CRM 2030: Strategic Blueprint to Compete in a $142 Billion Customer Intelligence Market

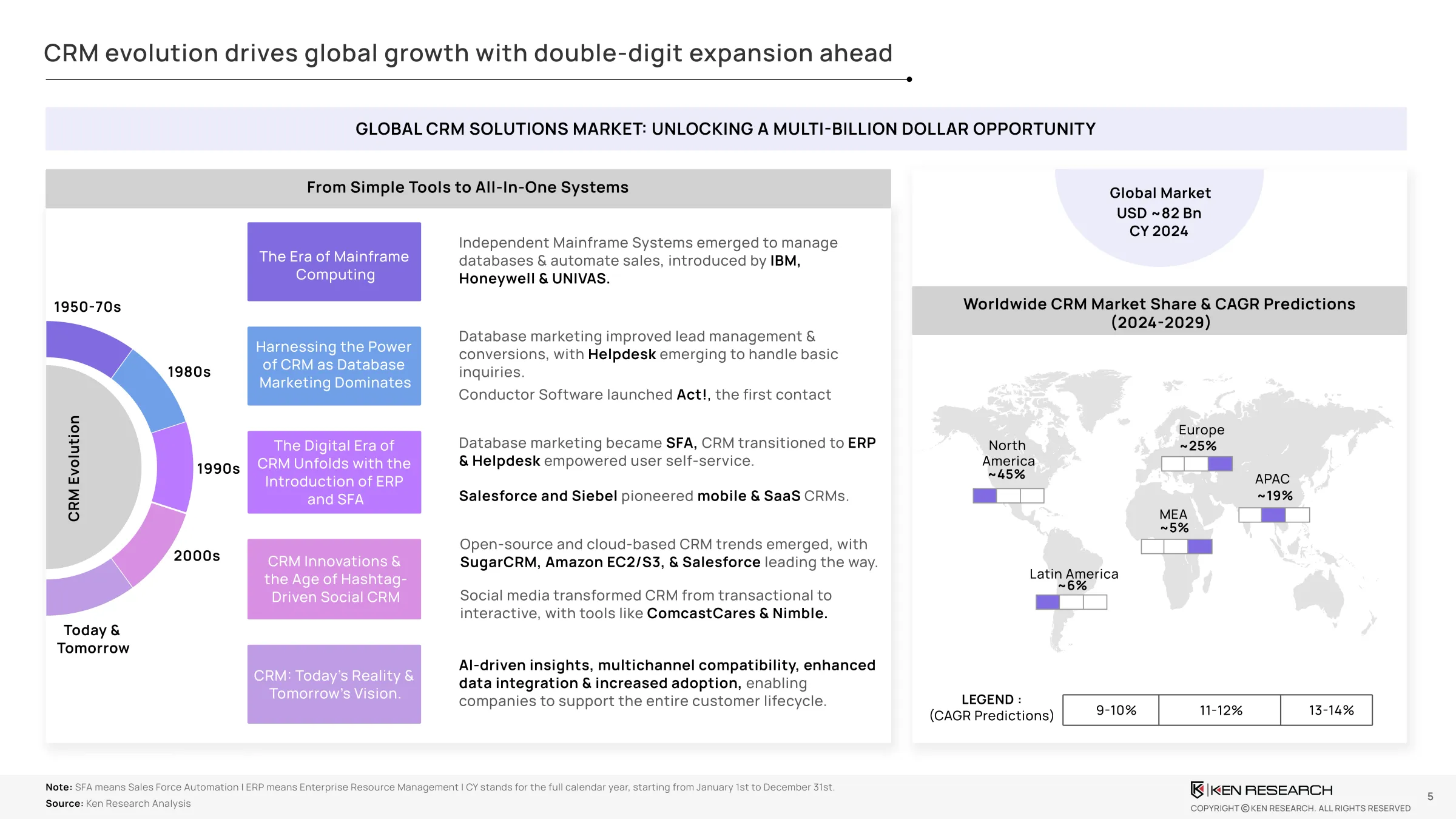

CRM was valued at USD 82 billion market in 2024 fueled by AI, vertical solutions, and omnichannel personalization.

Built for Leaders Across

This insight is tailored for:

- CRM vendors re-architecting for vertical growth and AI-native design

- CXOs and CTOs overseeing digital transformation and sales modernization

- GTM and product leaders driving customer intelligence programs

- Investors tracking growth-stage SaaS CRM opportunities

Access Market Strategy Tools, AI-Readiness Frameworks, and Regional CRM Playbooks

Executive Summary

CRM platforms are entering a phase of maturity and disruption. Growth toUSD 142 billion by 2029is being fueled by rising adoption in emerging markets, vertical-focused CRM deployments, and demand for mobile-first and AI-embedded features.

Key shifts driving urgency:

- 70%of surveyed companies cite poor CRM integration across ERP, billing, and support

- 60%report unmet needs in mobile CRM access, especially in SMB and frontline use cases

- 65%struggle to apply analytics to improve pipeline performance and customer retention

The shift is from CRM as a record system to CRM as a real-time, AI-powered customer strategy engine.

Download Now: Key Insights on Market Expansion and Platform Strategy

Market Snapshot – Global Revenue & Growth Forecasts

The CRM market is projected to grow at a9–14% CAGR, scaling fromUSD 82 billion in 2024toUSD 142 billion by 2029.

By Region:

- North America:45%market share

- Europe:25%, steady growth

- Asia Pacific:19%, fastest-growing region

- Latin America:6%

- Middle East & Africa:5%

By Industry (2024 Values):

- IT & Telecom: USD 30.5B →35–37%sales growth

- Retail: USD 14.8B →43–45%increase in online conversions

- BFSI: USD 11.5B →30–45%uplift in cross-sell and lifecycle revenue

- Manufacturing: USD 6.9B →63–65%gain in service automation

- Healthcare: USD 5.8B →30–32%improvement in patient follow-up metrics

Access Sector-Wise Revenue Models and Geo-CAGR Forecasts

Technology Landscape – Designing Future-Ready Crm Stacks

CRM innovation is now shaped by five foundational layers:

- AI-native architecture: Predictive scoring, churn forecasting, and sales automation

- Mobile-first access: Offline-ready CRM for SMBs, field teams, and distributed service roles

- Open API ecosystems: Seamless connection to ERP, CX platforms, analytics layers

- Embedded analytics: Actionable dashboards integrated into daily workflows

- Low-code extensibility: Custom workflows without developer friction

Download CRM Technology Strategy Toolkit and Data Integration Scorecard

Competitive Landscape – CRM Leadership Vs Segmented Advantage

Top CRM platforms are shaping the next decade:

- Salesforce: Category-defining stack with AI, vertical modules (Vlocity), and Tableau analytics

- Microsoft Dynamics 365: Unified experiences with Power Platform, Teams, and Azure services

- HubSpot: Freemium model and low-complexity UI for SMB onboarding

- Zoho & Freshsales: Strength in offline mobile, multi-language support, and regional growth

- SAP & Oracle NetSuite: Enterprise customization and back-office integration depth

Access Competitor Feature Matrix and Capability Deep-Dive Comparisons

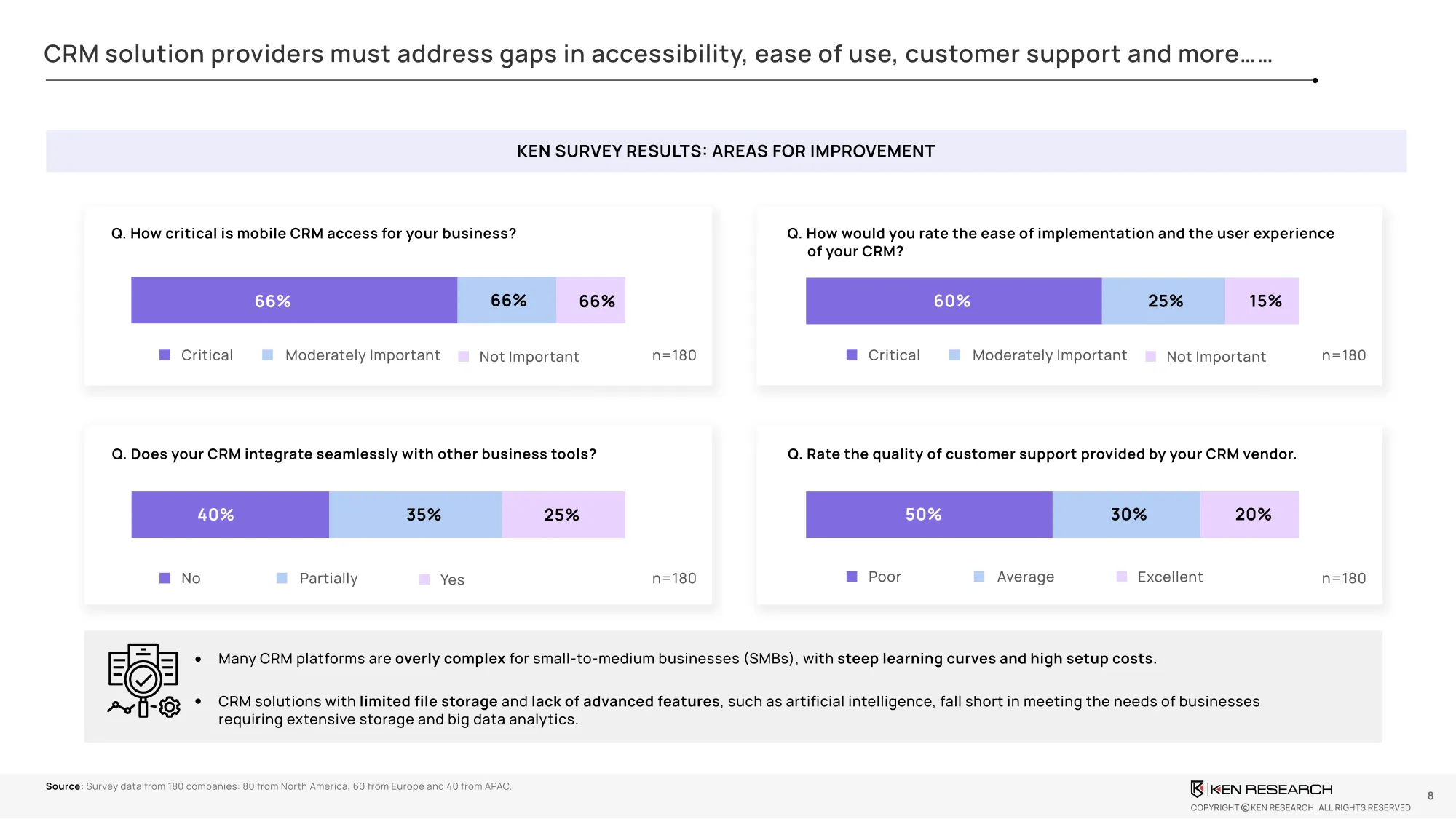

Customer Challenges – Insights From 180 Enterprise Users

CRM users report significant value friction:

- 70% cite integration issues with adjacent tools (support, billing, ERP)

- 68% report steep UI/UX learning curves delaying adoption

- 65% say analytics exist but remain underused

- 60% require mobile access, but only 40% find it effective

Download Voice of Customer Report + Adoption Bottleneck Tracker

Strategic Solutions – Closing Delivery Gaps In Crm Systems

What leading vendors are deploying:

- Salesforce: Expanded native storage and advanced dashboards via Tableau

- Microsoft: Embedded workflow automation through Power Automate

- HubSpot: Seamless onboarding and mobile workflows for SMBs

- Zoho CRM: Offline CRM and multilingual UI enhancing global adoption

Access CRM Capability-Gap Solutions Matrix and Field-Ready Workflow Playbooks

Strategic Imperatives – Where The Next Phase Of Crm Growth Lies

To remain competitive, CRM vendors and enterprise buyers must:

- Verticalize CRM solutions by embedding industry-specific processes

- Expand mobile CRM functionality to include offline sync, custom views, and push notifications

- Build AI into core workflows, not just as reporting tools

- Prioritize integration architecture to reduce CRM-ERP-CX friction

- Deploy multilingual, region-ready training to reduce churn and improve time to value

Download Strategic CRM Growth Framework + Product-Market Fit Checklist

Why Crm Is Entering Its Strategic Era

CRM is no longer a sales tool. It’s an intelligence layer driving acquisition, engagement, and retention. Growth to USD 142 billion by 2029 will favor platforms built for AI activation, mobile adoption, vertical agility, and data-driven action.

Access the Full Strategic CRM 2030 POV – Built for Scale, Designed for Execution

FAQ's

Still Got Questions? Connect Via Mail

What is the CRM market projected to reach by 2029?

USD 120 billion globally, with CAGR between 9–14%

Which sectors see the highest ROI?

IT, Retail, BFSI, and Manufacturing—all reporting >30% improvement in process or revenue performance.

What are the most cited user pain points?

Integration challenges, poor mobile UX, steep adoption curve, underutilized analytics.

What differentiates top vendors today?

Mobile innovation, open integration, vertical CRM modules, and AI-native workflows.

Where is product innovation headed?

Toward industry-specialized platforms with automation-first design and embedded analytics.