Why Is Singapore's Cold Chain Market a USD 460 Mn Opportunity?

Download the Full Consulting POV Now

Overview

Singapore’s cold chain industry is at a turning point, driven by rising food imports, pharmaceutical exports, evolving dietary preferences, and government-backed initiatives. As a tropical nation heavily reliant on imports, with 90% of its food sourced externally, cold storage and temperature-controlled logistics are not just necessary but foundational to national supply chain resilience.

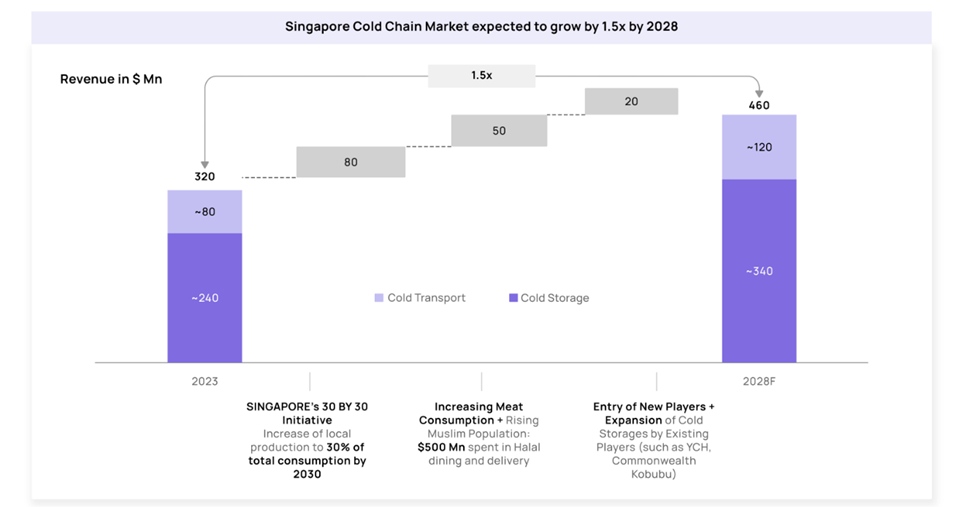

By FY 2028, the Singapore cold chain market is expected to grow by 1.5x and reach a value of USD 460 million, propelled by increased domestic production goals under the “30 by 30” initiative, booming halal dining, and the expansion of integrated cold storage networks. However, inefficiencies in upstream and midstream operations still create considerable friction, representing both a challenge and an investment opportunity.

Emerging Trends Overview

- Gap in Value Chain Infrastructure: Over 80% of current cold storages lack integrated facilities such as ripening chambers, pack houses, or reefer freight capabilities. This results in a 70–75% infrastructure supply gap and contributes to massive food losses averaging 62 kg per person annually.

- Urban Cluster Dominance:Nearly 45% of cold chain revenue in 2023 was concentrated in Changi.While areas like Jurong and Tuas are emerging, the ecosystem still shows signs of geographic and functional imbalance, limiting full market penetration.

- Food & Pharma Dependency:Singapore ranks among the world’s top hubs for healthcare innovation and food security. The cold chain underpins these sectors, especially with rising seafood, meat, and egg consumption per capita and a pharmaceutical export sector valued at USD 33 billion as of 2020.

- Strategic Government Push:The Singapore Food Agency’s “30 by 30” strategy aims to boost local food production to 30% of total consumption by 2030. This creates tailwinds for cold chain expansion across F&B and biotech applications.

- Halal Segment Growth:USD 500 million is spent annually on halal dining and delivery.With a growing Muslim population, cold chain solutions that ensure halal-certified integrity across the supply chain are gaining traction.

Impact on Industry Ecosystem

- Manufacturers & Logistics Providers:Players like YCH and Commonwealth Kobubu are expanding capacity and exploring integrated solutions.Still, many facilities remain storage-centric, lacking forward linkages to retail or processing centers.

- Investors:Amid a global search for alternative asset classes, cold chain infrastructure presents a stable, high-yielding investment vehicle.Demand is rising for private equity, REITs, and infrastructure funds focused on storage and logistics.

- Government & Regulators:Policy frameworks are supportive of sustainability, food security, and innovation in logistics.However, there is a clear need to encourage balanced ecosystem development across Singapore’s key logistics corridors.

- Consumers:End users benefit from fresher produce, safer food, and broader pharmaceutical access. However, gaps in storage quality and transportation consistency still affect retail shelf life and pricing.

Sector-Specific Implications

- F&B Sector:The largest cold chain user segment, F&B is challenged by perishability, import dependency, and a lack of integrated storage–distribution links. New clusters in Tuas and Jurong are critical to decongest Changi.

- Pharmaceuticals:With over 30 global pharma players operating in Singapore, biomedical cold chain demand is robust. But greater real-time monitoring and risk mitigation tools are needed to protect high-value payloads.

- E-Commerce & Last-Mile Delivery:Online grocery platforms, meal delivery services, and direct-to-consumer models are driving demandfor micro cold storage hubs and rapid, insulated transportation systems.

Strategic Recommendations

For Logistics Players

- Expand into integrated CS ecosystems with ripening chambers, reefer trucks, and real-time temperature tracking.

- Diversify facility locations to reduce congestion and serve western Singapore more efficiently.

For Investors

- Back early-stage logistics innovators offering full-stack CS capabilities.

- Explore REIT models or long-lease logistics parks focused on halal, pharma, and F&B storage clusters.

For Policymakers

- Offer subsidies or incentives for backward integration in CS value chains.

- Promote smart cold chain management using IoT and blockchain for traceability.

The Sustainable Future Ahead

Singapore cold chain industry, while strategically positioned and technologically adept, has yet to fully bridge infrastructure and ecosystem gaps. With the market poised to reach USD 460 million by 2028, this decade presents a transformative moment for logistics players, investors, and policymakers alike.

By focusing on holistic infrastructure development, cold chain regularization, and forward ecosystem linkages, Singapore can not only future-proof its food and pharma supply chains but also lead the region in cold chain excellence.