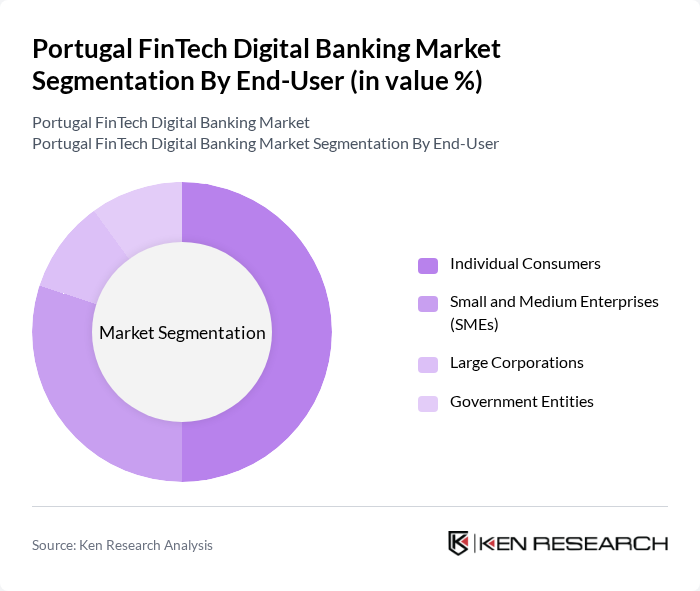

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing preference for digital banking solutions for personal finance management. SMEs are also significant contributors, leveraging digital banking for operational efficiency and cost savings.

The Portugal FinTech Digital Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BPI, Millennium BCP, Novo Banco, Banco Santander Totta, Revolut Ltd., N26 GmbH, Wise (TransferWise), Monzo Bank Ltd., Banco CTT, Unibanco, ActivoBank, BNI Europa, Raiz Investimentos, Fintonic, Bnext contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal FinTech digital banking market appears promising, driven by technological advancements and evolving consumer preferences. As mobile-first banking solutions gain traction, financial institutions will increasingly focus on enhancing user experience through innovative features. Additionally, the integration of AI and machine learning will enable personalized banking services, catering to individual customer needs. The ongoing collaboration between FinTechs and traditional banks will further accelerate the development of new financial products, ensuring a competitive landscape that fosters innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Banking Online Banking Digital Wallets Peer-to-Peer Lending Robo-Advisory Services Cryptocurrency Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Customer Segment | Retail Customers High Net-Worth Individuals Business Customers |

| By Service Offering | Savings Accounts Loans and Credit Facilities Investment Services |

| By Distribution Channel | Direct Online Sales Mobile Applications Third-Party Platforms |

| By Payment Method | Credit/Debit Cards Bank Transfers Digital Currencies |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 150 | Retail Banking Customers, Digital Banking Users |

| FinTech Startup Insights | 100 | Founders, Product Managers, Business Development Leads |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Investment Trends in FinTech | 70 | Venture Capitalists, Financial Analysts |

| Consumer Attitudes Towards Digital Banking | 120 | General Consumers, Tech-Savvy Users |

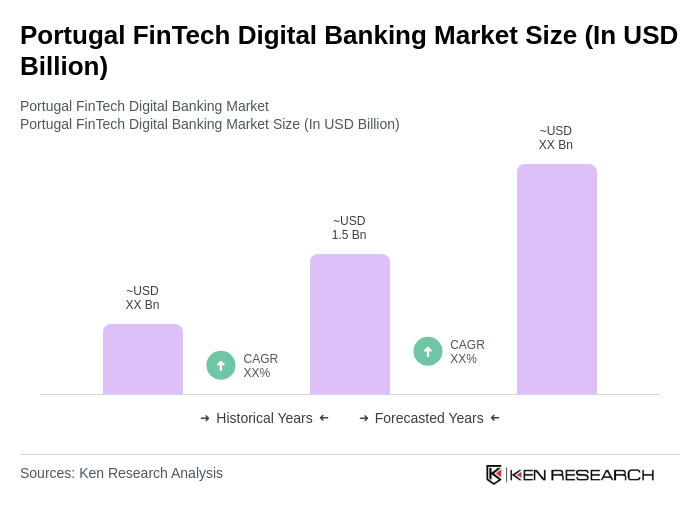

The Portugal FinTech Digital Banking Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and a surge in smartphone penetration among consumers.