How is Industrial Diversification Re-shaping the Future of SEA's Chemical Sector?

Download the Full Consulting POV Now

Overview

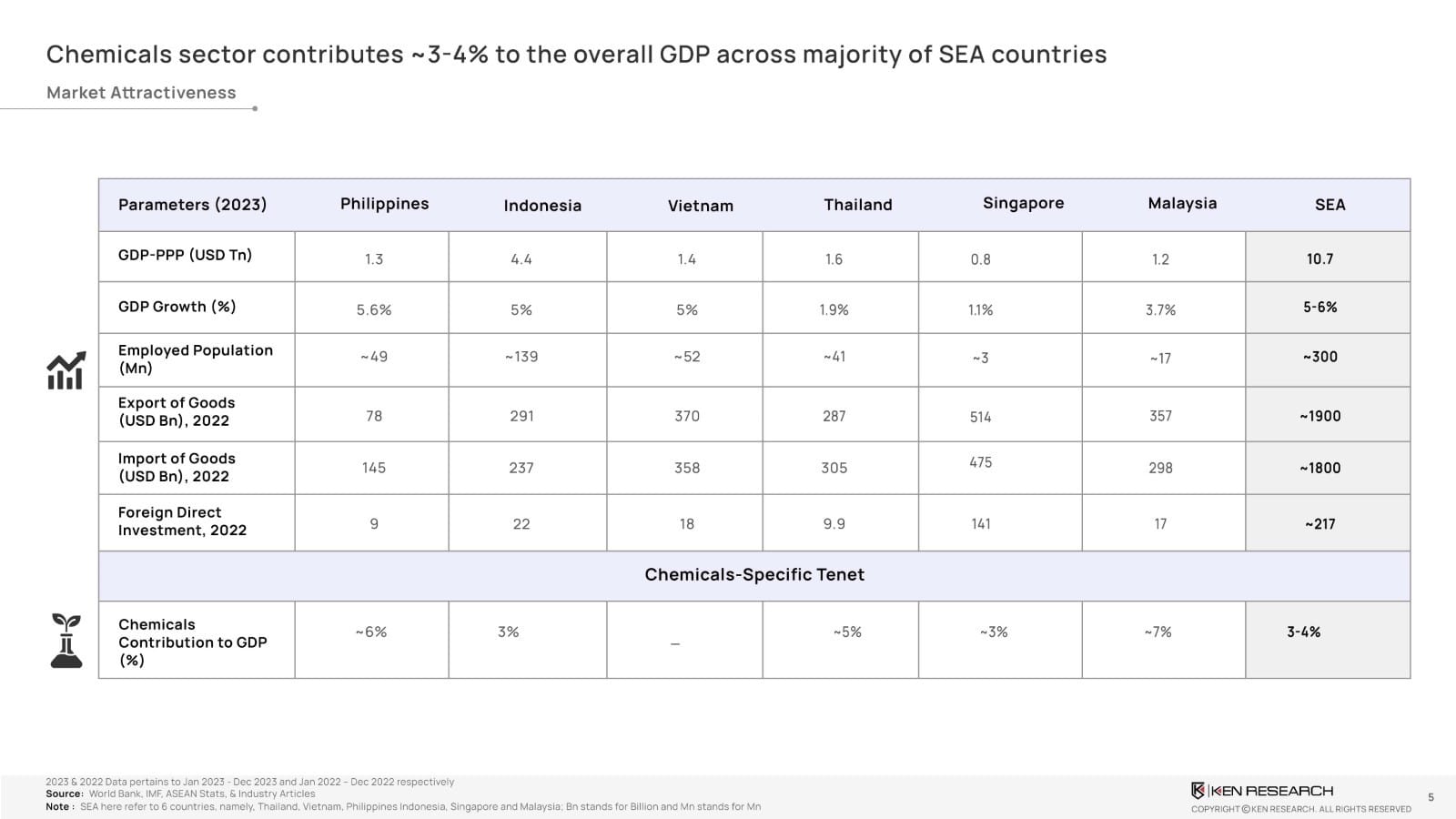

The Southeast Asia (SEA) chemicals sector is undergoing a structural transformation, driven by industrial expansion, rising FDI, and evolving trade priorities. Contributing 3-4% to the GDP across major SEA economies, the sector is expected to grow 1.5X faster than the global average. Singapore leads with over 100 active chemical entities, while countries like Indonesia and Vietnam are scaling to meet regional and export demand. With local production scaling and increasing downstream consumption potential, SEA is poised to emerge as a diversified regional hub for industrial chemicals.

Key Emerging Trends Reshaping Southeast Asia’s Chemical Industry

- Regional Consolidation Creating Supply-Side Imbalances: Chemical production remains heavily concentrated in a few countries primarily Singapore, Thailand, Indonesia, and Malaysia.This clustering results in overdependence on select hubs, increasing vulnerability to disruptions and supply chain inefficiencies across the region.

- Import Dependency Driving Exposure to Global Volatility:Many Southeast Asian countries with underdeveloped industrial infrastructure remain reliant on chemical imports. This dependency exposes them to external trade shocks, currency fluctuations, and global pricing volatility limiting their economic resilience.

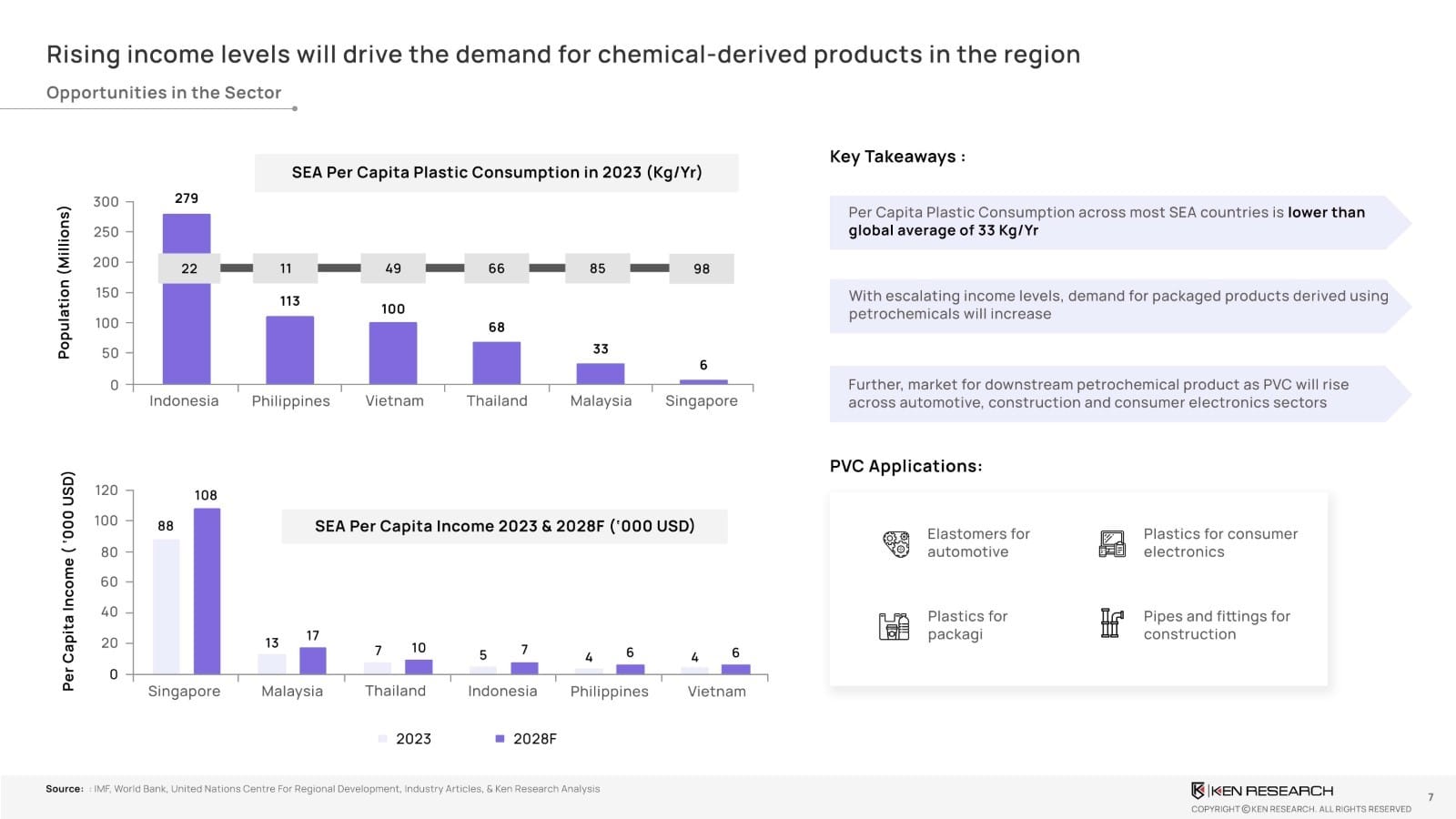

- Domestic Demand Remains Largely Untapped:Despite rapid industrialization,SEA’s per capita plastic consumption remains below the global average of 33 kg/year.This underutilization of downstream demand reflects an untapped opportunity for regional manufacturers to grow consumption-driven segments.

- Slow Advancement Along the Value Chain:Most nations are still focused on basic or bulk chemical processing. However, there is substantial potential to move up the value chain into high-margin specialty chemicals and advanced petrochemicals, which are critical for innovation-driven sectors like electronics and renewables.

- FDI Concentration in Select Investment Hubs: Countries like Singapore and Malaysia dominate regional foreign direct investment flows Singapore alone received USD 217 billion in 2022.In contrast, several neighboring countries struggle to attract investment due to policy gaps, infrastructure limitations, or regulatory risk.

Broader Impact of Agentic AI on the Industry Ecosystem

- Driving Product Diversification and Global Competitiveness:The expansion of midstream and downstream processing capabilities allows manufacturers to move beyond basic inputs and develop higher-value, specialized products. This not only diversifies their portfolio but also enhances their ability to compete in global export markets.

- Catalyzing Growth Through Incentives and Infrastructure:Policymakers play a pivotal role by introducing incentives and investing in enabling infrastructure especially in emerging economies like the Philippines and Vietnam. These efforts are key to scaling production capacity and attracting long-term industrial development.

- Unlocking High-Yield Opportunities Across Sectors:As demand for packaging, construction, and electronics-grade materials rises, Southeast Asia presents an attractive landscape for investors. The region's growing industrial base and supply chain diversification create strong ROI potential across the chemicals and materials spectrum.

- Advancing Regional Integration and Operational Efficiency:Stronger collaboration among ASEAN countries can improve regulatory harmonization, supply chain coordination, and cross-border logistics. These partnerships lay the foundation for creating specialized industrial zones and integrated regional value chains.

Sector-Specific Demand Drivers Shaping the SEA Chemical Landscape

- Packaging & Plastics: Accelerated urbanization and shifting consumption patterns are driving increased demand for food-grade packaging and lightweight polymer solutions.Countries like Vietnam and Indonesia are witnessing a surge in packaged goods, making these markets prime hotspots for packaging polymer adoption and local production scale-up.

- Electronics:The rapid expansion of semiconductor and consumer electronics manufacturing particularly in Malaysia and Thailand is fueling demand for high-purity chemical inputs. These include specialty solvents, etchants, and dielectric materials essential for advanced fabrication processes in electronics and chip production.

- Construction & Automotive: Infrastructure development across Southeast Asia, coupled with growing automobile localization efforts, is boosting the need for performance-grade chemical materials.Products such as elastomers, specialty coatings, adhesives, and composites are essential for lightweight construction and fuel-efficient vehicles.

- Specialty Materials:The long-term competitiveness of SEA’s chemical industry hinges on its ability to supply advanced materials for high-value sectors. These include active pharmaceutical ingredients (APIs), renewable energy materials, and Agro-chemical derivatives critical to driving innovation in healthcare, sustainability, and food security.

Strategic Recommendations

For Manufacturers:

- Move beyond basic chemicals into specialty and high-margin materials.

- Localize production near consumption zones to reduce logistics costs.

For Investors:

- Prioritize projects in midstream infrastructure and integrated chemical parks.

- Support automation-led processing for margin expansion.

For Policymakers:

- Align national FDI targets with GDP and trade objectives.

- Promote regional chemical clusters across Tier 2 geographies.

- Provide R&D incentives for material innovation in electronics and packaging sectors.

Forging a Innovation-Led Chemical Ecosystem in SEA

The Southeast Asian chemical industry is on the cusp of a structural shift from volume-focused manufacturing to value-added, innovation-led growth. Surging demand across key sectors like packaging, electronics, and automotive is being met with renewed policy support and increasing private sector momentum. Yet, the true opportunity lies in addressing downstream underutilization and fostering end-to-end value chain integration.

As regional governments and industry leaders align on technology adoption, infrastructure development, and consumption scaling, SEA is poised to emerge as a self-sufficient, globally competitive chemical powerhouse. The countries that lead in advancing specialty production, green chemistry, and ecosystem collaboration will not only future-proof their industries but will also set the benchmark for sustainable industrial transformation across the region.