CPaaS Market in APAC – Strategic Outlook, Sector Trends & Growth Pathways (2024–2031)

This POV reveals how APAC’s CPaaS market is turning communications from a cost center into a growth engine, with forecasts and insights.

Built for Leaders Across

This strategic POV is built for:

- CXOs, CDOs, and Digital Strategy Heads at high-volume B2C and platform-first organizations

- Heads of Product and Customer Experience in BFSI, Retail, Healthcare, and Logistics

- Growth-stage and late-stage investors seeking programmable SaaS and infra-tech opportunities

- Telecom & Tech policy architects shaping real-time communications infrastructure

Explore Strategic Roadmaps and Sector Priorities Tailored for APAC Decision-Makers

Executive Summary

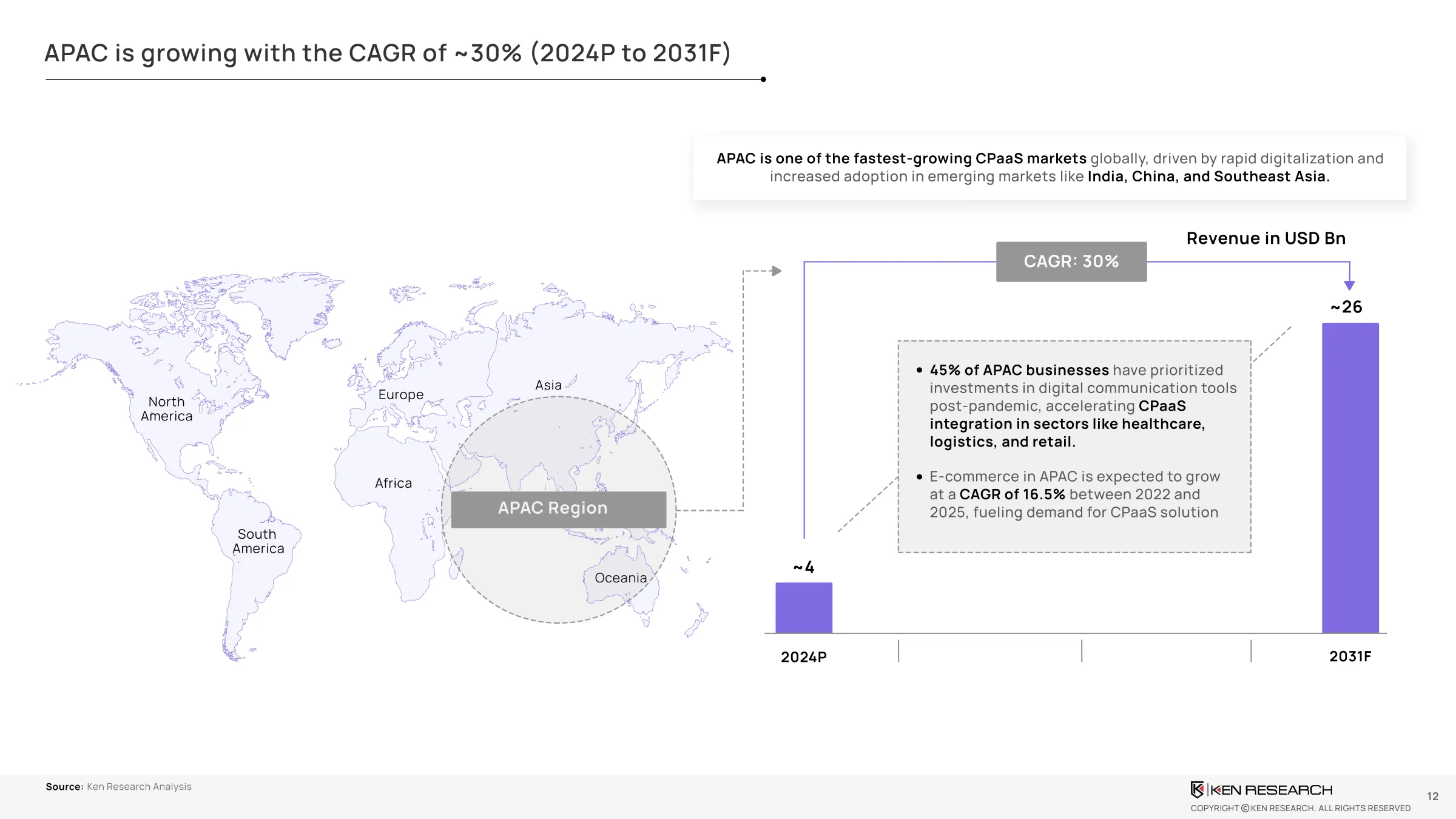

TheCPaaS market in APACis forecasted to grow from USD ~ 4 Bn in 2024 toUSD 26 Bn by 2031, expanding at a CAGR of~30%, outpacing North America and Europe.

This growth is driven by:

- Mobile-first consumer behavior across APAC’s digital-native economies

- Cloud-led enterprise modernization, requiring integrated CX and security

- Policy tailwinds including real-time digital identity, digital payments, and localization

As digital-first sectors like BFSI, e-commerce, and logistics adopt CPaaS, organizations must shift from legacy communication stacks to API-first infrastructure. This POV distills regional patterns, sectoral triggers, and monetization models shaping the next chapter of CPaaS growth.

Download the Strategic Snapshot on APAC CPaaS Growth and Sector Shifts

CPaaS Overview – Why It Matters in APAC Now

CPaaS enables organizations to embed communication features—voice, SMS, video, WhatsApp, authentication—into applications and workflows via APIs.

Why CPaaS adoption is scaling rapidly:

- Transactional messaging at scale: OTPs, fraud alerts, payment status, etc.

- Personalized multichannel engagement: Retail promos, banking alerts, e-health reminders

- Programmable infrastructure: Reduces friction and improves speed-to-market

Understand CPaaS as the Infrastructure Layer for Real-Time Customer Experience in Asia

CPaaS Value Chain – Who Powers the Ecosystem

The APAC CPaaS stack includes:

- Core Infrastructure Providers: Twilio, Sinch, Infobip, Vonage

- Telco Enablers: MNOs, SMS/voice carriers, regional aggregators

- Software Integrators & ISVs: Route Mobile, Comviva, Tanla, Kaleyra

- Channel & Implementation Partners: System integrators, marketing cloud partners, CPaaS marketplaces

- AI/Analytics Providers: Integrating bots, personalization engines, compliance dashboards

Download the CPaaS Ecosystem Stack and Provider Integration Models

Compare Monetization Paths Across Leading CPaaS Providers in APAC

CPaaS Business Models – From APIs to Monetization

Revenue models across APAC CPaaS players include:

- Usage-Based APIs (Twilio Model): Pay-per-message, pay-per-minute

- Platform License (Vonage/Infobip): CX suite for enterprise campaigns

- Telco Aggregation (Route Mobile): Partner APIs + regulatory enablement

- AI-Led CPaaS (Sinch/Infobip): Context-aware conversational flows + analytics

Growth Trend: Shift from raw messaging APIs toCX Intelligence Suitesthat combine communication, data, and insights.

Compare Monetization Paths Across Leading CPaaS Providers in APAC

APAC Market Forecast to 2031 – Where Growth is Concentrated

- Total APAC CPaaS Market: USD ~4B (2024P) → USD ~26 Bn (2031F) | CAGR: ~30%

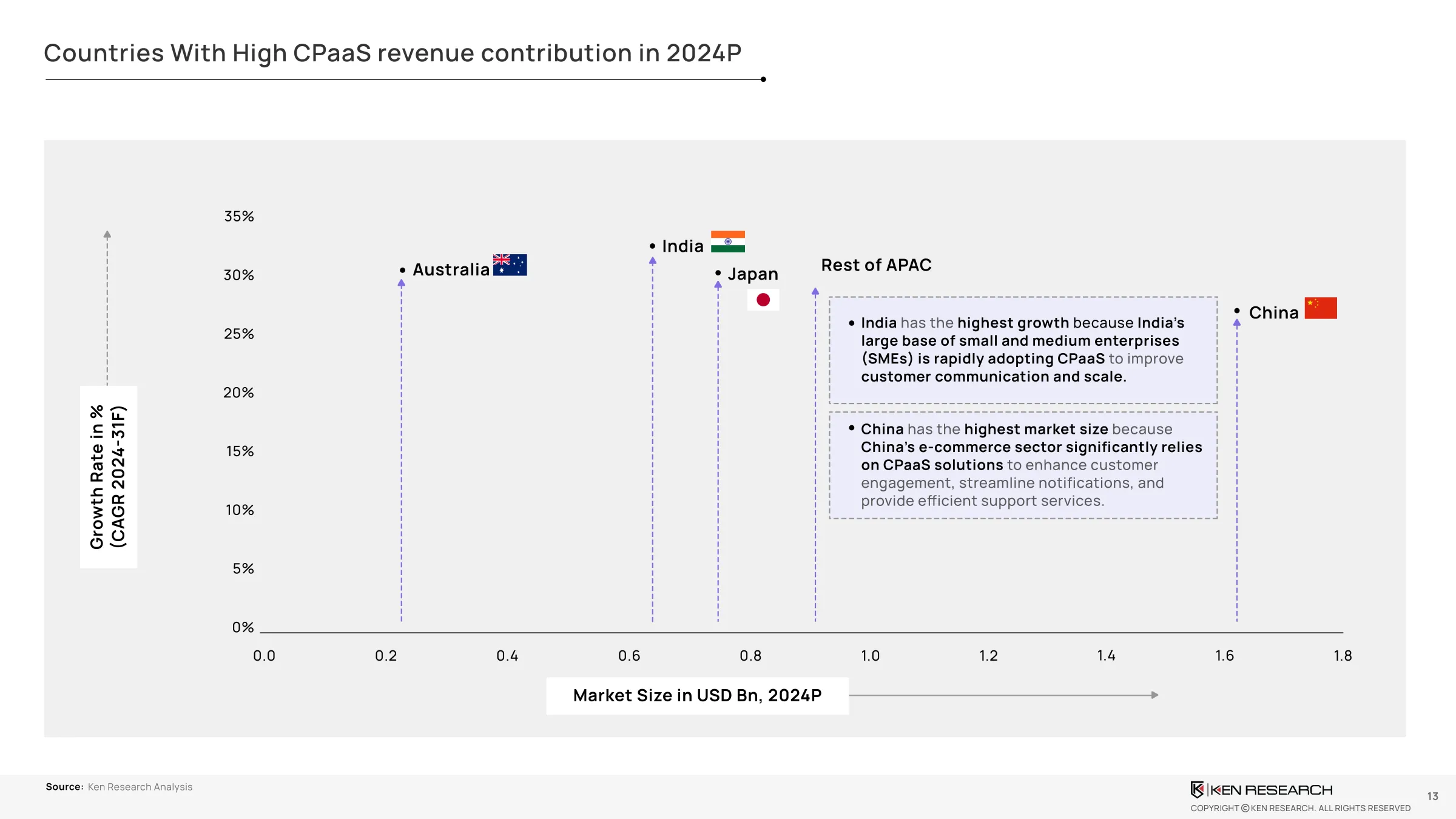

- Indiais the fastest-growing, with ~38% CAGR, driven by fintech and SME SaaS adoption

- Southeast Asiahas latent demand due to high mobile penetration and low CX tech maturity

Access Market Sizing by Country, Vertical, and Use Case for 2024–2031

Country Highlights – CPaaS Landscape by Region

Download Country Benchmark Deck with Regulatory Maps & Growth Indicators

Top CPaaS Use Cases in APAC

Access Use Case Sheets with KPIs and Sample Architectures

Partnership Strategies That Unlock CPaaS Scale

- Sinch + Singtel: CPaaS on 5G, rolled out RCS and WhatsApp for enterprise

- Infobip + Globe Telecom: CPaaS for Filipino SMEs with AI voice bots

- Twilio + SoftBank: Telco-led CPaaS for compliance-first enterprises

- True + Route Mobile: Layered CPaaS + CCaaS stack for BFSI in Thailand

Review Strategic Partnership Tracker and Deployment Impact by Region

Competitive Landscape – Player Comparison & Positioning

Download APAC CPaaS Market Map and Strategic Comparison Grid

CPaaS AS AN INFRASTRUCTURE PILLAR FOR 2024–2031

CPaaS is more than a messaging API—it is the programmable interface of enterprise-customer interaction. In APAC, where real-time, secure, mobile communication defines the customer journey, CPaaS adoption will define who leads digital CX over the next decade.

Download the Full Strategic CPaaS POV for 2024–2031 Planning & Execution

FAQ's

Still Got Questions? Connect Via Mail

What is the size of the APAC CPaaS market by 2031?

Estimated at USD 26B, growing ~6x from 2024.

What differentiates CPaaS from CCaaS or UCaaS?

CPaaS embeds programmable comms into apps. CCaaS/UCaaS are managed platforms for agent-based contact.

What is the ROI timeline for CPaaS deployment?

9–15 months for measurable ROI via churn reduction, CSAT improvement, and automation.

How do I prioritize CPaaS use cases?

Start with high-volume flows (e.g., SMS, IVR), then integrate AI chat, analytics, and loyalty triggers.