Pharmaceutical Packaging in APAC – Strategic Roadmap for a $125 Billion Market Opportunity

Asia Pacific’s pharma packaging market is set for major growth, reaching $125B by 2028, fueled by evolving regulations, and biologics.

Built for Leaders Across

- Packaging Innovation Heads & Product Development Leaders atand biotech firms

- Operations & Procurement Leaders managing primary and secondary packaging logistics

- Regulatory Compliance Heads navigating evolving APAC standards

- Private Equity & Growth Investors seeking scalable packaging tech opportunities

- Sustainability & ESG Officers implementing green packaging mandates

Explore how your packaging strategy stacks up against the region’s best-in-class

Executive Summary

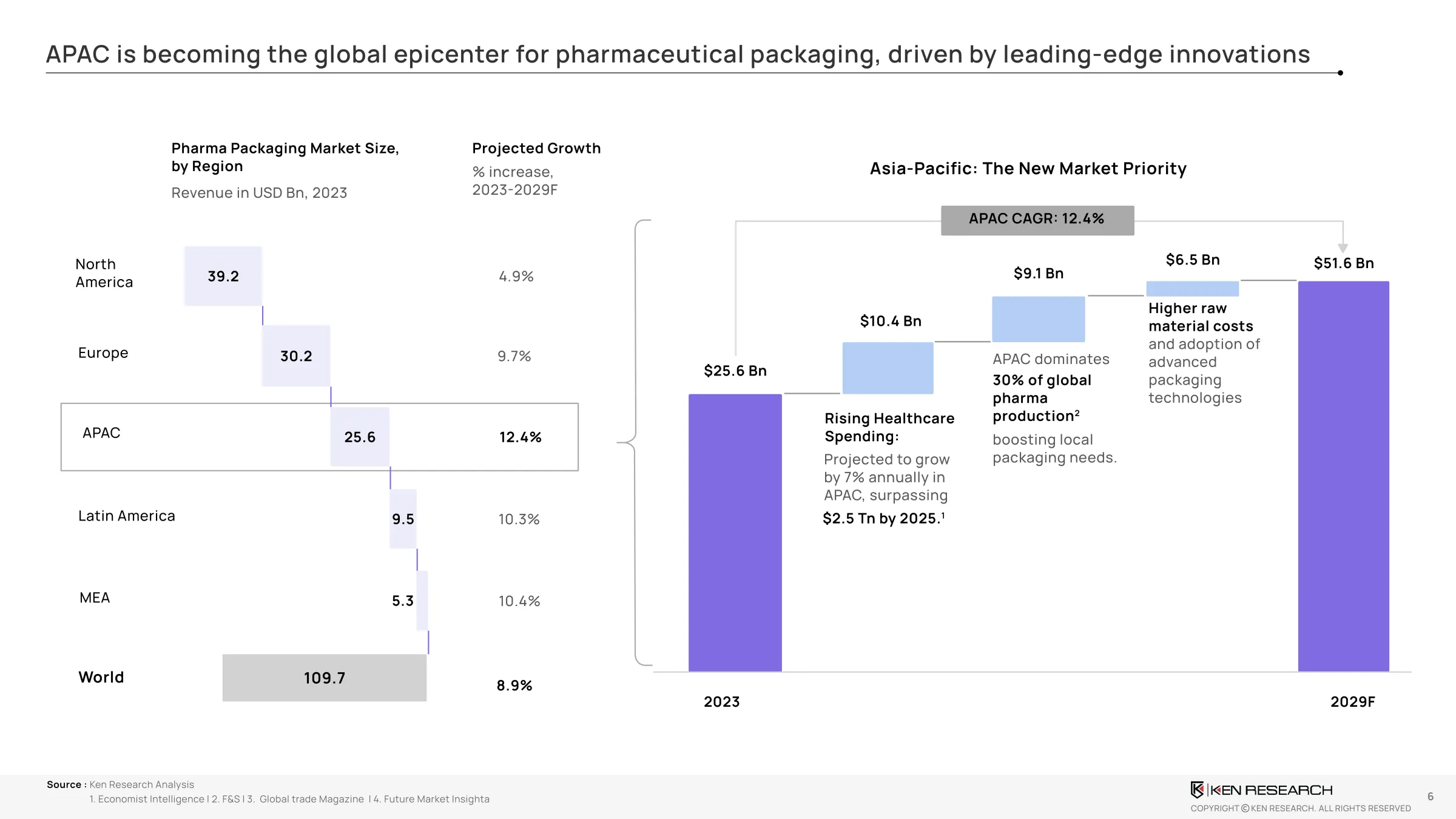

The APAC pharmaceutical packaging industry is entering a high-velocity phase of growth and innovation. The market is projected to grow from $25 billion in 2023 to $51.6 billion by 2028, at a CAGR of 13.4%. Growth is being driven by:

- Demand from India, China, Japan, and South Korea, each scaling their generics and biologics segments

- Rise in chronic diseases requiring more temperature-sensitive, tamper-proof packaging

- Regulations tightening on anti-counterfeiting, traceability, and sustainability

- Adoption of connected packaging and IoT-enabled track & trace for supply chain integrity

According to the attached industry report, India alone is expected to contribute over$27 billion by 2028, driven by its position as a major exporter of generics. China’s growth is tied to state-backed investments in biologics and high-end packaging automation.

Moreover,over 70% of pharma firmsacross APAC now consider packaging a strategic function, not just a compliance layer. Nearly60%of surveyed executives are planning packaging transformation investments within the next 12–18 months.

Pharma leaders must not only meet compliance requirements but also drive competitive advantage through smart packaging, local sourcing, and flexible formats. This POV maps the opportunity zones, risks, and imperatives that define the future of pharmaceutical packaging in APAC.

Need a region-specific demand forecast or competitor benchmarking? We can help

Market Snapshot: Key Segments & Trends

- Primary Packaging (Blister Packs, Ampoules, Syringes): 55% market share, growing with biologics and injectables

- Secondary Packaging (Cartons, Boxes, Inserts): 30% share; demand rising for patient education and branding

- Tertiary Packaging (Bulk Handling, Cold Chain): Accelerated adoption due to vaccine rollouts and biologic therapies

Regional Highlights:

- India: Emerges as the world’s largest volume producer; key exporter of generics and oncology drugs

- China: Investing in biologics packaging and local innovation centers

- Japan & Korea: High demand for child-resistant and senior-friendly formats

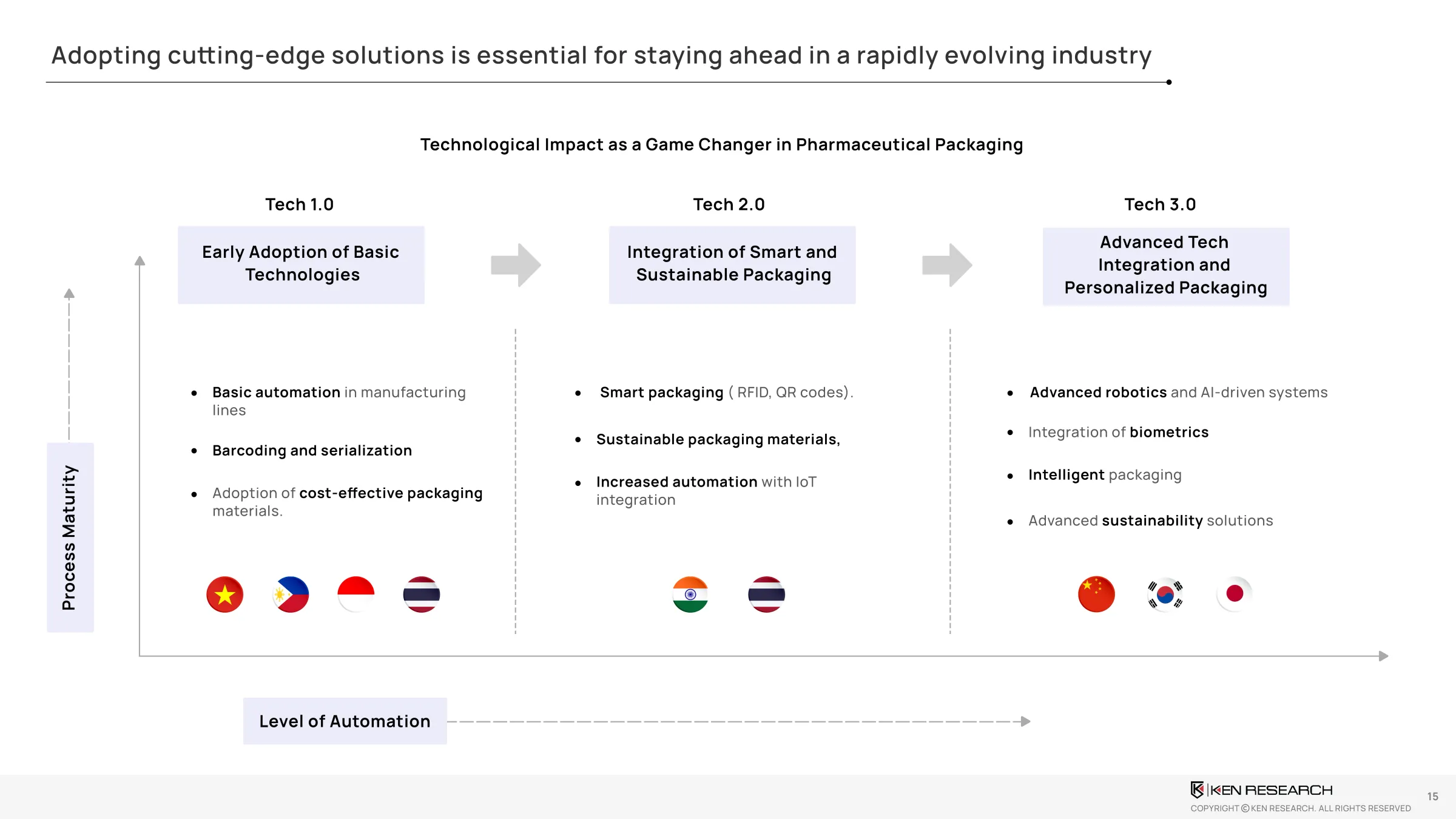

The adoption of temperature-controlled packaging solutions has surged by 38% since 2021, largely due to biologics and mRNA vaccine expansion. Meanwhile, smart packaging (e.g., RFID/NFC integration) is expected to grow at 20%+ CAGR, especially in regulated markets like Japan and SouthKorea.

Download country-specific packaging forecasts by format and application

Regulatory Landscape: APAC Policy Heatmap

- India: CDSCO mandates barcoding on all injectable drugs; serialization for export to EU/US required

- China: NMPA driving strict GMP standards on cold chain and container integrity

- Japan: PMDA pushing for eco-labeling, reduced plastic formats, and tamper evidence

- South Korea: Adopting international ISO 21976 for packaging safetyAcross APAC, the harmonization of packaging standards is lagging—creating complexity. The number of packaging recalls in India rose by 17% in 2023 alone due to mislabeling and compliance failure.

An estimated 42% ofexports from India and China must undergo packaging revision post-regulatory updates.

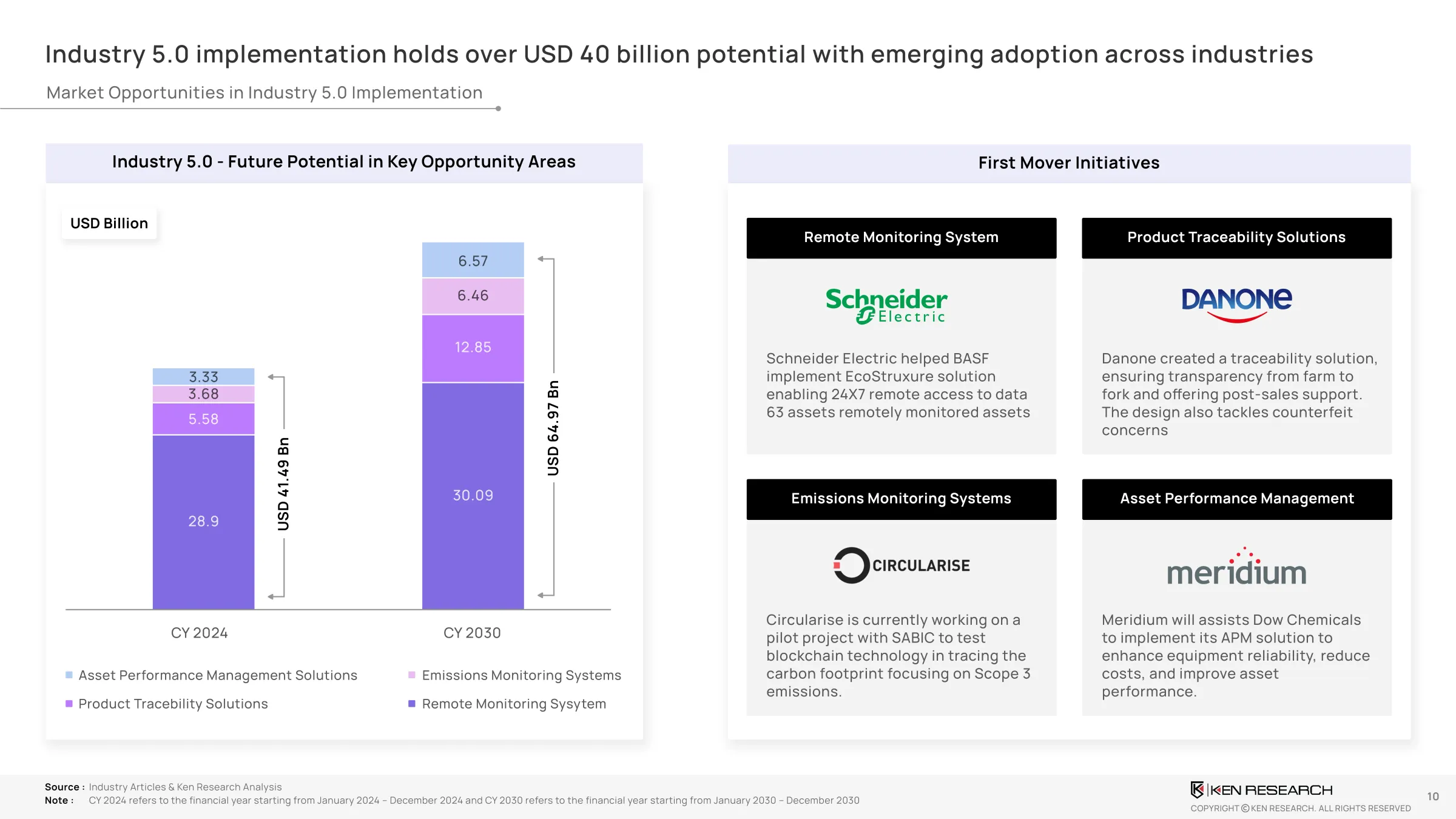

Innovation Landscape: What's Reshaping the Category

- Sustainable Packaging: Demand for plant-based polymers, biodegradable blister packs, and recyclable pouches is rising

- Smart Packaging: Growth in temperature sensors, NFC-enabled compliance tracking, and eleaflets for digital patient support

- Personalized Packaging: For targeted therapies and biologics requiring low volume, high integrity containers

Based on industry data, over 45% of pharma packaging innovation in APAC is now centered around sustainability and smart tracking.

Get our Innovation Tracker: Top 25 pharma packaging launches in APAC

Competitive Advantage: Who's Doing It Right

- Aurobindo Pharma (India): Reduced secondary packaging waste by 32% through carton redesign across oncology lines

- WuXi Biologics (China): Introduced digital temperature logging with NFC tags, reducing cold chain losses by 28%

- Daiichi Sankyo (Japan): Transitioned to child-resistant eco packs, improving senior adherence scores by 19%

A Bain-style teardown of leading firms shows that those who embed packaging innovation early see 6-10% lower time-to-market cycles and enhanced cross-border approval rates.

Want a competitive teardown for your key APAC packaging rivals? Request a brief

Strategic Imperatives: What Leaders Must Do Now

- Redesign for Regulation: Prioritize serialization, tamper-evidence, and local GMP mandates

- Invest in Smart Tech: Integrate IoT sensors and connected packaging features for critical therapies

- Diversify Supply Base: Localize sourcing to reduce disruption and increase cost efficiency

- Sustainability by Default: Adopt low-carbon and recyclable materials to align with upcoming ESG norms

- Digitalize Pack Communication: Enable QR-based patient leaflets, dosage compliance, and refill tracking

FAQ's

Still Got Questions? Connect Via Mail

What is the projected size of the APAC pharmaceutical packaging market?

The market is projected to grow from $67 billion in 2023 to $125 billion by 2028, registering a CAGR of 13.4%

What are the fastest growing packaging segments in APAC?

Primary packaging (especially vials, syringes, blister packs) and cold chain tertiary packaging are showing the fastest growth due to biologics and vaccine distribution.

Which regulations are impacting packaging in Asia?

Key regulations include CDSCO serialization in India, NMPA cold chain rules in China, and PMDA sustainability mandates in Japan.

How are companies innovating packaging in APAC?

By using NFC sensors, eco-materials, AI-based pack monitoring, and digital e-leaflets to improve compliance, reduce waste, and support remote patient engagement.

What are the top 3 action areas for packaging heads in 2024?

1) Aligning with ESG & regulatory mandates, 2) Upgrading to smart packaging, 3) Re-engineering supply chain resilience.