Pioneering SaaSification in India's Education – Strategic Roadmap for a $3.1 Billion Opportunity

India’s EdTech SaaS market, projected at $3.1B by 2030, is reshaping education operations with scalable, agile, and student-centric models.

Built for Leaders Across

- Founders and CXOs of EdTech startups or SaaS platforms targeting Indian education markets

- Academic Administrators driving digitization in schools, colleges, and skilling platforms

- Venture Investors and PE Firms exploring scalable SaaS bets in the education domain

- Policy and Regulatory Decision Makers looking to frame enabling frameworks

- Technology Heads responsible for LMS, ERP, CRM, or AI-powered education tools

Benchmark your institution or SaaS strategy against India’s emerging leaders

Executive Summary

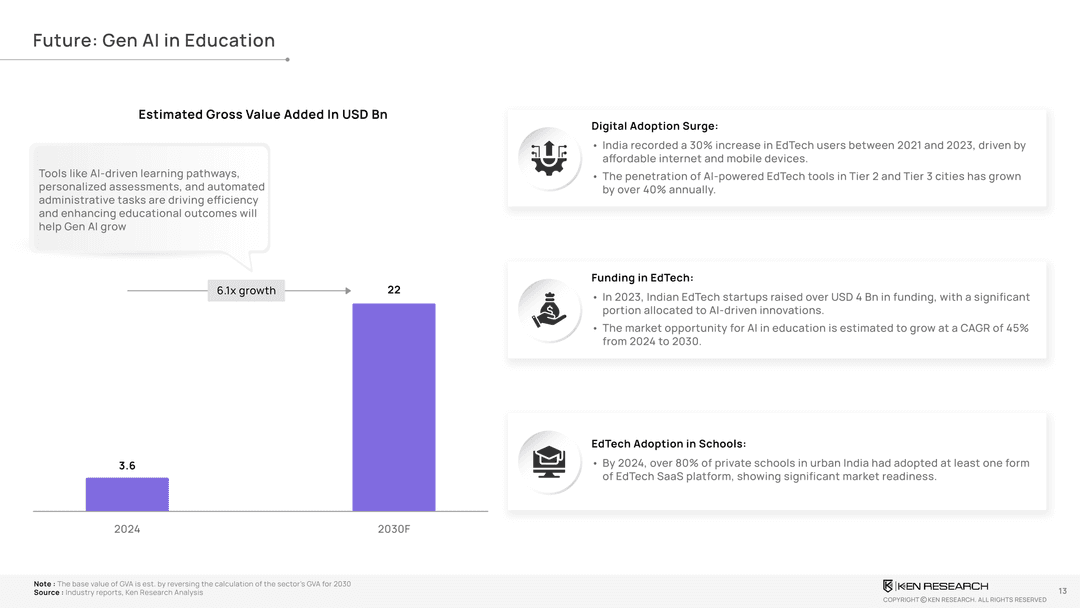

—valued at over $120 billion in 2023—is now entering a phase of digital acceleration powered by SaaS-first platforms. As per the latest industry analysis, the EdTech SaaS segment is projected to grow at a CAGR of 22%, reaching a $3.1 billion valuation by 2030.

This surge is led by: -

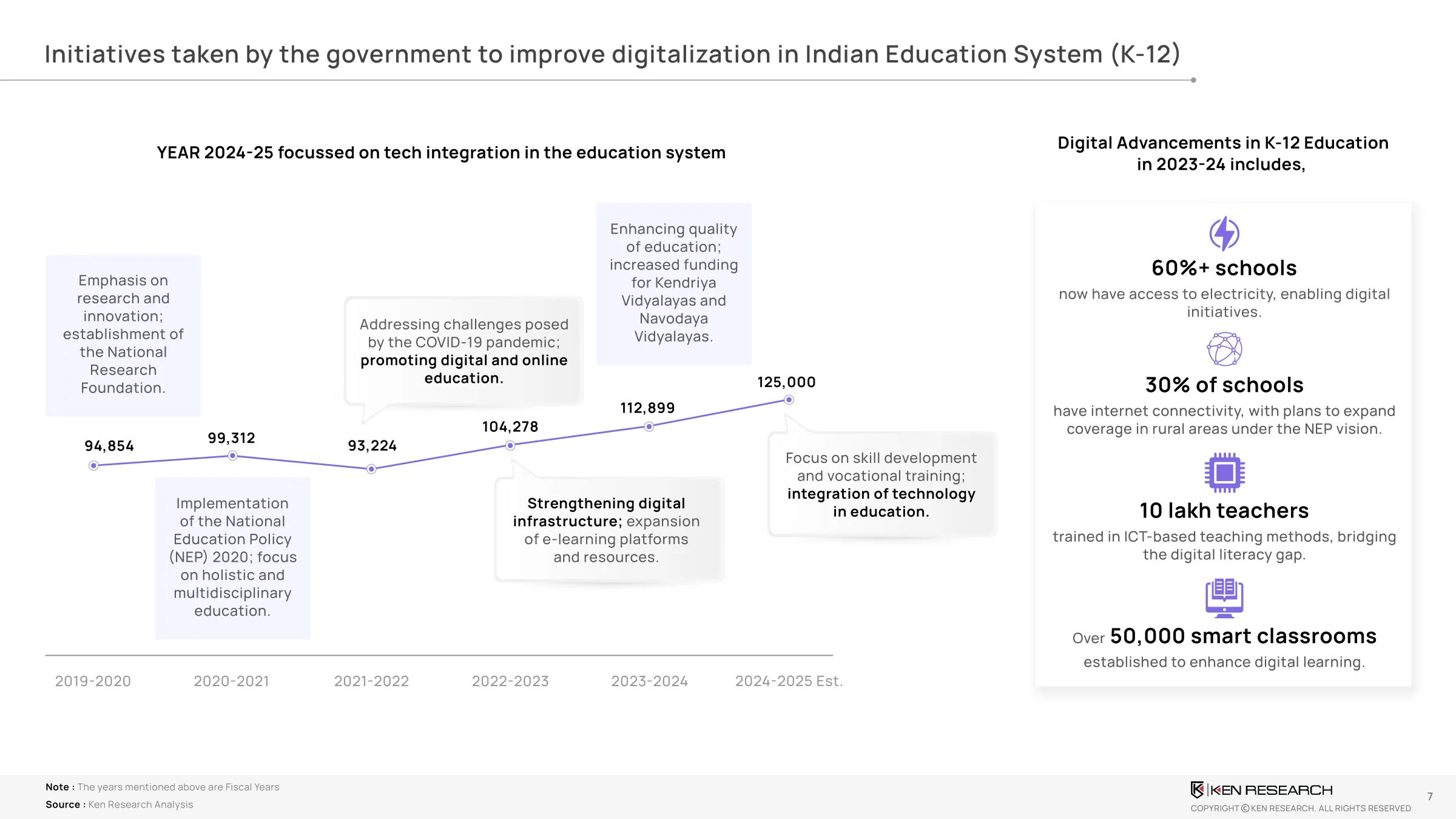

- Rising cloud adoption among private K-12 institutions and coaching networks. The national push for digital transformation under the New Education Policy (NEP 2020).

- Investor shift toward B2B models with recurring revenue and measurable ROI - Demand for platforms that unify administration, learning, assessments, and engagement.

From curriculum digitization to AI-led personalized learning journeys, SaaS models are reimagining how institutions deliver value. Moreover, over 70% of institutional leaders surveyed report higher transparency, faster administration, and better learning outcomes post-SaaS deployment.

However, challenges remain around tech literacy, affordability, and regional content availability. To win, players must design India-first solutions—localized, modular, and compliant with evolving standards.

Want a cross-segment SaaS product validation map? Request a 1:1 session with our analysts

Market Snapshot: SaaS in India’s Education

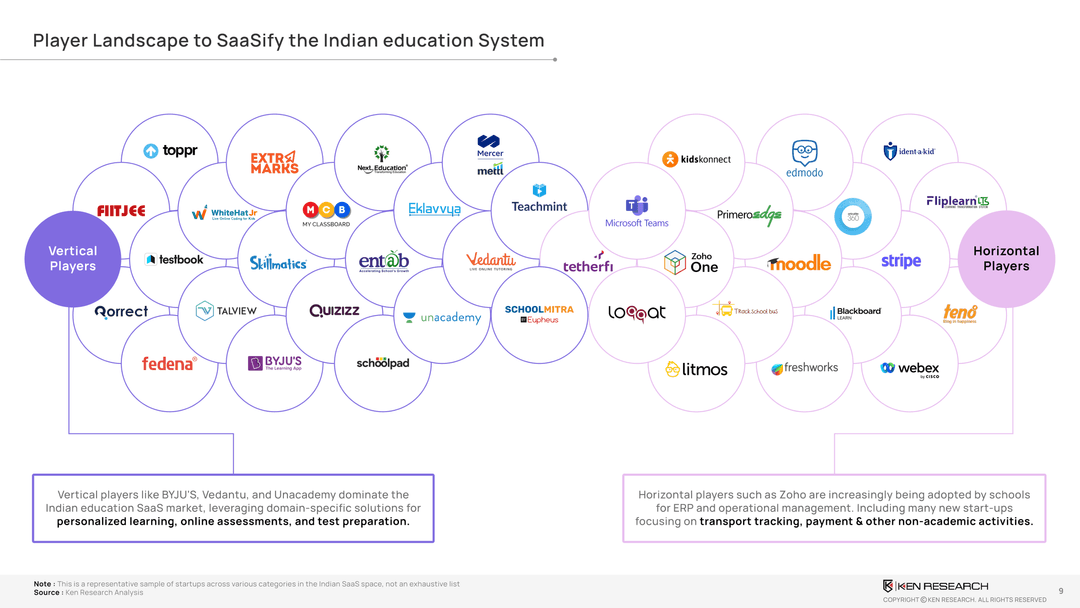

The current SaaS adoption in India’s education landscape is fragmented but fast-growing:

- K-12 Segment: Over 250,000 private schools with a growing appetite for ERP, LMS, fee, and transport modules.

- Higher Education: 40,000+ colleges and 1,100+ universities are investing in cloud-based course delivery and student lifecycle management.

- Test Prep and Coaching: Platforms such as Classplus are driving SaaS usage in offline centers, enabling mobile-first content and payment tools.

Adoption Statistics:

LMS platforms account for 35% of SaaS investments in 2023 - Fee Management & CRM tools saw a 48% YoY growth across Tier 2 and Tier 3 cities - Over 20,000+ schools in India have adopted some form of cloud-based education SaaS solution as of 2024.

The sector is also witnessing increasing multi-modal product use, where a single SaaS layer covers administration, parent communication, assessment, and analytics—creating sticky and scalable value chains.

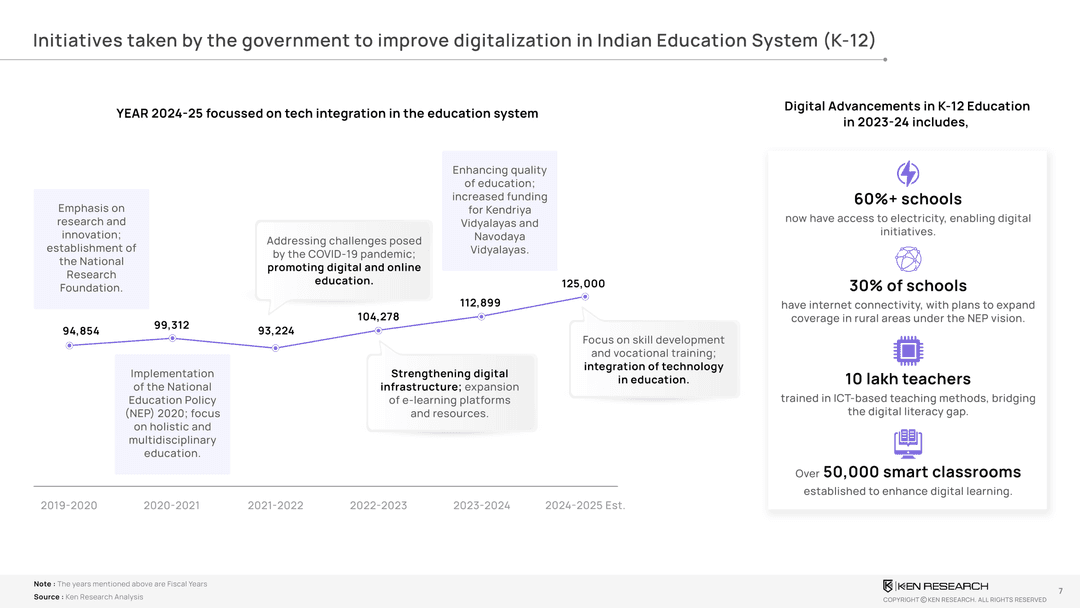

Policy Backdrop: Regulatory Support for Digitization

The government’s policy thrust is reinforcing the SaaS trend:

- EP 2020: Recommends adoption of technology across all levels of education

- PM eVIDYA and SWAYAM: Flagship platforms relying on digital tools for reach and scale

- Digital University Framework: India’s push to build full-stack online learning ecosystems

TheDigital India initiativeallocates over ₹1,300 crore annually toward education tech enablement. At the state level, schemes such as Rajasthan’s Shala Darpan and Maharashtra’s DIKSHA create precedents for SaaS integration in public systems.

Regulatory Outlook:

75% of public education platforms launched in the last 3 years are now cloudnative - National Education Technology Forum (NETF) to set guidelines for tech-enabled learning systems.

Investment Landscape: Where Capital is Flowing

Despite a funding winter in B2C EdTech, SaaS continues to attract capital due to its operational efficiency and institutional stickiness:

- $260M+ raisedin EdTech SaaS deals between Jan 2022–Dec 2023

- Top investors: Blume Ventures, Sequoia Capital, GSV Ventures, Omidyar Network

- Seed to Series Brounds dominate—focused on niche workflows like student CRM, test delivery engines, and AI grading

Notable Funding Cases:

LEAD School: Raised $100M in Series E to expand its SaaS-driven curriculum platform - Classplus: Secured $70M across two rounds to power India’s offline coaching segment - Teachmint: Raised $20M for building mobile-first ERP stacks

Our Investment Radar maps 60+ active SaaS players across education verticals

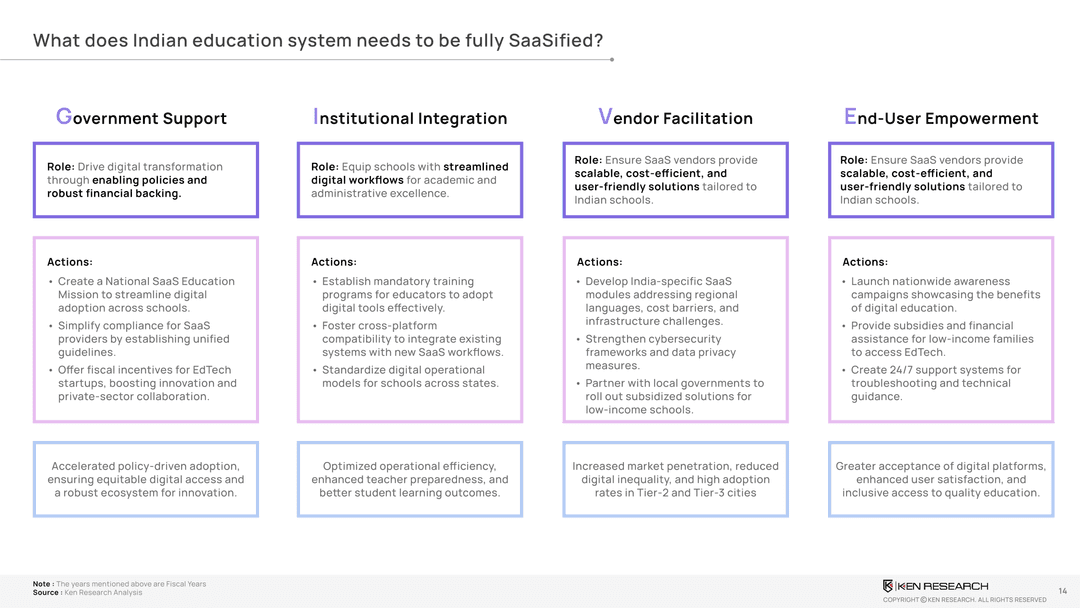

Strategic Imperatives: How to Scale Successfully

- India-First SaaS Models: Build products compatible with regional languages, offline-first access, and modular design

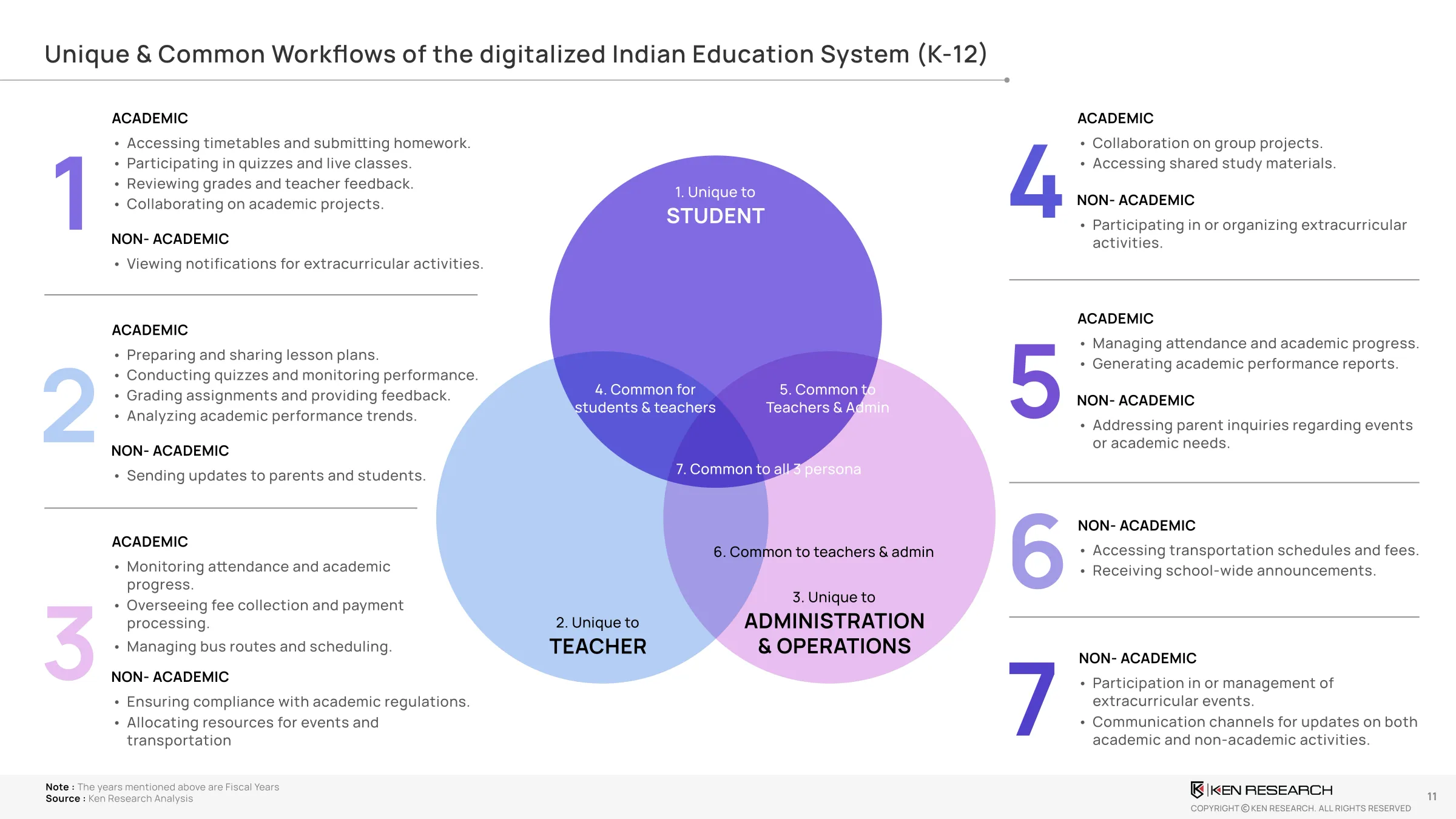

- Multi-Stakeholder Design: Ensure value creation for admins, parents, students, and teachers

- Data & Outcome Focus: Integrate analytics dashboards to drive decision-making and funding compliance

- B2B2C Monetization: Enable revenue shares via learning centers, franchise schools, and coaching hubs

- Policy Embeddedness:Align roadmaps with NEP and state-level digital mandates

Explore our SaaS GTM playbook used by top 5 education unicorns in India

FAQ's

Still Got Questions? Connect Via Mail

What is the market size of SaaS in Indian education?

India’s EdTech SaaS market is projected to grow from $650M in 2024 to $3.1B by 2030, registering a 22% CAGR.

Which segments are adopting SaaS fastest in India?

K-12 private schools and hybrid coaching centers are leading SaaS adoption, especially for fee collection, CRM, and LMS platforms.

What are the biggest challenges to SaaSification in education?

Low digital literacy, regional language limitations, and budget constraints in public institutions.

How is NEP 2020 supporting SaaS models in India?

NEP mandates technology adoption in teaching, learning, and assessment—opening doors for platform-based models across all tiers.

What’s the investment trend in education SaaS?

Despite B2C cooling, investors are backing institutional SaaS due to strong retention and operational leverage.