Capturing the $170B Surge in Global Dietary Supplements

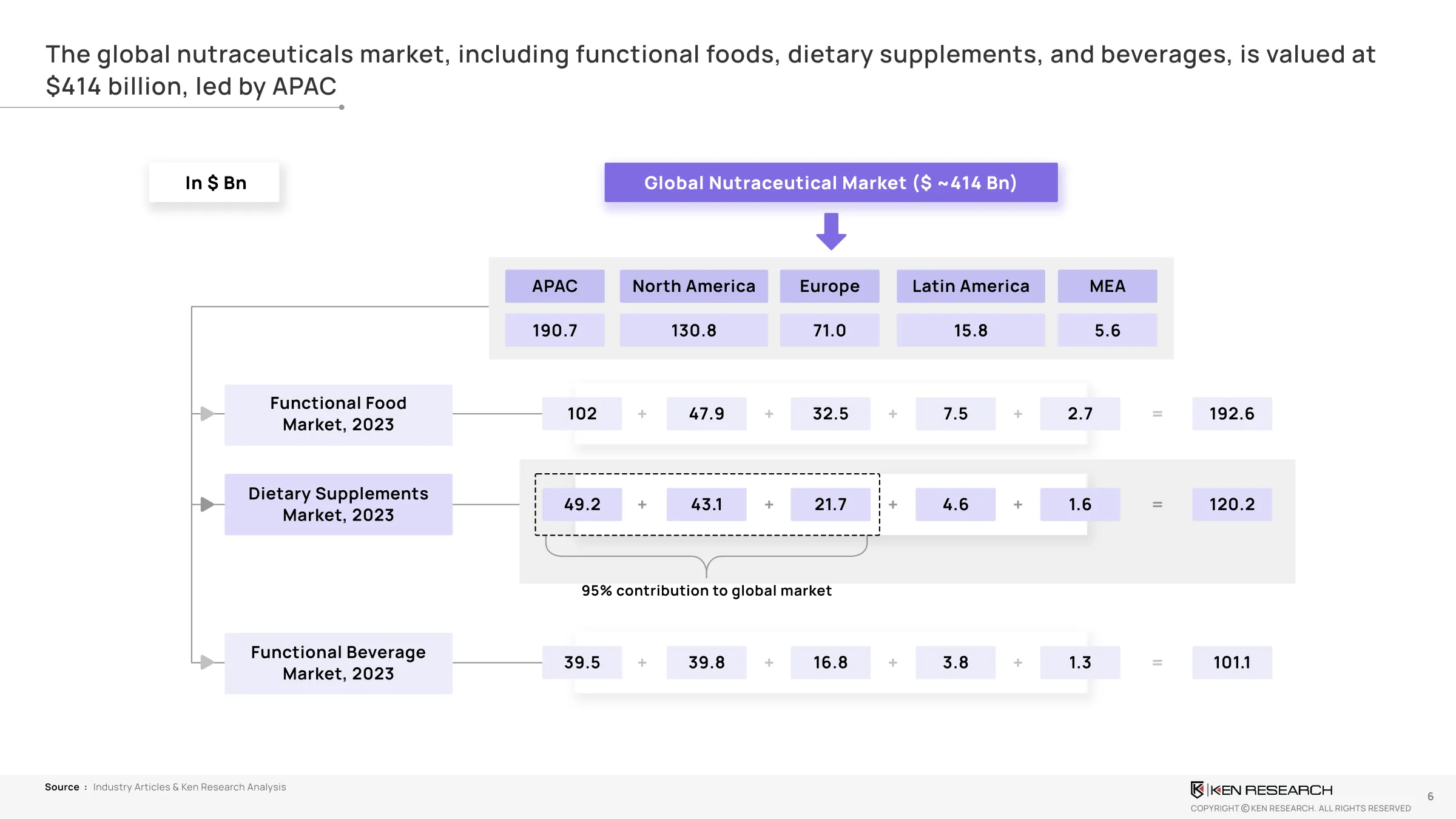

Theis undergoing a major inflection point, with the market set to grow from $120.2 billion in 2023 to $170 billion by 2029 (6.0% CAGR).

Built for Leaders Across

- Strategy and Growth Leaders at Nutraceutical and CPG Health Brands

- Private Equity and M&A Heads Exploring High-ROI Consumer Health Assets

- R&D, Innovation, and Product Teams Shaping Format and Personalization

- Founders and CXOs in Wellness D2C, Insurtech, and Digital Health

Need insights tailored to your brand’s geography or demographic? Talk to us

Executive Summary

- The global market, currently valued at $120.2 billion, is expected to grow to $170 billion by 2029.

- APAC, which currently holds a $47.9 billion share, is on track to overtake North America as the leading region.

- Personalization is becoming central: from DNA kits to AI-enabled dosage recommendations.

- Flavored gummies and softgels dominate—with 41% consumer preference.

- D2C-led formats, clean labels, and on-demand fulfillment define the new consumer expectation

Want a market outlook segmented by region, format, or category? Request a briefing

Market Opportunity & Growth Triggers

- Global Nutraceuticals market: $414B; dietary supplements account for 29–30%.

- 70%+ of APAC’s population is vitamin-deficient, making it the top region for rapid adoption.

- D2C brands are scaling across India, Indonesia, and Vietnam with performance-first messaging.

- Brain, mood, and immune health are seeing >10% YoY category growth.

Technology & Personalization: A New Value Layer

- Consumers are integrating health tech into supplementation via wearables, biometrics, and digital planners.

- AI-led dashboards and genomics are enabling subscription-based micro-personalization.

- Supplement routines synced with Fitbit, Apple Health, and mental health apps are rising in urban metros.

- Explore our Personalization Tech Vendor Evaluation Matrix – Request Access

Explore our Personalization Tech Vendor Evaluation Matrix – Request Access

Consumer Behavior: Flavor, Function & Speed

- 50%+ of global sales are in immune, brain/mood, and stress relief categories.

- Men’s grooming and wellness (sleep, hair, sexual wellness) driving new male SKUs at >12% CAGR.

- Gummies and drinkables are favored for taste, compliance, and portability.

- Q-commerce and 1-hour delivery are driving adoption in urban centers.

Testing flavor or formulation? Run a VOC study with Ken Research

Regional Outlook

Key Catalysts to Track (2024–2029)

- Flavor-first R&D: Gummies, effervescent tablets, and drinkables

- Subscription-first D2C scaling: Bundled offers, influencer co-creations

- Corporate plan bundling: Supplements entering B2B via health insurers

- Regulatory modernization: Japan, Singapore, UAE accelerating fast-tracking

- Tech-health convergence: Biometrics powering real-time dosage updates

Benchmark Your Roadmap Against Market Shifts – Ask for Our Strategy Pack

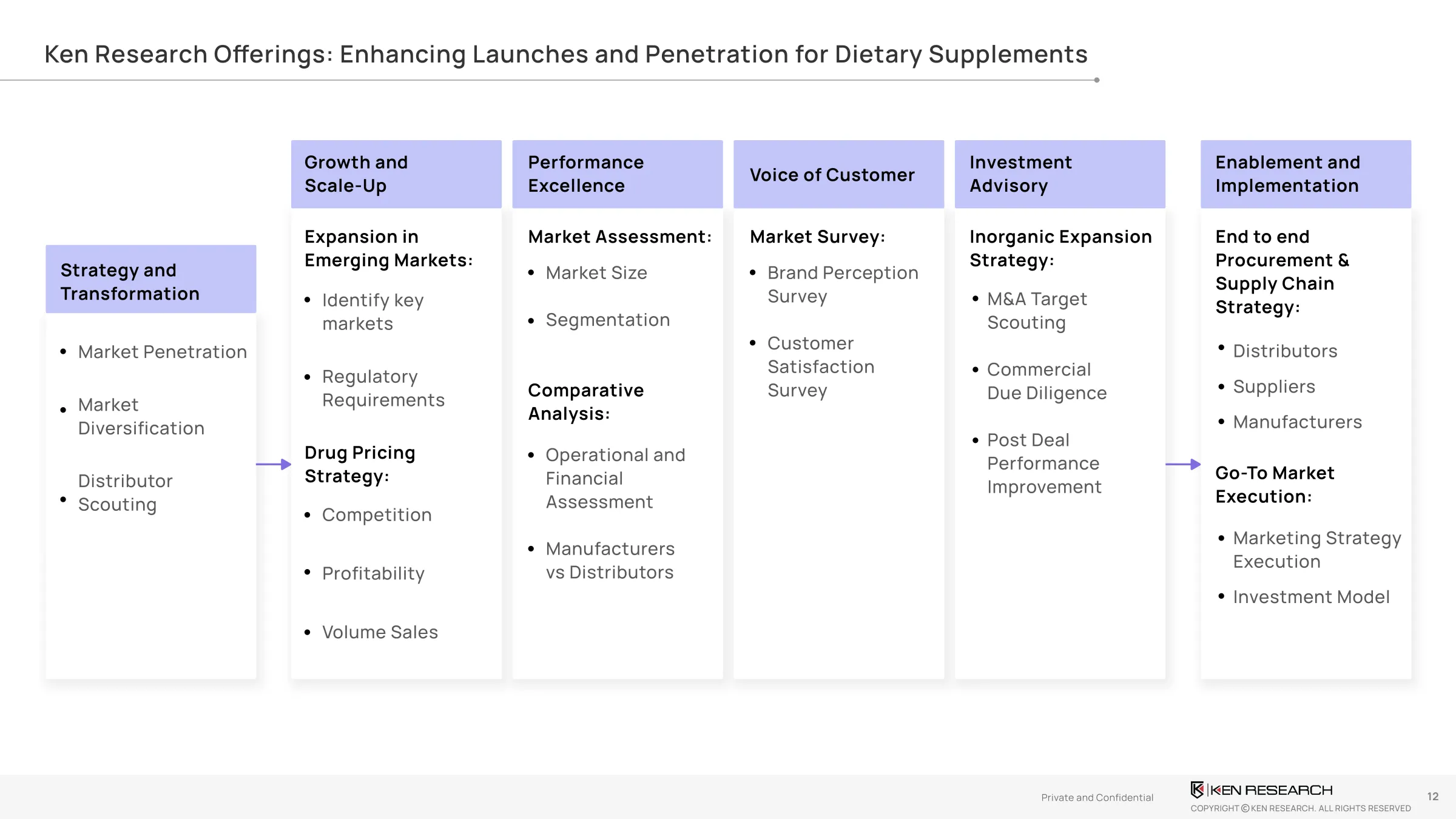

How Ken Research Helps Supplement Leaders

- GTM & Segmentation Strategy: Persona-building, region-specific SKU playbooks

- Consumer VOC: Primary feedback on format, ingredients, packaging, pricing

- D2C and Omni-channel Planning: Shopify playbooks, retail partnerships, pricing elasticity

- Innovation Scouting: AI, wearable, genomics, and Q-commerce integrations

- M&A Screening: Target identification, synergy modeling, and integration frameworks

FAQ's

Still Got Questions? Connect Via Mail

What is the size of the global dietary supplements market?

The global dietary supplements market is valued at $120.2 billion in 2023 and is expected to reach $170 billion by 2029, growing at a 6.0% CAGR.

Which formats are most preferred?

Gummies and softgels are the leading formats, favored by over 41% of global consumers for taste and compliance.

Why is Asia-Pacific emerging as the top market?

With 70%+ of the population vitamin-deficient and a surge in mobile-first D2C brands, APAC is projected to lead by 2029.

What are the fastest-growing supplement categories?

Immune boosters, brain health, and mood enhancers are the top-performing categories, contributing to over 50% of global sales.

How are technology and personalization shaping the future?

From DNA-based personalization to AI-led subscription models, consumers are now expecting hyper-personalized plans that align with wearables and health apps.