Southeast Asia Lubricants Market: Strategic Roadmap for a $17 Bn Market Opportunity

Southeast Asia’s $15B lubricants market is set to hit $17B by 2029, fueled by fleets, construction, and shifting mobility trends.

Built for Leaders Across

- Strategy Heads, Country Leads & Lubricants Division Managers (B2B/B2C)

- Regional CXOs at Oil & Gas Majors entering SEA or launching synthetic lines

- OEM Partnership Leaders seeking EV or commercial fleet lubricant tie-ins

- Distribution/Channel Managers planning e-commerce or logistics expansion

Schedule a 1:1 Strategic Deep-Dive with Our SEA Market Consultants

Executive Summary

Lubricants In Transition – From Friction To Function

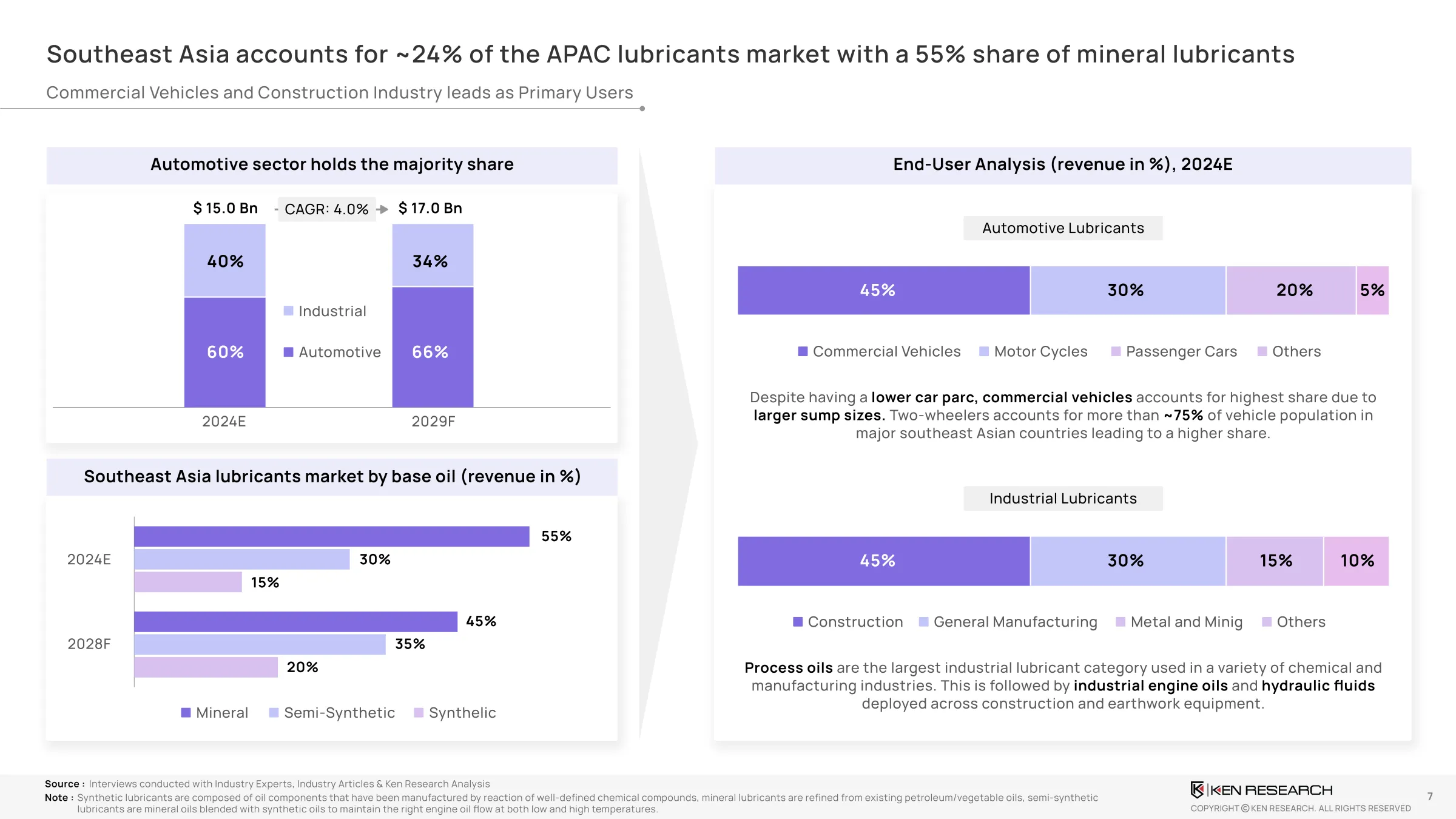

Southeast Asia accounts for approximately 24% of APAC’s $63 Bn lubricants market and is projected to reach $17 Bn by 2029, growing at a 4% CAGR. This growth is underpinned by:

- Industrial output scaling at 11–12%, increasing demand for high-performance fluids

- Commercial vehicle dominance in lubricant consumption due to large sump sizes

- Digital transformation led by oil diagnostics, POS retail systems, and predictive tools

- Shift toward synthetic blends across Indonesia, Thailand, and Vietnam

- First-fill and service-fill e-fluid markets emerging with EV adoption (currently ~1%)

Use This Deck to Benchmark Growth Levers & Plan Market Prioritization

Market Overview: Size, Segments & Trends

- 2024 Market Size: $15 Bn across SEA

- 2029 Forecast: $17 Bn; CAGR of 4.0%

- Automotive Lubricants Share: 66% in 2024 → stable through 2029

- Industrial Share: 34% (led by construction, agriculture, and manufacturing)

Base Oil Mix (by Revenue, 2024):

Mineral Oils: 55% - Semi-Synthetic: 30% - Synthetic: 15% (expected to double by 2029 in urban hubs)

Request Full Oil Type Penetration Breakdown by Country & Application

Country-Wise Snapshot: Demand & Attributes

Get Our Full Country-Wise Demand Heatmap & Sump Size Analysis

Emerging Themes: Trends That Will Define the Next Phase

- Synthetic Acceleration: Shift toward performance oils as 2W, 4W OEMs recommend premium fill grades

- EVs and E-Fluids: First-fill EV lube market to form 90% of e-fluid volume by 2025

- IoT Oil Diagnostics: Real-time usage monitoring by early adopters (Shell, Chevron)

- E-Commerce Channels: Lubricant e-retailing via platforms like Oilmart and fuel station apps

- Sustainability & Bio-Lubes: Growth in R&D for low-emission and longer-life products

Ask Us for Use-Case Benchmarks in Predictive Monitoring & EV Integration

Digital Investments by Leaders: -

Shell LubeChat & Predict AI-based support - Chevron’s forecasting tools & IoT sensors - Pertamina Oilmart POS platform & LTC analytics - ExxonMobil’s API integration & oil analysis

Compare Tech Readiness Scores of 15 Lubricant Majors – Ask for the Matrix

Strategic Priorities For 2025–2029

- Expand Synthetic Portfolio: Prioritize entry into semi-synthetic, full synthetic, and e-fluid categories

- Digitally Enable Distribution: Integrate POS, analytics & last-mile e-retailing

- Localize Formulations: Tailor to hot, humid conditions and commercial loads

- Form OEM Alliances: Secure first-fill partnerships in 2W, 4W and commercial vehicle channels

- Tap Underserved Growth Zones: Invest in Vietnam, Malaysia, and the Philippines

- Bundle Predictive Tools: Offer diagnostics + refill alerts to increase aftermarket lock-in

Book an Innovation Roadmap Session for Your Next 5 Product Lines

Outlook: Sea Lubricants By 2029 – Growth Enablers

- $5.7 Tn: SEA GDP projection by 2029 (7.2% CAGR)

- 712 Mn: Total population – growing urbanization, mobility needs

- $727 Bn: Construction market (industrial oil demand boom)

- $146 Bn: Auto sector size; EV penetration at just 1% → room for 50x e-fluid growth

Use This Outlook to Build a 3-Country Business Case for Investment

FAQ's

Still Got Questions? Connect Via Mail

What is the current size of the Southeast Asia Lubricants Market?

SEA’s lubricants market is valued at $15 Bn in 2024 and expected to grow to $17 Bn by 2029, driven by commercial and industrial demand.

Which countries are driving demand for lubricants in SEA?

Indonesia, Thailand, and Singapore account for over 70% of the region’s consumption, led by automotive and marine lubricants.

What role does EV penetration play in SEA’s lubricant growth?

With EV penetration currently at ~1%, the future market for e-fluids and diagnostics-enabled lubricants is just beginning to scale.

How are global lubricant players digitizing operations in SEA?

Shell, Chevron, and Pertamina are deploying AI, IoT, and real-time oil diagnostics, enabling smarter asset management and customer support.

Is the SEA market moving toward synthetic lubricants?

Yes. While mineral oils still hold 55% share, the adoption of synthetic and semi-synthetic oils is increasing rapidly in urban and OEM-backed segments.