How Industrial Growth and Mobility Shifts Are Reshaping the Lubricants Market in APAC

Download the Full Consulting POV Now

Overview

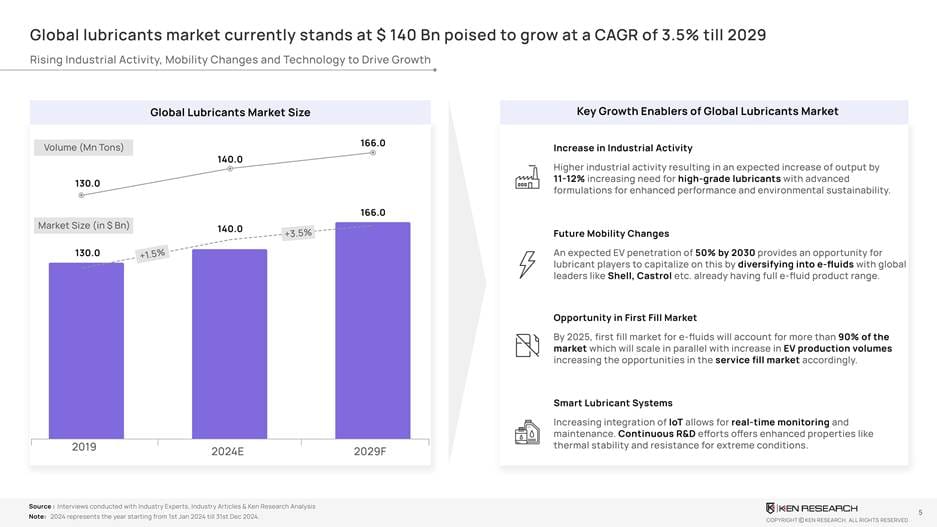

Theglobal lubricants marketis currently valued at USD 140 billion, expected to grow at a CAGR of 3.5% until 2029. Volume-wise, the market is projected to reach 166 million tons, up from 130 million tons in 2019. Key growth drivers include rising industrial activity, evolving mobility patterns, and a shift toward high-grade, sustainable formulations.The APAC region contributes ~45% of the global market and is poised for a CAGR of 4.4%, making it the leading contributor to global demand.

What Are the Core Challenges

- Uneven Regional Growth:Mature markets like North America and Europe are witnessing sluggish expansion at just 2% CAGR, reflecting saturation and slower industrial demand. In contrast, Southeast Asia is emerging as a high-opportunity region, growing at 4–4.5% CAGR due to rising mobility and manufacturing activity.

- Overdependence on Mineral Lubricants:Over 55% of lubricant consumption in Southeast Asia relies on mineral-based products, which are less efficient and environmentally taxing. This reliance poses challenges in achieving sustainability goals and limits advancements in engine performance.

- Price Sensitivity:Despite the superior efficiency and longevity of synthetic lubricants, their high upfront cost deters widespread adoption. Consumers, especially in cost-sensitive SEA markets, often prioritize short-term affordability over long-term value.

- Fragmented Usage by Industry:While the automotive sector accounts for 66% of lubricant consumption, the commercial and industrial segments remain under-leveraged. This imbalance highlights a missed opportunity for growth through targeted solutions in machinery, logistics, and manufacturing operations.

Root Cause Analysis

- Low Adoption of Sustainable Solutions:R&D is active, but high costs deter small enterprises and budget-conscious fleet operators.

- Industrial Fragmentation:Manufacturing growth is strong but not matched by a synchronized lubricant transition plan.

- Lack of Localized Blending & Supply Chain Optimization:Smaller SEA nations face limited access to diversified lubricant products.

- Limited Tech-Driven Distribution:While e-commerce is growing (~22% expected growth by 2025), online lubricant distribution remains nascent.

The APAC Advantage & Potential Solutions

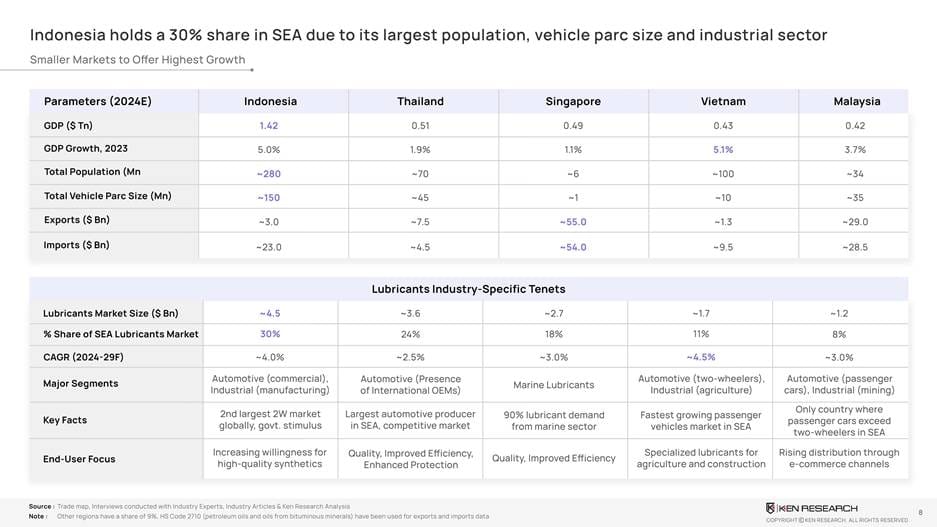

- SEA accounts for 24% of APAC’s lubricant market, with key segments including motorcycles, logistics, and construction fleets.

- Indonesia alone holds 30% of the SEA market, followed by Thailand (24%) and Singapore (18%).

- E-commerce and 2-wheeler sales are directly correlated; ~8% growth in 2W for delivery use is expected, increasing lubricant demand.

- Industrialization is accelerating, with manufacturing output growing at ~6% CAGR and government spending per capita at ~7% CAGR.

Roadmap for Execution

Short-Term (0–1 Year) – Digital Retail & Education

- Launch targeted awareness campaigns highlighting the benefits of synthetic lubricant alternatives to key automotive and industrial segments.Enable digital distribution platforms for small and mid-sized lubricant sellers by leveraging the rapid growth of e-commerce channels in SEA.

Mid-Term (1–3 Years) – Product Bundling & Customization

- Facilitate region-specific R&D to create localized base oil formulations tailored to diverse climatic and performance conditions.Encourage the bundling of semi-synthetic lubricants with maintenance packages for fleet operators to ensure product loyalty and service continuity.

Long-Term (3–5 Years) – Sustainable Transition

- Develop green labeling programs and government-backed subsidies to incentivize the production and adoption of eco-friendly lubricants.Support the establishment of local blending units to minimize reliance on imports and deliver market-specific lubricant solutions.

Unlocking APAC’s Strategic Advantage in Lubricant Innovation

With the global market expected to reach over USD 166 billion in volume and USD 200 billion in value by 2029, APAC’s strategic role is undeniable. By prioritizing mobility integration, urban logistics, and green reformulations, APAC can lead the next generation of industrial lubricant transformation.